5 Minutes

Bitwise Solana ETF posts strong first-day demand

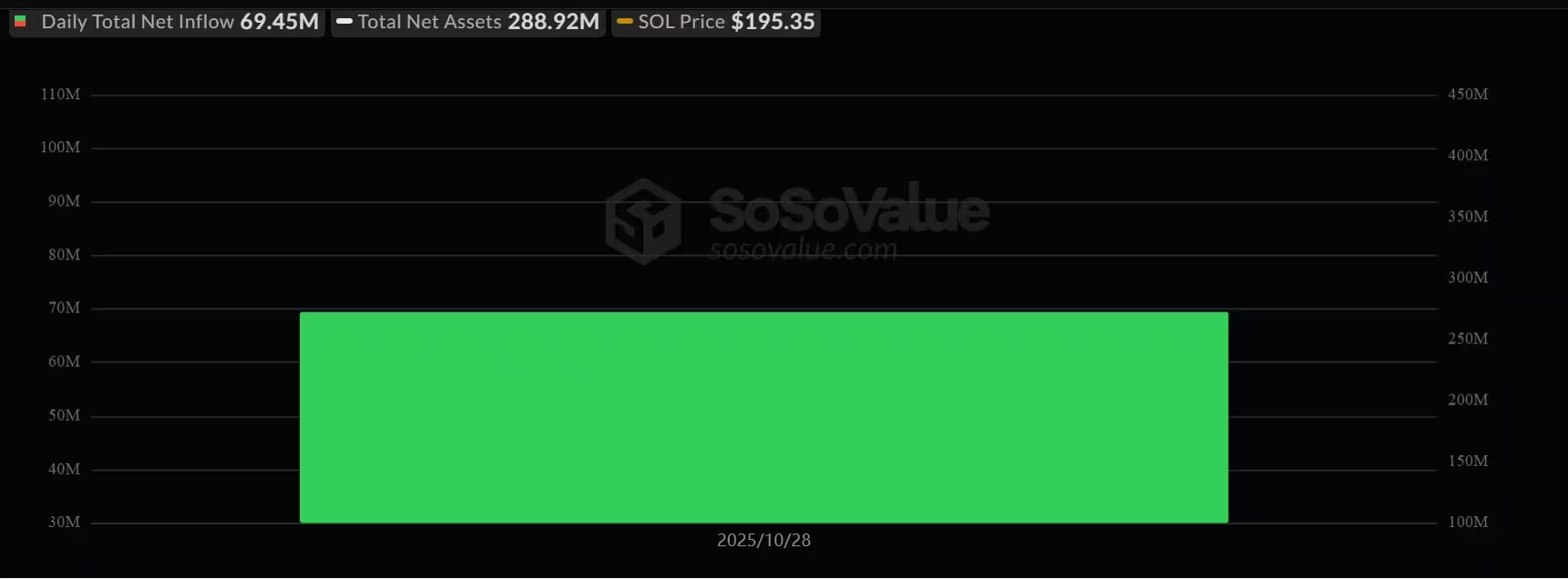

The Bitwise Solana ETF (BSOL) made a striking entrance into the U.S. spot ETF market, attracting $69.45 million in net inflows on its first trading day. The debut underlines growing institutional and retail interest in Solana (SOL) exposure through regulated products, and highlights demand for staking-enabled cryptocurrency ETFs that combine price appreciation with network staking rewards.

Bitwise reported that first-day inflows pushed the fund’s total net assets to $288.92 million. Trading activity was active from the outset: the fund logged roughly $10 million in volume during its first 30 minutes on the exchange and has recorded total traded value of about $57.91 million since launch.

Bitwise Solana ETF entered the market with $69.45 million in first-day inflows

What BSOL offers investors

The Bitwise Solana Staking ETF is a spot Solana ETF that aims to capture both SOL price movements and on-chain staking rewards. The fund is fully backed by SOL tokens held in institutional cold storage and is benchmarked to the Compass Solana Total Return Monthly Index, net of fees and expenses. By design, BSOL lets investors earn blockchain-native yields without holding private keys or managing validator infrastructure.

Fee structure and custody

Bitwise set the management fee at 0.20%, which is slightly lower than many competitive Bitcoin and Ethereum ETF fee ranges (commonly 0.21%–0.25%). Custody of the underlying SOL is handled with institutional-grade cold storage controls, while staking operations are managed by the fund to retain simplicity for investors and meet regulatory expectations for a U.S.-listed product.

Market context and competing Solana ETFs

BSOL’s upbeat debut comes ahead of several other expected Solana-focused listings. Grayscale prepared to list a Solana Trust ETF shortly after Bitwise, and Canary has updated its S-1 for a spot Solana ETF, proposing a fee of 0.50% after launching other altcoin ETFs such as Canary Litecoin and Canary HBAR.

On the same day that Bitwise launched BSOL, Canary’s Litecoin and HBAR ETFs reported no net inflows or outflows, making Bitwise the only altcoin-focused ETF among the group to register inflows that trading day. The early traction for BSOL could set a precedent for subsequent products targeting SOL exposure and staking rewards.

Implications for Solana and the altcoin market

Although BSOL’s assets represent a small fraction of Solana’s total market capitalization—roughly 0.01%—its launch signals a new, regulated on-ramp for institutional capital into Solana. At the time of the debut, Solana’s market cap was reported near $107.4 billion, reflecting a modest short-term decline of about 2.8%.

Analysts and market strategists believe staking-enabled ETFs could meaningfully expand inflows into altcoins. Ryan Lee, Chief Analyst at Bitget, forecasted that Solana staking ETFs could attract between $3 billion and $6 billion of new inflows in their first year, citing the potential of a ~5% staking yield to appeal to yield-seeking institutions.

Why staking ETFs could change institutional allocation

Staking ETFs provide two core benefits that may accelerate institutional adoption: (1) regulated, custodied exposure to an altcoin's price performance; and (2) an integrated mechanism to capture staking rewards without the operational overhead of running or vetting validators. For many institutions, that frictionless yield component could be a deciding factor when allocating to non-Bitcoin crypto assets.

Risks and considerations

Investors should weigh several risks when considering Solana ETFs: network-specific risks (e.g., outages or security incidents), protocol governance and staking mechanics, counterparty and custody risk, and the typical market volatility associated with altcoins. Regulatory scrutiny and evolving ETF approvals for crypto products remain relevant as more issuers list spot and staking ETFs.

What to watch next

Key near-term indicators include inflow trends across competing Solana ETFs, fee competition among issuers, and whether staking yields materially influence institutional allocations away from more established crypto ETFs. If BSOL’s early momentum continues, the Solana ETF cohort could expand and broaden access to altcoin yield strategies for mainstream investors.

For investors tracking cryptocurrency ETFs, BSOL’s debut is an important data point: it demonstrates that regulated, staking-enabled spot ETF structures can draw measurable capital on day one. As more issuers list similar products, monitoring net inflows, AUM growth, trading volumes, and annualized staking yields will be essential for assessing long-term demand and capital migration within the crypto ETF landscape.

Source: crypto

Comments

Marius

Is this even real? 0.20% fee sounds suspiciously low. Will they actually pass staking yields to holders or skim them? curious if inflows stick

coinpilot

Whoa 69.45M day one? didnt expect that. Staking + spot is clever but kinda nervous about network outages, hope custody is truly solid. big move for SOL

Leave a Comment