4 Minutes

BNB clings to lower band as traders reduce leverage

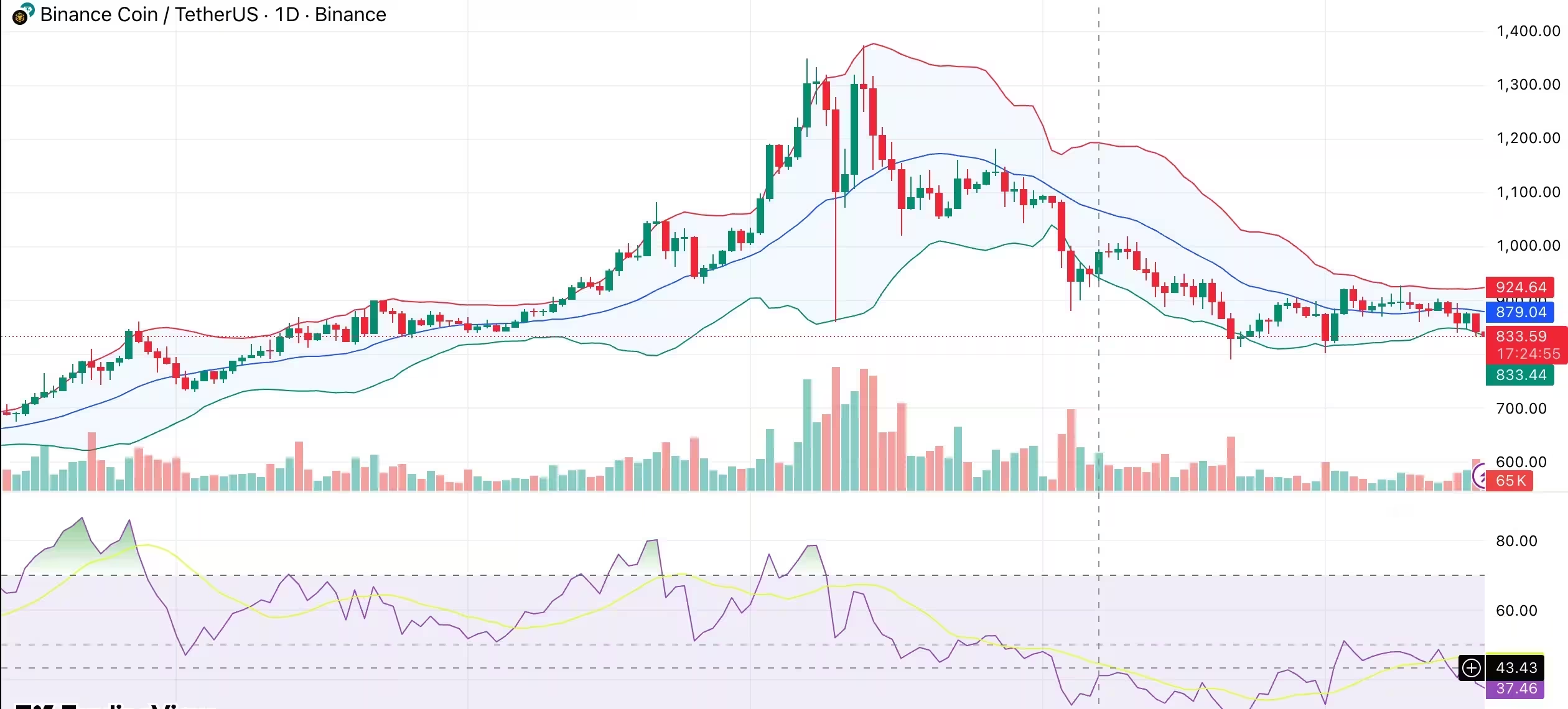

BNB traded around $832 at the time of writing, holding close to the lower Bollinger Band near $830 after a sharp pullback from recent highs. Over the past 24 hours the token fell roughly 4%, extending a weekly decline of about 4.3% and a 30-day loss near 8.4%. The market remains well below October peaks, with BNB about 39% under its $1,369 high.

Market snapshot

Price action and derivatives flow

Trading activity picked up as prices dropped, signaling active repositioning rather than calm consolidation. BNB recorded $2.51 billion in 24-hour spot volume, up 33.6% day-over-day. Derivatives volume also surged, rising about 48% to $2.03 billion, while open interest declined roughly 1.72% to $1.33 billion. That combination typically indicates traders closing leveraged positions and reducing exposure into volatility, contributing to the recent downside pressure.

Indicators of risk-off behavior

Volume spikes during the selloff and falling open interest point to position unwinding across futures and perpetuals markets. When derivatives volumes rise while open interest drops, it usually means liquidations and profit-taking outpaced fresh directional bets. For BNB, this dynamic has amplified bearish momentum even though some external fundamentals remain constructive.

On-chain and regulatory fundamentals remain constructive

Despite the price correction, several structural drivers support BNB's long-term proposition. Abu Dhabi Global Market granted Binance full regulatory approval, marking the exchange as the first to receive exchange, clearing, and brokerage licenses under that framework. This regulatory recognition bolsters institutional confidence in Binance and the broader BNB ecosystem.

BNB Chain adoption is expanding: BlackRock's tokenized treasury fund now runs on the network, creating tangible on-chain demand and lending weight to blockchain-based tokenization use cases. BNB's ongoing auto-burn mechanism continues to reduce circulating supply, which supports scarcity-driven value arguments.

Leadership developments have also been relevant. Changpeng Zhao has become more publicly engaged after legal matters wound down, and market attention is shifting toward stronger positioning in the U.S., which could unlock further institutional flows over time.

Technical outlook

Bollinger Bands, RSI, MACD and moving averages

BNB is trading close to the lower Bollinger Band near $830, suggesting sustained downward pressure rather than an exhausted selloff bounce. Volatility expanded during the breakdown and each attempt to recover toward the mid-band near $880 has been met with weak buying.

Momentum indicators remain soft: the Relative Strength Index is holding below 50 and bounces have faded quickly, while the MACD sits below its signal line, indicating persistent downside momentum. On the moving-average front, price is trading well under major short- and medium-term averages from the 10-day through the 200-day, reinforcing the bearish technical framework.

BNB price daily chart

Key levels to watch

- Immediate resistance: $880 — reclaiming this level would ease near-term pressure and open room toward the $900–$920 range.

- Nearby support: $820 — a failure to hold here would likely keep downside scenarios in play while price remains under key moving averages.

Trading implications and risk management

For traders and investors, the current environment calls for cautious positioning. The blend of higher trading volume and falling open interest means many leveraged players are stepping back, which can amplify intraday volatility. Short-term traders should monitor liquidation clusters around the $820 area, and use tight risk controls if attempting mean-reversion trades. Longer-term investors may view recent weakness as an entry window given ongoing on-chain adoption, token burns, and regulatory progress, but should remain mindful of macro liquidity conditions and broader crypto market cycles.

Overall, charts favor sellers until BNB can convincingly break above the mid-Bollinger band and key moving averages. Conversely, a decisive hold below $820 would keep bears in control and leave downside targets open until technical momentum shifts.

Source: crypto

Comments

neurobit

Feels overhyped imo. Leverage unwind explains the drop, 820 looks like a trap, trade tight or just wait for a clean flip

coinflux

Is this even true? BNB bleeding but on-chain wins are real, who's gonna buy the dip - institutions or retail? curious... not sure

Leave a Comment