3 Minutes

Macro analyst warns rapid Bitcoin rally could trigger a crash

Bitcoin's potential leap to $250,000 in a short timeframe has raised alarm bells among some macro investors. Mel Mattison, a macro analyst and investor, told crypto entrepreneur Anthony Pompliano that a swift ascent to $250K — along with a large concurrent S&P move — could produce a classic 'blow-off top' where retail and institutional players rush to take profits, sparking a sharp reversal.

What Mattison means by a 'blow-off top'

In his interview, Mattison argued that overly rapid price appreciation often precedes intense profit-taking. For Bitcoin, a 142% jump from current levels to $250,000 would be unprecedentedly fast by historical market-cycle standards. Such momentum-chasing can create liquidity imbalances and leave many investors stuck in crowded trades when the market turns.

Recent price action and healthy rotations

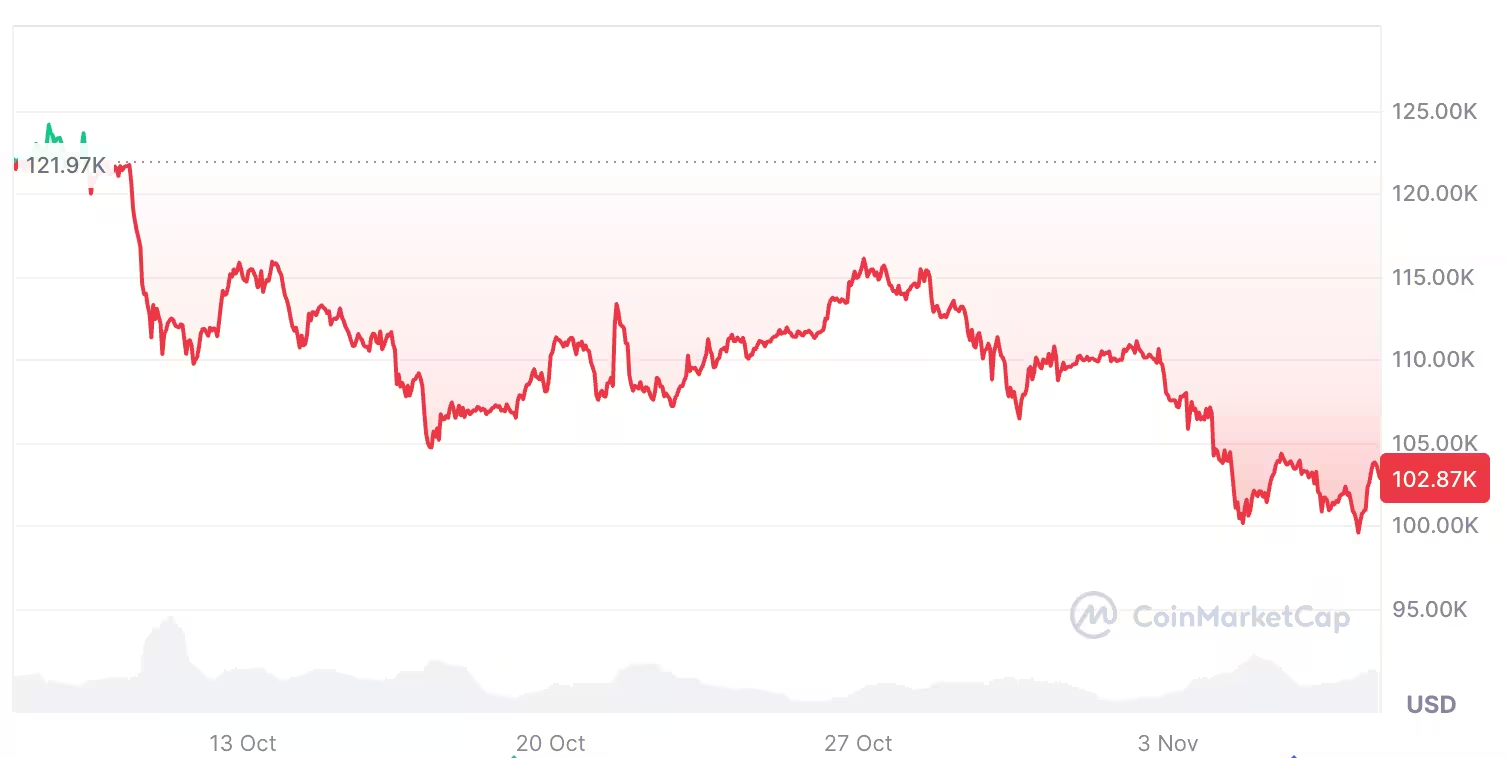

Bitcoin dipped below $100,000 on Nov. 4 for the first time in four months, and the asset is showing volatile but rotational movement between market participants. Mattison described these as 'healthy rotations' and noted that key technical channels are at interesting inflection points.

Bitcoin is down 16.39% over the past 30 days

Competing forecasts: bulls still see $250K this year

Despite Mattison's caution, bullish voices remain. BitMEX co-founder Arthur Hayes and BitMine chairman Tom Lee have reaffirmed that $250,000 is still achievable before year-end, even as the timeline narrows. Galaxy Digital CEO Mike Novogratz has said that planetary alignment would be required for such a target by December — highlighting how difficult it would be.

Historically, November has been one of Bitcoin's strongest months, with an average return around 42%. If that pattern held at current BTC prices near $103,000, it would imply a move toward $145,000 by month-end, according to CoinGlass data.

Outlooks for 2026 and the broader crypto market

Analysts disagree on whether a bear market will arrive in 2026. Canary Capital CEO Steven McClurg expects Bitcoin could climb to $140K–$150K by year-end before slipping into a 2026 bear cycle. Conversely, Bitwise CIO Matt Hougan anticipates another 'up year' in 2026, challenging the conventional four-year cycle narrative.

Mattison himself suggested a more measured path, saying Bitcoin might reach $150,000 by February 2026 rather than exploding to $250K in months. The debate highlights differing views on market cycles, institutional accumulation, macro liquidity, and regulatory risk.

Investor takeaways for crypto traders

For traders and investors, the key takeaway is to weigh the risks of rapid rallies. A fast move to $250,000 could generate headline-grabbing gains but also increase the odds of a violent correction. Risk management, diversification across crypto and traditional markets, and attention to on-chain and macro indicators remain essential as BTC navigates this next phase of its market cycle.

Source: cointelegraph

Leave a Comment