4 Minutes

Analyst: BTC dominance weakness could usher in altcoin gains

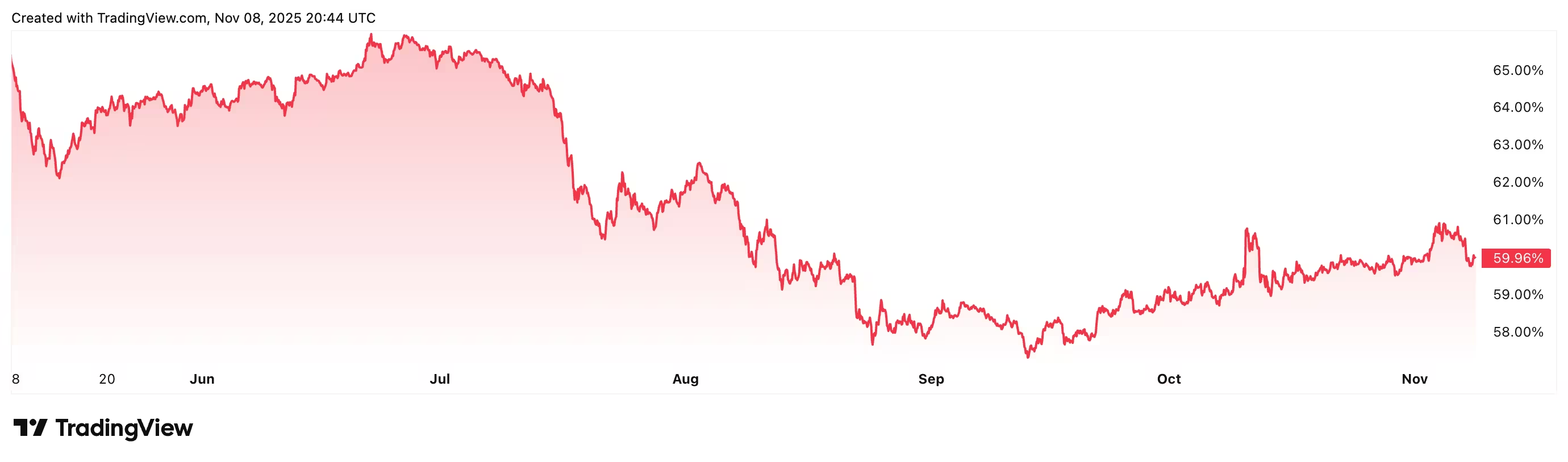

Recent shifts in Bitcoin dominance suggest the market may be tilting toward altcoins, according to on-chain and chart analysts watching BTC dominance trends. Crypto strategist Matthew Hyland pointed out that Bitcoin’s dominance chart has appeared bearish for weeks, and that downward pressure on BTC dominance often precedes stronger altcoin performance.

Why traders are watching BTC dominance

Bitcoin dominance — a metric that tracks Bitcoin’s share of total crypto market capitalization — is a leading indicator for rotation into risk-on assets such as altcoins. When BTC dominance falls, capital often flows into altcoins, driving higher price action across smaller-cap tokens. Hyland argued that the recent bounce in BTC prices looks like a short-lived relief rally within a larger downtrend.

"The downtrend is favorable to continue; therefore, this relief rally has been a dead cat bounce in a downtrend," Hyland wrote. He also suggested that some of the recent volatility in major cryptocurrencies may reflect intervention or positioning by large institutional players.

Volatility and market context

Bitcoin BTC $101,666 price may have been orchestrated by traditional finance giants, Hyland said, adding that Wall Street activity could explain sudden moves across BTC and broader markets.

Bitcoin dominance is down 5.05% over the past six months

At the time of reporting, CoinMarketCap listed Bitcoin trading near five figures, with price action that has kept traders cautious. Bitcoin slipped under $100,000 in early November, stoking debate about whether the next phase of the cycle will be led by BTC or altcoins.

Bitcoin is down 15.65% over the past 30 days

Despite the decline in BTC dominance, on-chain indicators and popular tools like CoinMarketCap’s Altcoin Season Index still show a market that remains Bitcoin-centric — the Altcoin Season Index currently reads 28 out of 100, putting conditions closer to "Bitcoin Season" than an outright altcoin breakout.

What could make the next altcoin season different?

One common view among market professionals is that the upcoming altcoin rotation — if it arrives — may not mirror prior cycles. Maen Ftouni, CEO of CoinQuant, expects capital to focus on older, more liquid projects, especially those tied to exchange-traded fund (ETF) narratives. Tokens with ETF potential or existing ETF-related demand could capture a disproportionate share of inflows.

"Not every single coin is going to have massive returns; the liquidity is going to be concentrated into certain places, dinosaurs being one of them, of course," Ftouni said, suggesting a more selective, concentrated altcoin season than past cycles where broad-based altcoin rallies were common.

How traders can prepare

For traders and portfolio managers, the signals point to increased importance of risk management and selective exposure. Monitor BTC dominance, trading volumes, token liquidity, and ETF-related developments. Consider positioning in established altcoins with strong liquidity and clear narratives rather than casting a wide net across low-liquidity projects.

In short, a sustained decline in BTC dominance raises the probability of renewed altcoin interest, but the next altcoin season may favor liquidity, ETF-linked narratives, and selective rotations rather than a blanket altcoin boom.

Source: cointelegraph

Leave a Comment