4 Minutes

Zcash rally accelerates as halving approaches

Zcash (ZEC) has become one of crypto’s standout performers this month, extending gains as traders and institutions position for the upcoming halving. ZEC climbed to $658 at press time, vaulting roughly 20% in 24 hours and adding to an extraordinary 200% advance over the past 30 days. Year-to-date performance is even more dramatic, with ZEC up more than 1,300% over the last 12 months as renewed interest in privacy coins and supply-tightening mechanics drive demand.

Market flows and derivatives activity

Daily spot volume eased to about $2.3 billion, down roughly 29% from the prior day, suggesting some traders are pausing after heavy accumulation earlier in the week. Derivatives data paint a mixed but constructive picture: open interest rose 22% to $1.12 billion while futures volume dropped by 24% to $5.95 billion, per CoinGlass. That mix points to holders sitting on positions and a market that may be transitioning from speculative spikes to conviction-led accumulation.

Halving countdown: scarcity and price implications

The primary catalyst is the scheduled Zcash halving on Nov. 18, which will reduce block rewards from 3.125 ZEC to 1.5625 ZEC per block. That effectively cuts the annual supply growth to an estimated 3.5%, mirroring Bitcoin-style scarcity dynamics that historically have supported bullish narratives. Traders often pre-position ahead of halvings, and several analysts — including notable voices in derivatives markets — have floated targets north of $1,000 if momentum holds.

On-chain privacy adoption gains traction

Beyond the halving, on-chain indicators show rising real-world use: shielded pools now hold more than 30% of total ZEC supply — roughly 5 million coins — a 60% increase month-over-month. Shielded pools rely on zk-SNARK cryptography to enable fully private transactions, and their growth signals both technical adoption and a shift in user behavior toward privacy-preserving transfers. New cross-chain integrations and user-friendly privacy wallets such as Zashi have helped push shielded transfers nearly nine times higher year-to-date.

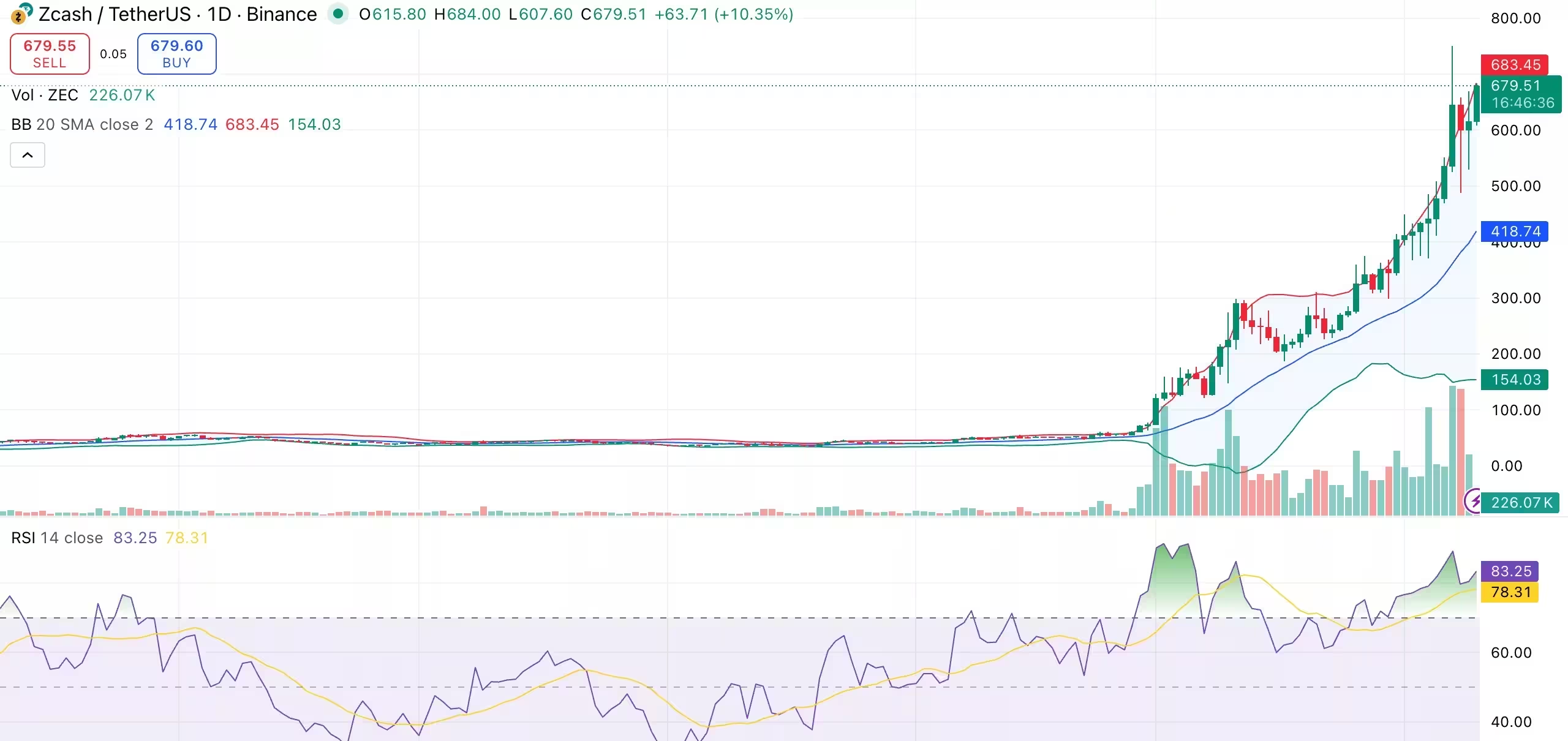

ZCash daily chart

Institutional interest returns

Institutional demand is returning to privacy-oriented tokens. Grayscale’s Zcash Trust has more than doubled assets under management in recent weeks, rising to about $151 million. The inflow of regulated capital suggests that asset managers and funds see privacy and data security as increasingly important themes in global finance, which could provide a steadier bid for ZEC going forward.

Technical outlook and key levels to watch

Short-term technicals show a powerful uptrend, though signs of exhaustion are visible: the 14-day Relative Strength Index (RSI) sits near 83, indicating overbought conditions. Major moving averages from the 10-day up to the 200-day remain below the current price, reinforcing bullish momentum. Immediate support is forming around $550, aligning with the 20-day moving average and recent consolidation. Near-term resistance clusters between $700 and $720 — a breach above that zone could open a pathway toward $850 and higher, while a pullback toward $600 could offer a healthy reset before another rally leg.

Overall, ZEC’s move highlights how halving-driven scarcity, rising privacy adoption, and renewed institutional flows can combine to propel a privacy token into the spotlight. Traders and investors should weigh the potent upside against overbought indicators and the possibility of short-term consolidation.

Source: crypto

Leave a Comment