3 Minutes

Leaked screenshots reveal Coinbase may launch Kalshi-backed prediction markets

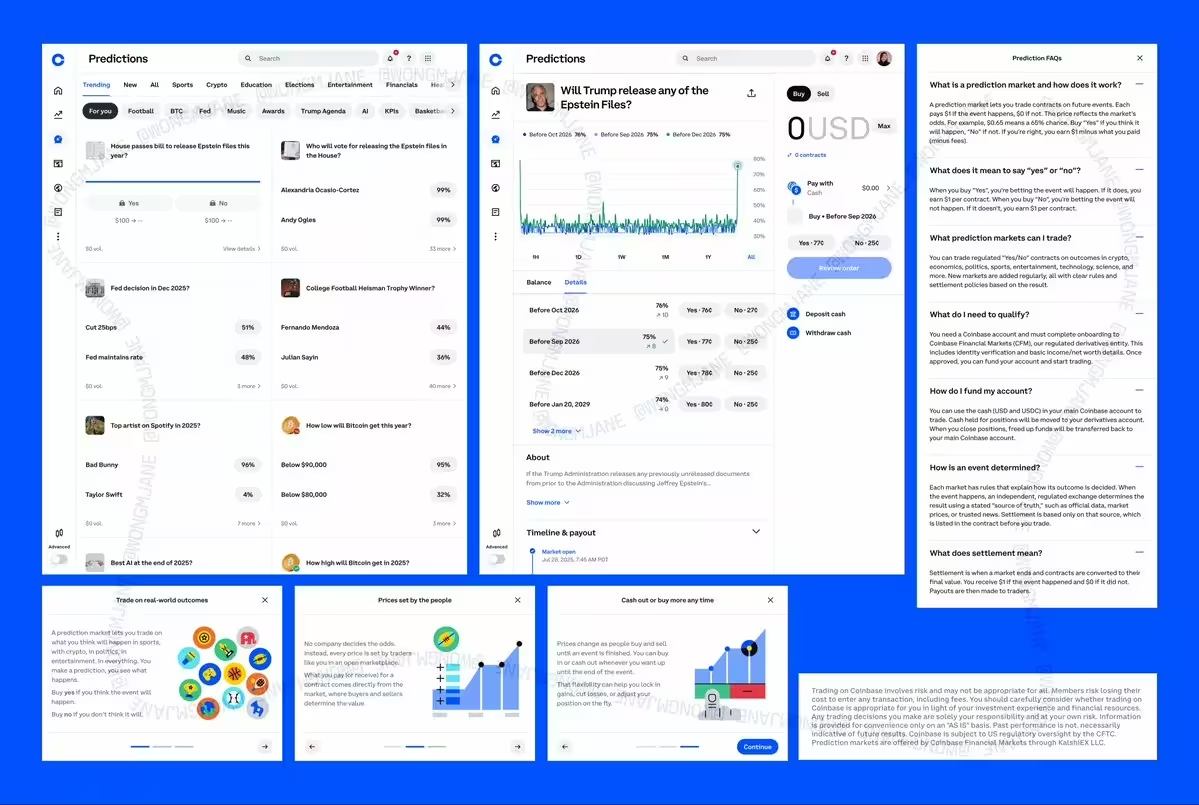

Leaked images shared by researcher Jane Manchun Wong indicate Coinbase is developing a new prediction markets platform that would rely on Kalshi's regulated infrastructure. The screenshots, circulated on social media, show Coinbase-branded market pages, onboarding guides, and a user interface that appears to support USDC and U.S. dollar participation across categories like economics, sports, science, politics, and technology.

Product signals and structure

The leaked UI suggests the product would be managed by Coinbase Financial Markets, the exchange's derivatives arm, delivered "through Kalshi," implying the offering will lean on Kalshi's regulatory framework and event-contract architecture. Screenshots also indicate an FAQ section and step-by-step onboarding, pointing to a full consumer flow from custody to trade execution using USDC stablecoins or fiat dollars.

Why Coinbase is targeting prediction markets

Coinbase has signaled its intent to become an "everything exchange," and prediction markets fit that strategy by expanding derivatives and event-based trading. Coinbase and Kalshi announced a partnership in mid-November allowing Coinbase to act as custodian for Kalshi's USDC-based event contracts. Using Kalshi's regulated infrastructure could accelerate a compliant rollout under CFTC oversight while letting Coinbase leverage its custody and USDC rails.

Competition and industry context

The push into prediction markets comes as competitors also advance regulated event contract offerings. Gemini has filed to become a designated contract market with the Commodity Futures Trading Commission, laying groundwork for regulated event contracts. Crypto.com recently launched a prediction product via a partnership with Trump Media. The market saw strong growth through 2024 and 2025, with platforms like Kalshi and Polymarket reporting record volumes ahead of major political and economic events.

Regulatory and market implications

Bringing a prediction market to a mainstream exchange raises questions about compliance, custody, and stablecoin usage. Relying on Kalshi offers Coinbase a path to operate within existing regulated frameworks for event contracts, potentially reducing regulatory friction. The use of USDC highlights the steady role stablecoins play in on-chain and off-chain trading infrastructure, while CFTC engagement will be central for derivatives-style products.

Coinbase expands business services in Singapore

Separately, Coinbase launched Coinbase Business in Singapore, its first international rollout of a business-oriented platform. The service supports instant USDC payouts, global transfers, automated accounting integrations, and real-time SGD banking via Standard Chartered. The Singapore expansion builds on Coinbase's BLOOM Initiative collaboration with the Monetary Authority of Singapore, aiming to bridge fiat and crypto for cross-border payments and payroll automation.

What to watch next

Watch for an official Coinbase announcement detailing whether the platform will open public markets, what approvals will be sought from the CFTC or other regulators, and how custody and USDC settlement will be integrated. If launched, a Kalshi-powered Coinbase product could accelerate mainstream access to regulated prediction markets and deepen ties between stablecoins, custody services, and event-based derivatives.

Source: crypto

Leave a Comment