8 Minutes

Why euro stablecoins matter to the EU

The rapid rise of stablecoins — digital tokens designed to maintain a stable value relative to fiat currencies — is reshaping payments and liquidity within crypto markets. Yet, as US-dollar-backed stablecoins dominate global markets, European central bankers warn that this dollarization could erode the euro’s role in the region’s digital economy and complicate monetary policy. Industry participants and euro-based issuers, however, argue that a competitive, well-regulated euro stablecoin ecosystem can be the pragmatic solution to preserve monetary sovereignty while fostering crypto innovation.

ECB concerns: Dollar stablecoins and monetary policy risk

Dollarization and policy transmission

In mid-2025, officials within the European Central Bank (ECB) flagged an accelerating risk: the growing use of US-dollar-backed stablecoins in Europe could mirror patterns found in dollarized economies. The core worry is that if European savers and businesses increasingly hold assets denominated in dollars via stablecoins, the ECB’s influence over euro-denominated interest rates and liquidity conditions could weaken. In crisis scenarios, large-scale shifts into dollar-linked instruments might reduce the effectiveness of eurozone monetary tools and complicate financial-stability responses.

Systemic relevance and contagion risk

Regulators also highlight systemic vulnerability. Dutch central bank leadership warned that if USD stablecoins grow unchecked, they could become "systemically relevant," meaning a sudden run or liquidity shock in that market would have knock-on effects across the European banking and payments system. That risk raises questions about central bank backstops, deposit-like protections, and how stablecoin issuers are supervised.

Market reality: USD stablecoins dominate

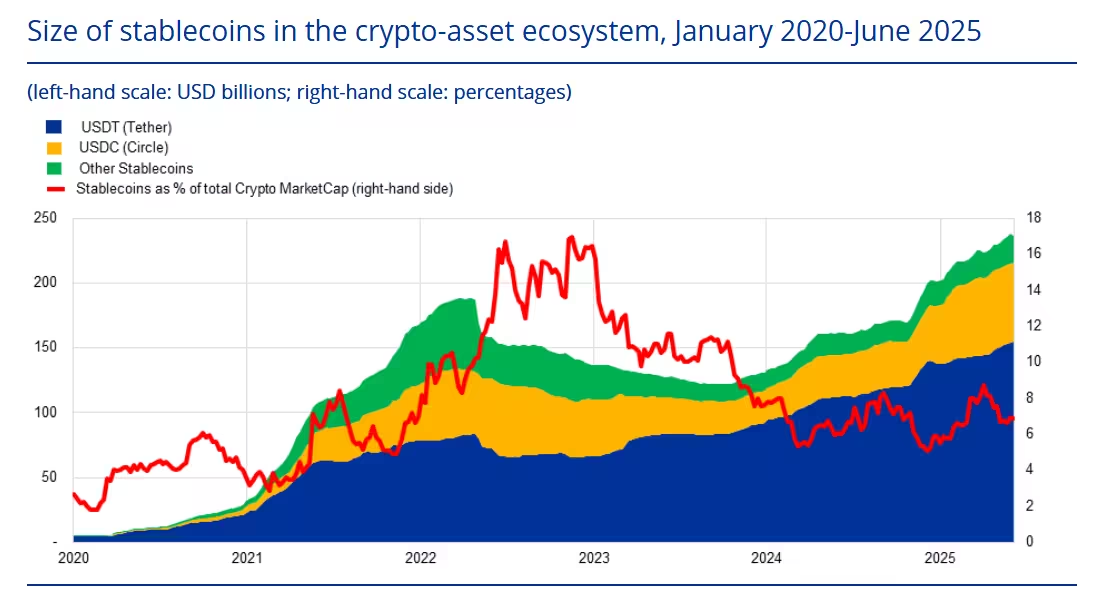

The numbers underscore the imbalance. Roughly 99% of a multi-hundred-billion-dollar stablecoin market is backed by the US dollar, while euro-denominated stablecoins remain marginal by comparison. The consequence is clear: dollar-pegged tokens have become the primary quote asset for many crypto traders and a preferred store of value in markets where local currencies are volatile.

The stablecoin ecosystem is growing apace.

Why euro-backed stablecoins lag behind

Initial demand drivers

Industry sources note that the initial wave of stablecoin adoption was driven by exchange liquidity needs and by crypto-native users who required a reliable quote currency. Because many exchanges and global markets quoted in USD, dollar-backed stablecoins naturally captured the lion’s share of trading volume and settlement flows.

Missing real-world use cases

Euro stablecoin issuers say the bigger barrier is not technology but demand: there are still relatively few mainstream payments rails, merchant integrations, payroll systems, and DeFi applications that consistently use euro-denominated tokens outside of speculative trading. Until euro-backed stablecoins can support everyday payments, invoicing, cross-border transfers within the EU, and payroll conversions, they will struggle to displace the entrenched USD players.

Private stablecoins vs. the digital euro (CBDC)

Timeline and capability concerns

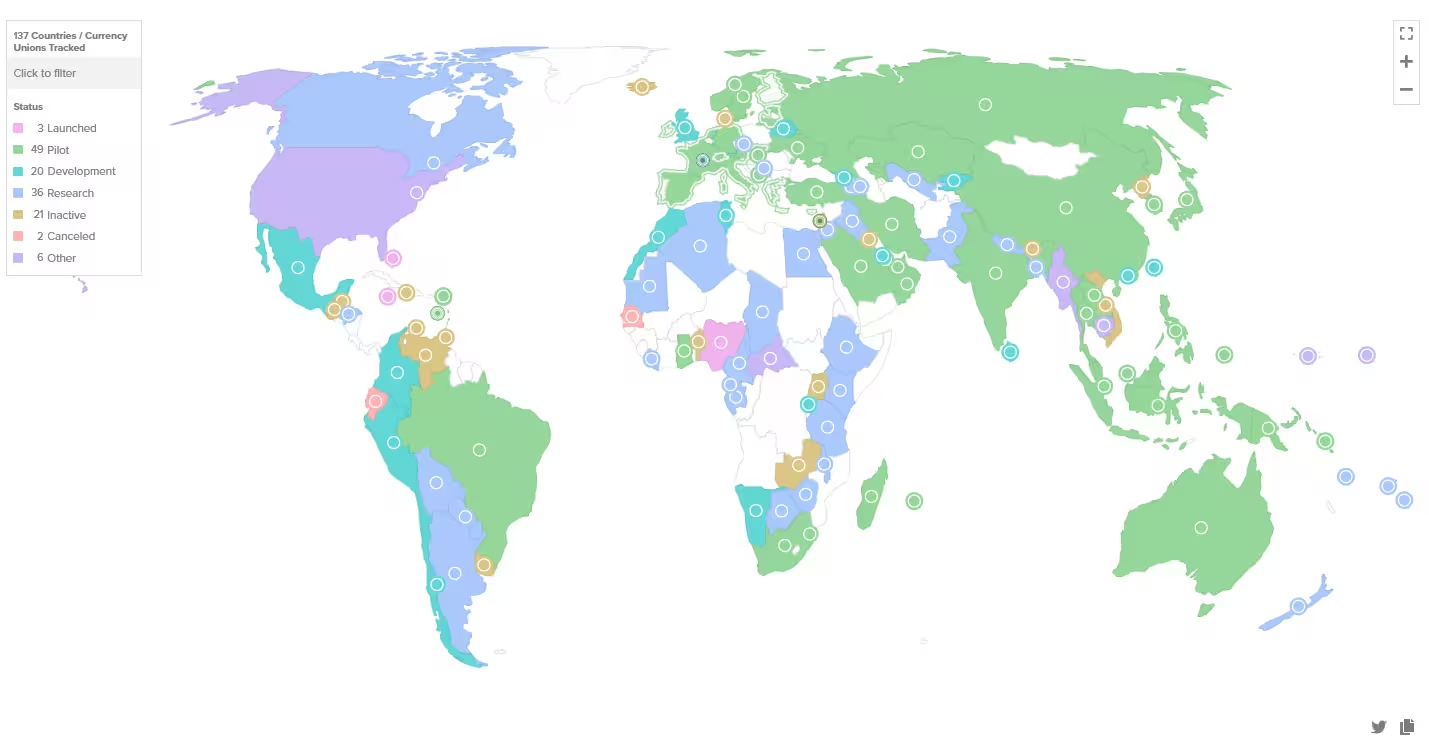

Central banks in the euro area are actively exploring a central bank digital currency (CBDC) called the digital euro. The ECB’s roadmap includes stakeholder consultations, infrastructure experiments, and a legislative timetable that could see formal proposals presented to EU institutions in coming years. Proponents position the digital euro as a trusted public alternative that could reduce dependence on non-European payment providers.

Three countries have launched CBDCs, and 105 countries have CBDCs in development, research or pilot phases.

But stablecoin issuers question whether the digital euro will arrive soon enough or with the functional design needed for global transfers, merchant usability, and programmable-finance use cases. Critics warn that CBDC designs often prioritize risk controls and holding caps that might limit scalability and fail to match the accessibility of private stablecoins built on public blockchains.

Design tradeoffs and adoption friction

Key uncertainties around the digital euro remain: will it be built on a blockchain or a proprietary ledger? Will it facilitate seamless peer-to-peer transfers, cross-border interoperability, and programmable smart-contract integrations? Suggested limits on individual holdings or constraints on secondary-market transfers could blunt many benefits private stablecoins currently offer.

Industry proposals: Build a competitive euro stablecoin sector

Why a private euro stablecoin ecosystem helps

Issuers advocate for a pragmatic approach: instead of waiting for a CBDC, regulators and banks should enable a thriving euro stablecoin market through clear rules, trusted reserve practices, and infrastructure support. A portfolio of well-regulated, euro-denominated stablecoins could provide the euro with digital liquidity, support payments innovation, and reduce demand for dollar-pegged alternatives.

Practical measures issuers recommend

- Regulatory clarity: Define supervision, reserve transparency, and redemption guarantees for stablecoin issuers to build public trust.

- Banking integration: Improve access to euro-denominated settlement accounts and payment rails for token issuers and exchanges.

- Infrastructure support: Offer central-bank liquidity backstops or access channels to limit systemic spillovers without crowding out private innovation.

- Real-world use cases: Encourage pilots for payroll, cross-border B2B payments, e-commerce checkout, and tokenized securities settlement using euro coins.

Cooperation between central banks and private issuers

While private and public digital money may compete on features, many industry leaders see a complementary future. Stablecoins are typically backed by traditional assets — bank deposits, short-term securities, or other high-quality reserves — which keeps them tied to the fiat banking system. This relationship suggests central banks and regulators can craft hybrid frameworks that preserve monetary sovereignty while empowering innovation in blockchain payments and decentralized finance (DeFi).

Some central banks have already signaled willingness to support liquidity facilities for regulated stablecoin issuers, recognizing that a resilient payments ecosystem requires collaboration across public and private actors. If designed carefully, such programs could ensure stability without turning CBDCs into the only viable digital option.

Policy options: What the EU can do now

For policymakers aiming to protect the euro and maintain efficient payments, a multi-track strategy is recommended:

- Accelerate regulatory certainty: Finalize rules that address reserve management, auditability, and redemption rights for stablecoins.

- Promote interoperability: Invest in bridges and standards that let euro stablecoins move seamlessly between wallets, exchanges, and merchant systems.

- Support pilots and real-world adoption: Fund or endorse public-private pilots for payroll conversions, cross-border SME payments, and tokenized asset settlement using euro tokens.

- Coordinate internationally: Work with other jurisdictions to ensure euro stablecoins are accepted in on-ramps and off-ramps globally, reducing incentives to prefer USD tokens for cross-border use.

Outlook: Toward resilient euro-denominated digital money

The choice facing the EU is not binary. A future where the euro remains central to Europe’s digital economy can be achieved through a combination of a thoughtfully designed digital euro and a diverse, regulated ecosystem of euro-backed stablecoins. If regulators move to establish clear rules and infrastructure, euro stablecoins could deliver the payments efficiency, programmability, and global transferability users demand — while preserving monetary-policy sovereignty.

In short, euro stablecoins are not just a technical novelty; they are a strategic tool. If Europe invests in supportive regulation, banking access, and real-world use cases, a competitive euro stablecoin sector can counter dollarization risks and ensure the euro’s relevance in the tokenized economy.

The stablecoin debate is ultimately about choice: giving European businesses, consumers, and developers robust euro-denominated digital money options that are secure, liquid, and fit for blockchain-native innovation.

Source: cointelegraph

Comments

labcore

Pragmatic combo: CBDC + regulated stablecoins makes sense, but regulators gotta move faster. Pilots now pls, not in 5 years

coinDrift

So euro coins could actually stop dollar domination? Seems optimistic… who'll use them for payroll though, banks will drag their feet, no real rails yet

Leave a Comment