6 Minutes

MicroStrategy’s exposure and the market shock

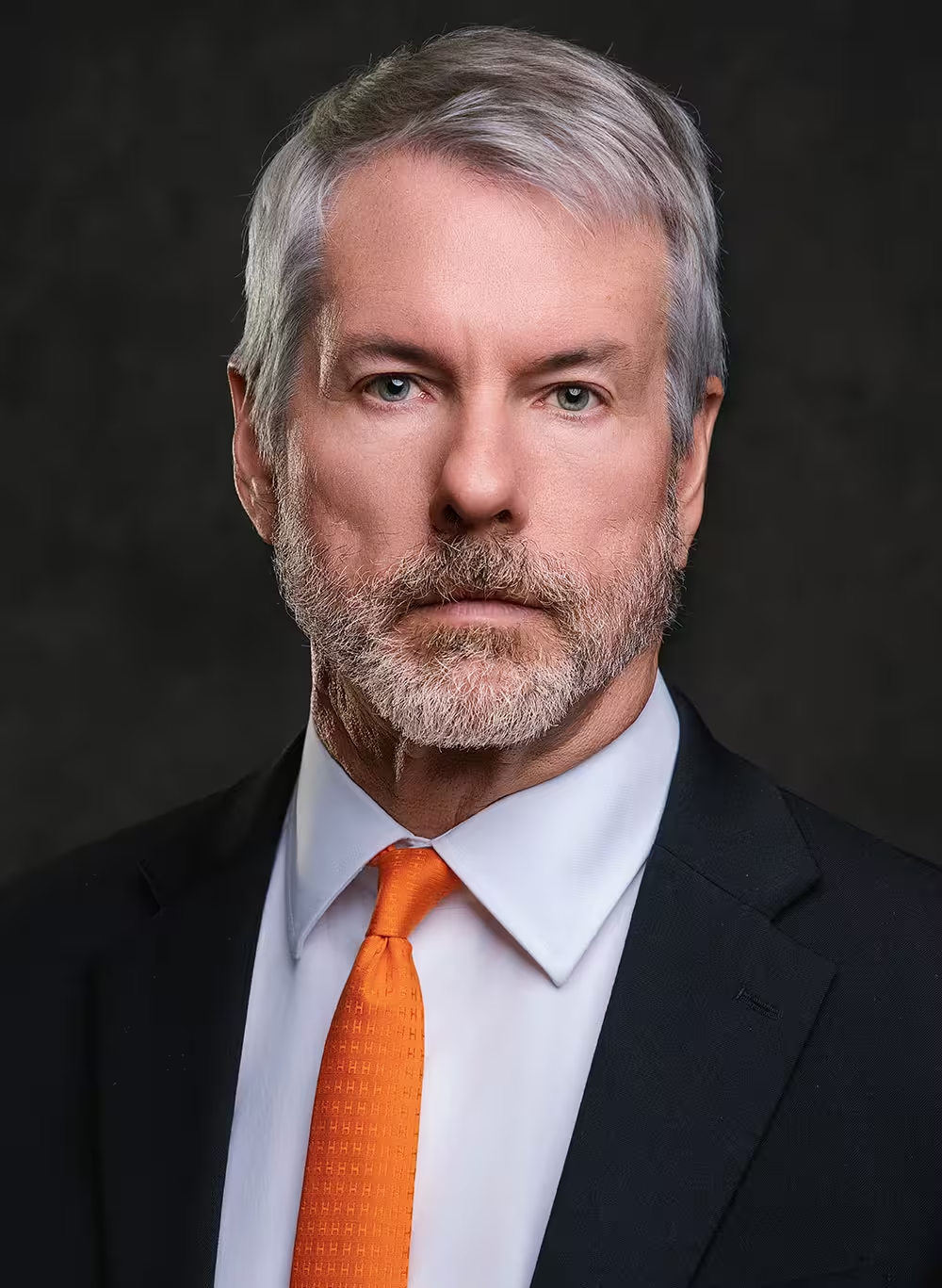

MicroStrategy — the Nasdaq-listed firm long associated with CEO Michael Saylor’s aggressive Bitcoin accumulation strategy — is facing renewed scrutiny as Bitcoin slipped to multi-month lows below $100,000. The company remains the largest publicly traded holder of BTC, but sharp declines in the cryptocurrency’s price have pushed MSTR shares into a steep correction.

Recent performance highlights indicate MSTR shares have tumbled more than 40% in the last month and are off over 55% year-to-date. That sell-off has mirrored Bitcoin’s downward momentum: Bitcoin dropped from a reported all-time high near $126,000 to roughly $82,175 at its intra-day low, erasing the $100,000 psychological level and tightening pressure on leveraged proxies and crypto-related equities.

MicroStrategy’s Bitcoin holdings: scale and risk

MicroStrategy’s BTC treasury remains huge — 649,870 BTC valued at approximately $48.3 billion according to the most recent figures reported in the source material. That hoard far exceeds the next-largest public holder and underpins the company’s entire market narrative: MicroStrategy is often treated as a proxy for Bitcoin exposure by retail and institutional investors alike.

How the “Saylor Premium” worked

The so-called Saylor Premium describes how MSTR historically traded at a premium to its net asset value. Investors bought MSTR not only for the company’s software business but largely for its embedded BTC exposure — effectively giving them leveraged exposure to price moves in Bitcoin. That premium allowed MicroStrategy to fund additional buys through equity issuances and convertible debt, creating a feedback loop: issue shares, buy BTC, market re-rates, repeat.

Why MSTR stock is falling faster now

Several converging factors explain the recent acceleration in MSTR’s decline. First, Bitcoin’s own correction has removed the tailwind that supported MSTR’s inflated multiples. Second, macroeconomic signals — softer jobs data and reduced odds of a near-term Fed rate cut — have drained liquidity from risk assets, including crypto and related equities. Third, investor concerns about dilution have grown: MicroStrategy has issued additional stock to fund BTC purchases, which can hurt per-share metrics and sentiment during downturns.

You might also like: Bitcoin price plunges to $85k in long squeeze fallout, ETF outflows, is the worst coming?

Index risk: MSCI review and possible delisting

A new layer of risk comes from index providers. MSCI confirmed it is reviewing whether to exclude companies whose core business model is the accumulation of crypto assets, particularly when such assets represent at least 50% of a company’s holdings. That consultation remains open with a decision expected by Jan. 15.

JPMorgan analysts have warned that exclusion from MSCI or similar benchmarks could reverse a key distribution channel that allowed Bitcoin exposure to flow into passive retail and institutional portfolios via index inclusion. MicroStrategy currently appears in major indices — Nasdaq-100, NASDAQ Composite, Russell 2000 and 3000, plus MSCI USA and MSCI World — which helped broaden its investor base.

Potential fallout from index exclusion

Analysts at JPMorgan flagged several consequences: reduced visibility among passive funds, diminished liquidity and lower trading volumes, and potentially meaningful outflows from index-tracking strategies. JPMorgan’s note estimates passive outflows tied to MSCI exclusion could reach about $2.8 billion; if other index providers follow suit, cumulative outflows might swell toward $11.6 billion. That magnitude of selling pressure could amplify downward moves in MSTR beyond the direct impact of Bitcoin’s price action.

Management stance and resilience claims

Michael Saylor has publicly downplayed the short-term damage from Bitcoin’s decline. In a recent interview he said the company was “engineered to take an 80% to 90% drawdown and keep on ticking,” positioning MicroStrategy as resilient through large BTC drawdowns. Investors should weigh that confidence against practical risks: funding costs, dilution, access to capital markets, and changing index treatment.

What institutional investors should consider

Institutional allocators and long-term crypto holders must assess the differences between holding Bitcoin directly and holding MicroStrategy shares. MSTR carries corporate governance considerations, the potential for equity dilution, and index-related liquidity risk. For those seeking pure BTC exposure, direct custody or spot Bitcoin ETFs (where available) may offer cleaner risk profiles. For investors who value potential leverage and corporate optionality, MSTR remains a differentiated — but riskier — vehicle.

What could happen next

Several scenarios are plausible in the short to medium term:

- If Bitcoin stabilizes and resumes an uptrend, MSTR could recapture some of its lost premium and recover market cap as investor confidence returns.

- If MSCI or other index providers move to exclude digital-asset treasury companies, MSTR could face forced passive outflows, reduced institutional participation and longer-term liquidity constraints.

- If macro liquidity remains constrained and BTC underperforms, continued share issuance to buy more Bitcoin could exacerbate dilution concerns and keep MSTR under pressure.

Active investors, index funds and individual traders should monitor BTC price action, funding announcements from MicroStrategy (including share issuances and debt plans), and updates from major index providers. Those elements will largely determine whether MicroStrategy’s strategy remains a viable long-term playbook or faces structural headwinds that require strategic pivoting.

Overall, MicroStrategy’s identity as the largest public BTC holder makes it uniquely exposed to Bitcoin’s volatility, and recent market dynamics have placed the company at a crossroads where index status, funding strategy and crypto market health will dictate near-term outcomes.

Source: crypto

Comments

Reza

Ive seen this pattern IRL, firm hoards asset, market turns, shares get hammered. If they keep issuing stock, longtime holders get hurt. sad but predictable

coinpilot

Is MicroStrategy really 'engineered' for an 80% drop? sounds bold. MSCI delist risk could wipe out passive holders, and dilution is real... Feels risky, no?

Leave a Comment