3 Minutes

Bitcoin shows early signs of a sustainable rebound

Bitcoin (BTC) appears to be stabilizing after testing lows near $80,600 last week, and market strategists say easing selling pressure and rising expectations for a Federal Reserve rate cut could support further gains. After dipping from its early-October all-time high above $126,000, Bitcoin's correction extended roughly 36% before buyers started to step back in.

Analysts point to capitulation and buyer exhaustion

Crypto market observers, including Charles Edwards of Capriole Fund, note that recent volatility in tech stocks and digital assets reflected shifting market expectations around monetary policy. As those expectations revert toward a softer outlook, Bitcoin has begun to climb from a bottom seen just above $82,000.

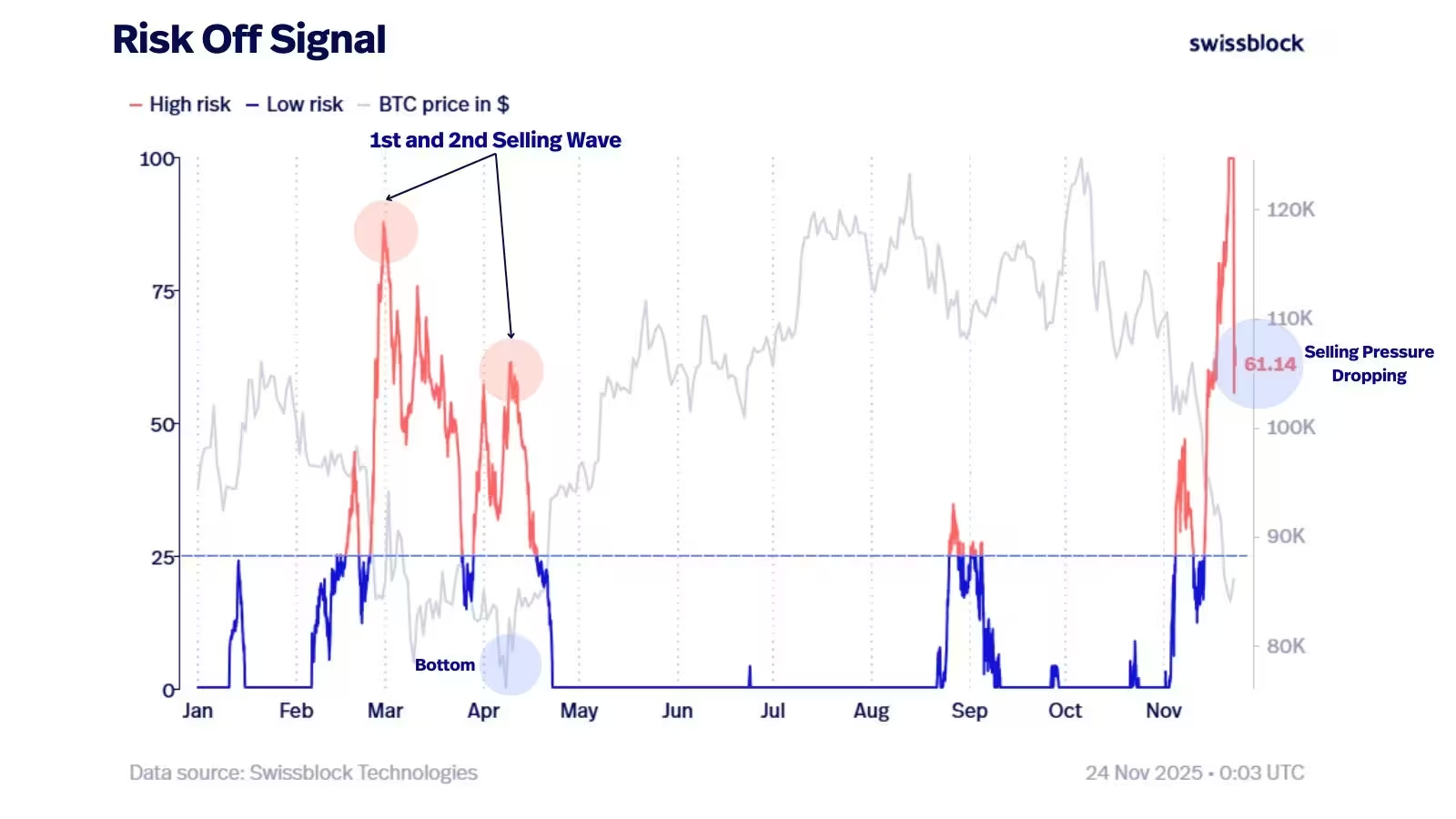

Swissblock: first real step toward a bottom

Wealth manager Swissblock flagged a sharp drop in the market's Risk-Off Signal, interpreting the move as two concurrent developments: selling pressure has eased, and the worst phase of capitulation is likely behind the market "for now." The team stressed the importance of this week, noting that continued fading of sell-side momentum would be required to confirm a durable bottom. They also warned of a potential, typically weaker, second selling wave that can nonetheless mark seller exhaustion when previous lows hold.

Bitcoin selling pressure is falling

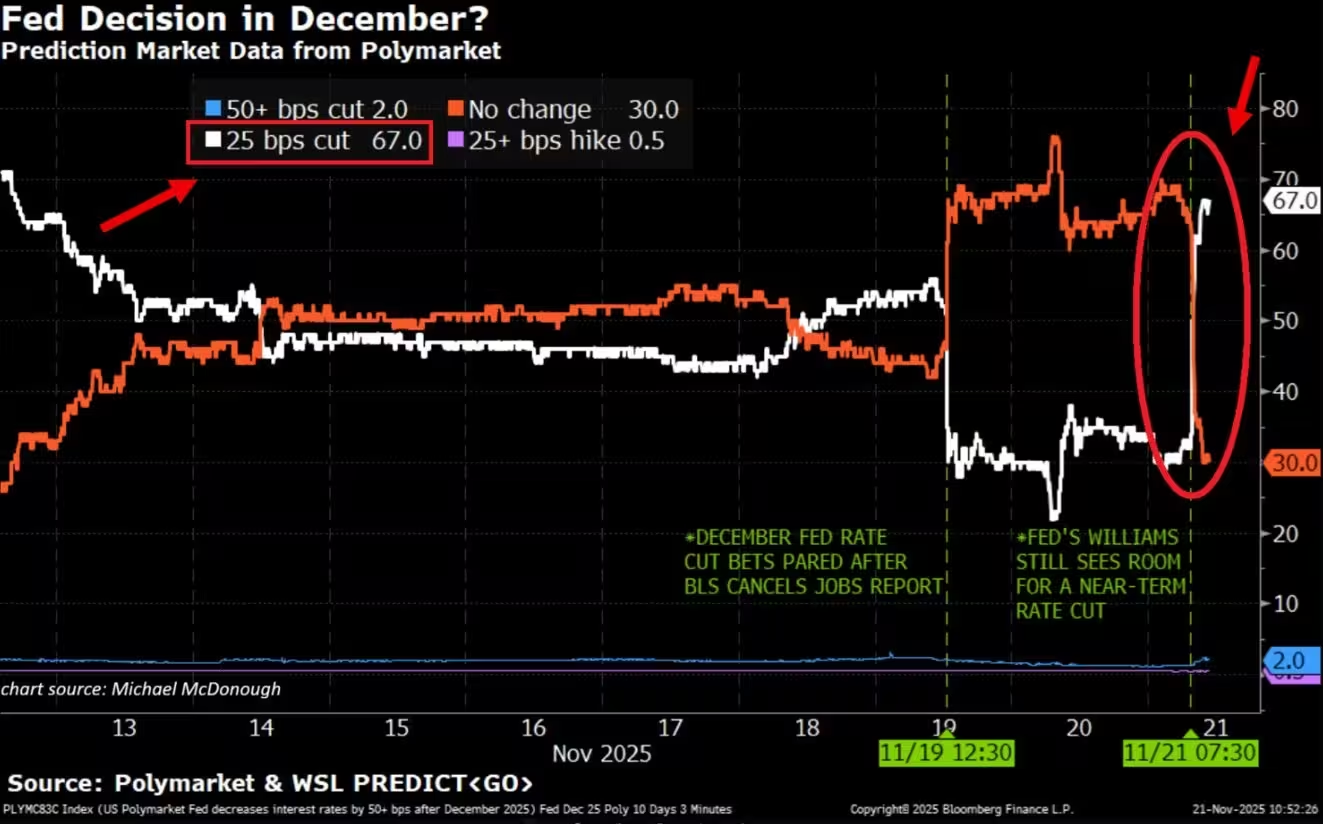

Macro drivers — Fed rate cut odds and liquidity expectations

Macro signals have been central to the market's shift. According to the CME Fed Watch Tool, implied odds of a 0.25% rate cut at the Fed's December meeting have swung back to around 69.3%, after dipping earlier. Traders on prediction markets also flipped their views in a short time span, highlighting how quickly expectations can change and how sensitive crypto prices remain to interest-rate narratives.

Fed rate cut predictions flip back toward 70%

Liquidity and quantitative easing — what traders are pricing in

Some market analysts argue the Fed may move to expand reserves management or otherwise inject liquidity to avoid more severe financial stress. Historically, rate cuts and increased liquidity — including quantitative easing episodes — have supported rallies in high-risk assets like cryptocurrencies. That dynamic is central to many traders' bullish thesis: if the central bank loosens policy, BTC and other crypto assets could see renewed demand from both retail and institutional participants.

What traders should watch next

Key technical and macro indicators to monitor include whether Bitcoin can sustain levels above recent lows, continued declines in selling pressure, shrinking funding and liquidation events, and whether Fed-cut probabilities remain elevated. Confirmation of a bottom often follows a short and weaker second sell-off where price holds prior lows and buyers reclaim control.

For crypto investors, the current setup balances clear risks with early signs of recovery. Traders should remain attentive to macro headlines, liquidity trends, and on-chain metrics as they assess potential entry points in a volatile market environment.

Source: cointelegraph

Leave a Comment