6 Minutes

MicroStrategy stock slides but BTC holdings remain profitable

MicroStrategy (MSTR) has endured a sharp pullback in its share price this year, sparking debate about whether the company’s deep conviction in Bitcoin is under stress. A closer look at its Bitcoin balance sheet and multi-year performance tells a more nuanced story: while the stock has fallen, MicroStrategy’s BTC position remains in the green and the firm’s long-term equity gains still outpace many major tech names.

Short-term stock moves vs. long-term BTC gains

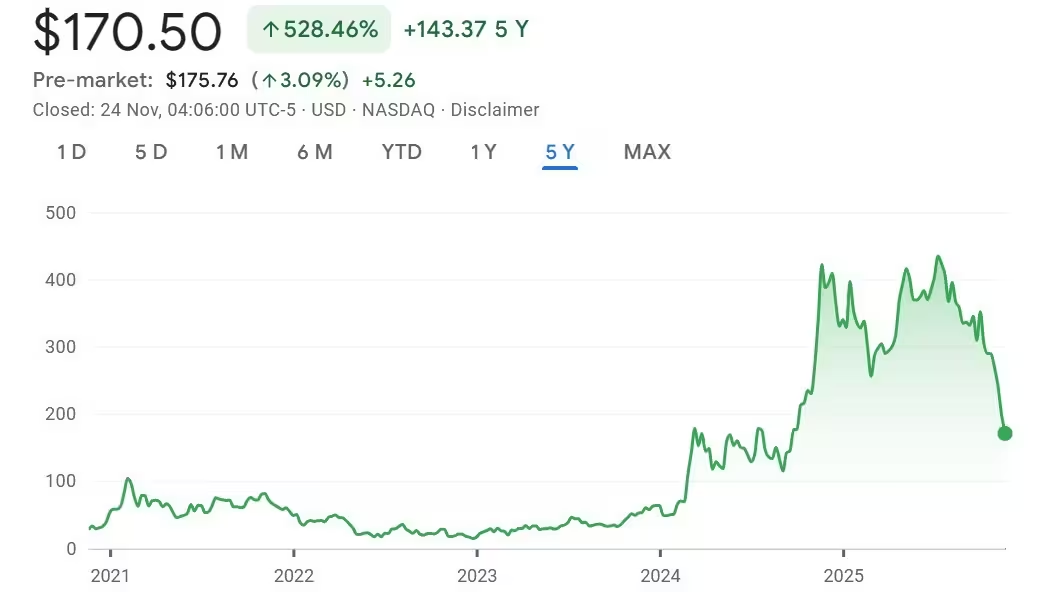

Google Finance data shows MSTR shares have dropped roughly 60% over the past 12 months and are down more than 40% year-to-date. The stock traded near $300 in October before sliding to about $170 at the time of reporting. Despite that decline, MicroStrategy’s Bitcoin purchases continue to show net profits.

According to BitcoinTreasuries.NET, MicroStrategy accumulated BTC at an average cost of $74,430 per coin. With Bitcoin trading in the mid-$80,000s, the firm’s treasury remains roughly 15–20% above its purchase basis — illustrating that the paper losses in the equity do not necessarily reflect losses in the company’s Bitcoin holdings.

Outperformance across multi-year windows

Over a five-year span, MicroStrategy shares are still higher by more than 500%, per Google Finance — far exceeding gains posted by major tech peers. To put that into context, Apple and Microsoft registered roughly 130% and 120% gains respectively in the same period. Even on a two-year view, MSTR’s performance outstrips these tech giants, reinforcing that a single-year drawdown can mask longer-term outperformance tied to the company’s Bitcoin strategy.

Strategy stock is still up over 500% in the last five years.

Why investors are shorting MSTR: hedging and options liquidity

One driving force behind the stock’s volatility is how traders use MicroStrategy as a proxy to hedge broader crypto exposure. Market participants often prefer to short MSTR or buy its liquid options to offset long Bitcoin positions, rather than trade spot BTC or less liquid derivatives. That dynamic can concentrate selling pressure on the equity during periods of market stress.

Tom Lee, chairman at BitMine, recently explained that MicroStrategy’s highly liquid options chain makes it convenient for traders to hedge crypto portfolios. In turn, that liquidity can transform MSTR into an unintended pressure valve for the market: funds and speculators funnel hedges and speculative shorts into the stock, increasing volatility that may be disconnected from the fundamentals of the company’s Bitcoin accumulation strategy.

Liquidation risk and structural considerations

Kyle Rodda, senior market analyst at Capital.com, warned that a steep drop in BTC prices could force MicroStrategy into asset sales or other stress events, which would add downward pressure to both the stock and Bitcoin itself. That tail risk highlights an important structural point: owning MSTR is not the same as owning BTC. A company can face corporate and market risks that an on-chain Bitcoin holder does not.

“We are probably a long way from this. But the risk makes abundantly clear that in the long run, buying MSTR stock is potentially inferior to owning actual Bitcoin,” Rodda said. “While MSTR stock can effectively disappear, one Bitcoin will always be one Bitcoin.”

Recent purchases and the company treasury

MicroStrategy reaffirmed its accumulation plan on Nov. 17 by announcing a purchase of 8,178 BTC for $835.6 million — a meaningful uptick versus its prior weekly cadence of roughly 400–500 coins. That acquisition brought the company’s disclosed total to approximately 649,870 BTC, a treasury now valued in the tens of billions of dollars at current BTC prices.

Broader liquidity slump in digital asset treasuries

MicroStrategy’s stock action occurs against a backdrop of thinning liquidity across the crypto ecosystem. Market-maker Wintermute has pointed to stablecoins, spot and futures ETFs, and digital asset treasuries (DATs) as primary liquidity sources. Recent data indicate inflows to these channels have slowed significantly, which can amplify price swings across both spot markets and correlated equities.

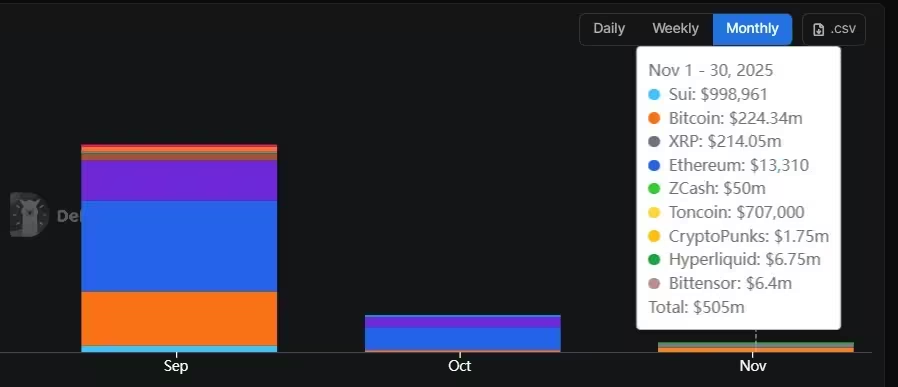

DefiLlama data show DAT inflows peaked in September before collapsing amid widespread liquidations. Net DAT inflows fell from nearly $11 billion in September to about $2 billion in October — an 80% decline — and weakened further in November. As of the latest reporting, November DAT inflows had dropped to roughly $500 million, a roughly 75% fall from October levels.

DAT inflows in the last three months.

What this means for investors

For institutional and retail crypto investors, the MicroStrategy case underscores the difference between equity exposure and direct Bitcoin ownership. MSTR can offer leveraged exposure to Bitcoin upside through a corporate vehicle, but it also introduces company-level risks, derivative-driven volatility, and liquidation scenarios that don’t affect spot BTC holders.

Investors weighing MicroStrategy should consider their time horizon, risk tolerance, and whether they want company-specific exposure or direct crypto ownership. For those seeking pure exposure to Bitcoin’s price action, holding BTC may remain the more straightforward and resilient option. For investors who prefer an equity vehicle with a history of aggressive accumulation, MSTR continues to represent a high-conviction, if volatile, play.

Source: cointelegraph

Comments

Tomas

Is this even true tho? They say funds use MSTR to hedge, but isn't that just shorts and options pushing the stock down, not BTC fundamentals?

blockray

whoa, MSTR down 60% yet BTC stash still up? wild. paper losses vs treasury gains, but company risk isnt nothing... uneasy

Leave a Comment