4 Minutes

Bitcoin dips below $88,000 ahead of FOMC decision

Bitcoin (BTC) pulled back into the weekly close, slipping under $88,000 and approaching the $87,000 area as traders positioned for a highly anticipated Federal Reserve interest-rate announcement. The sudden volatility marked an abrupt end to a relatively quiet weekend and reignited discussion about short-term macro risk, CME futures gaps and critical bullish support levels.

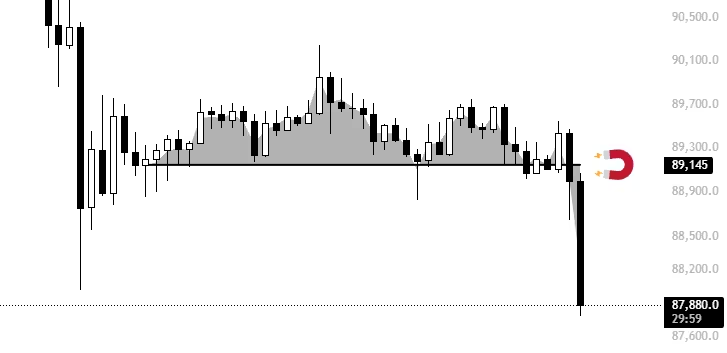

Price action and short-term volatility

BTC/USD saw swift downside movement, losing roughly $2,000 across two hourly candles as volatility returned to the market. This kind of snap decline is common ahead of major macro events, when liquidity and trader positioning can shift rapidly.

BTC/USD one-hour chart

The pullback also reopened the possibility of a new gap forming on CME Group’s Bitcoin futures ledger — a structural feature traders watch closely because gaps are often filled quickly once the regular trading week resumes.

BTC/USD chart with CME futures gap target

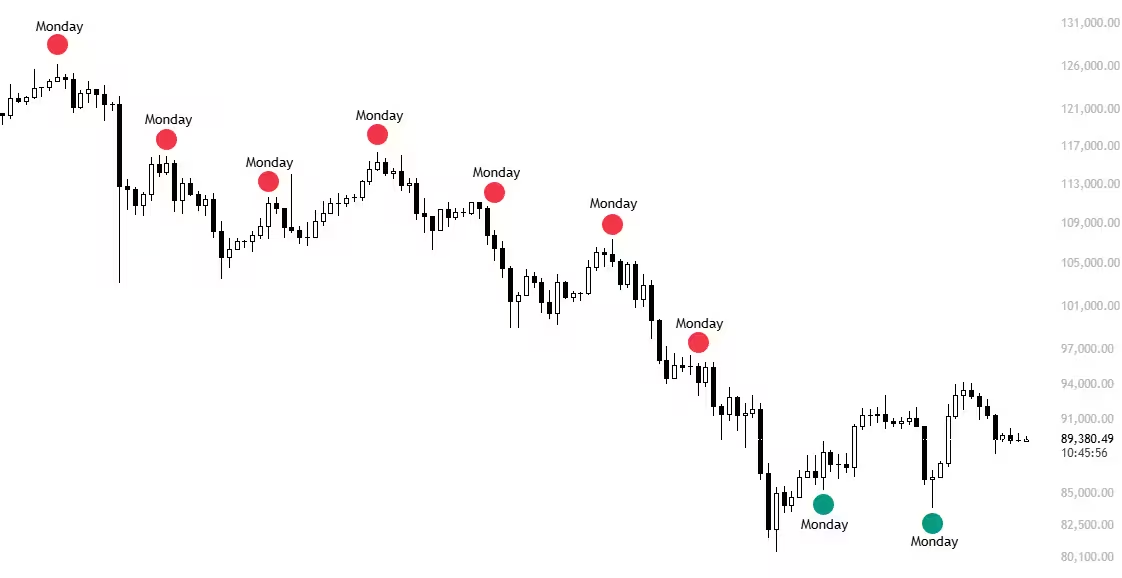

Weekend patterns and Monday setups

Market commentators highlighted the importance of weekend price action for shaping the week ahead. As one trader observed, Mondays frequently set pivot highs and lows; a weekend pump raises the odds of a Monday pivot high, while an absence of weekend upside increases the probability of a pivot low.

BTC/USD chart with Mondays highlighted

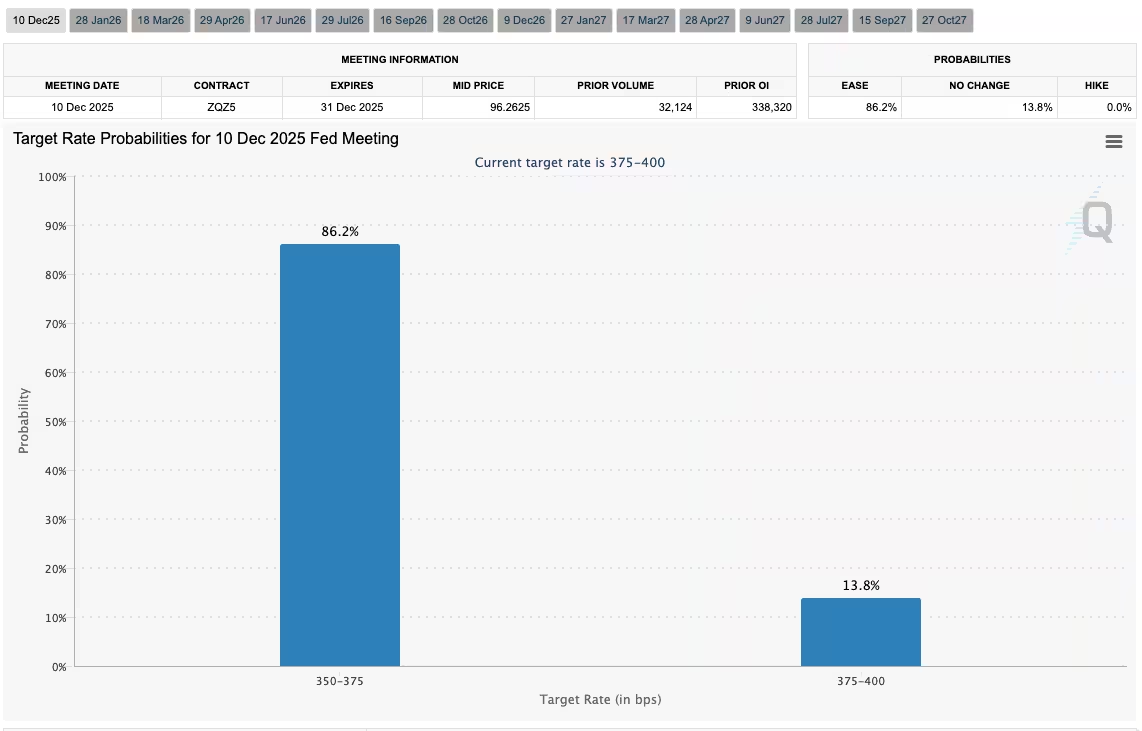

FOMC bets and market expectations

All eyes are on the Federal Open Market Committee (FOMC). CME Group’s FedWatch Tool indicated that most market participants were pricing in a 25 basis-point rate cut at the December meeting, and discussions around Fed policy and quantitative tightening (QT) guidance were driving risk appetite heading into the announcement.

Fed target rate probabilities for Dec. 10 FOMC meeting (screenshot)

Macro uncertainty tends to compress liquidity and increase short-term downside pressure on BTC as traders wait for clarity. Analysts and portfolio managers emphasized that the rate call is the dominant market event, affecting positioning, leverage and institutional flows.

Analyst views: support levels and upside scenarios

Several crypto strategists warned that FOMC nerves could push BTC toward the mid-$80,000s. One well-known analyst suggested a retreat to roughly $87,000 could occur before a quick rebound, while setting $86,000 as a crucial bulls’ line in the sand. If bulls hold that zone, the analyst argued, Bitcoin could resume an uptrend and attempt to reclaim $92K and push toward $100K in the coming weeks as monetary policy eases.

BTC/USDT four-hour chart with volume, RSI data

What traders should watch

Key items for traders and investors right now include: FOMC statement language and forward guidance; whether a CME futures gap appears and when it may be filled; and the $86,000–$87,000 support band that many analysts identify as pivotal for near-term bullish conviction. Risk management remains essential as volatility can spike around policy events.

In summary, Bitcoin’s dip under $88K reflects a classic pre-Fed consolidation and gap-risk dynamic. Traders should monitor Fed communications, CME futures behavior and the integrity of the $86K support level to gauge whether the market is setting up for a renewed rally or deeper pullback.

Source: cointelegraph

Leave a Comment