4 Minutes

Bitcoin whale reactivates after 12 years, shifts 1,000 BTC

A long-dormant Bitcoin whale transferred 1,000 BTC—roughly $116 million at current market prices—just ahead of the U.S. Federal Reserve’s closely watched interest-rate decision. Blockchain analytics firm Lookonchain identified the move: the tokens, originally acquired at about $847 per coin, were hodled for around a decade before being redistributed to new wallets on Wednesday.

Timing and market context: a move before the FOMC

The transfer occurred in the run-up to the Federal Open Market Committee (FOMC) meeting, an event that traders expect could mark the first U.S. interest rate cut of the year. The timing drew attention because large on-chain transfers from long-dormant addresses can coincide with heightened market sensitivity and volatility around major macro events.

FOMC expectations and macro outlook

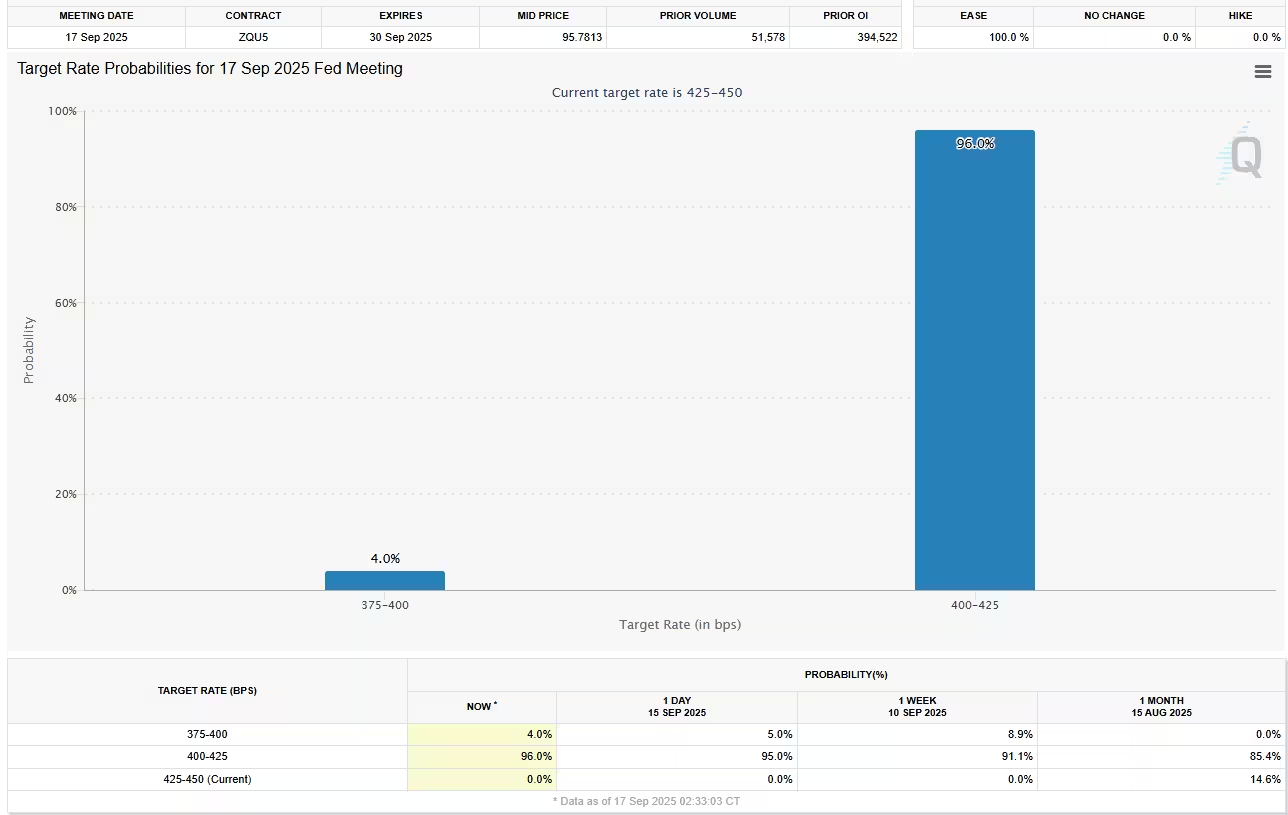

According to the CME Group’s FedWatch tool, market participants overwhelmingly priced in a 25 basis point cut, with around 96% probability—up from 85% a month earlier. Analysts and commentators highlighted the significance of this FOMC meeting for both traditional markets and crypto. Bitcoin-focused analysts noted market positioning is cautious as participants weigh the implications of an easing cycle on risk assets.

Trader positioning — shorts, futures de-risking and exchange flows

Market data show many crypto traders are positioning defensively ahead of the Fed announcement. On exchanges, more than 57% of Bitcoin holders were net short—betting on price declines—while roughly 42% held long positions, per on-chain exchange data from CoinAnk. Bitcoin futures open interest also contracted, falling by over $2 billion within five days, signaling de-risking by leveraged futures traders.

Exchange flows and institutional signals

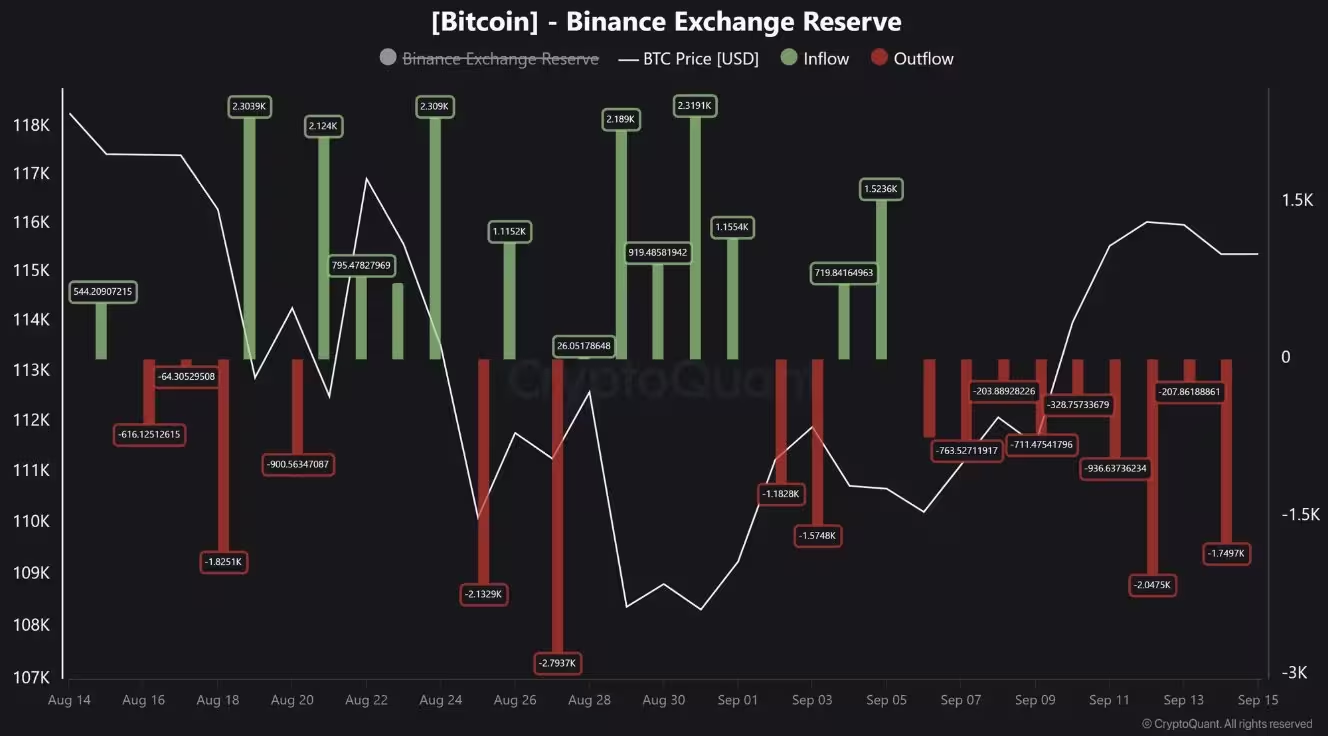

Contrasting the widespread short bias, Binance order-flow and custody data indicated buying interest. CryptoQuant reported nine consecutive days of what it called “constructive outflows” from Binance for BTC, a factor the platform linked to Bitcoin’s recent recovery from about $108k to above $115k. Such outflows often indicate accumulation into private wallets rather than selling pressure on the exchange order book.

Why the whale move matters to crypto markets

Large transfers from addresses dormant for over a decade raise multiple questions: is the whale reallocating funds, distributing to family or cold storage, or preparing liquidity for trading? While one wallet movement does not necessarily predict market direction, it contributes to on-chain narratives that traders use to gauge supply dynamics and possible selling intent.

Analyst forecasts and broader outlook

Major banks have also weighed in on the rate outlook: Bank of America analysts expect at least two Fed rate cuts in 2025, while Goldman Sachs economists have projected three 25-basis-point cuts this year, per earlier reports. These macro forecasts add another layer to crypto market expectations, influencing margin decisions, futures positioning, and institutional allocation to digital assets.

Bottom line

The reactivation of a 12-year dormant Bitcoin wallet and its 1,000 BTC transfer adds a notable on-chain data point ahead of a pivotal Fed meeting. Combined with high short exposure on exchanges, reduced futures open interest, and constructive outflows from major exchanges like Binance, the market is positioned for short-term volatility. Traders and investors will be watching both macro signals from the FOMC and continued on-chain flows to assess near-term price direction for Bitcoin and broader crypto markets.

Source: cointelegraph

Leave a Comment