3 Minutes

Dogecoin Price Snapshot and Volatility Overview

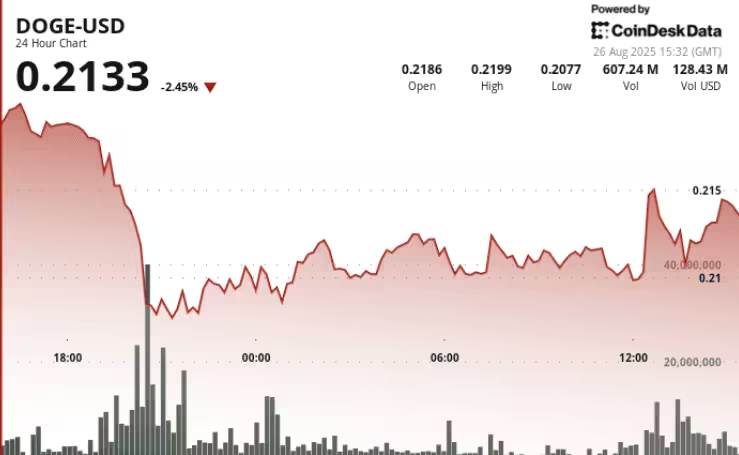

Dogecoin (DOGE) surged to around $0.21 after a period of heavy volatility between August 24–26. The meme coin traded in a roughly $0.013 intraday range before consolidating near $0.21. A notable dip from $0.218 to $0.208 on August 25 occurred during a high-volume 1.57 billion DOGE session and coincided with a 900 million DOGE transfer to Binance valued at over $200 million. That transfer triggered short-term selling pressure and market anxiety about distribution to exchanges, yet on-chain data shows whales continued to accumulate throughout August.

News Background: Whale Moves, On-Chain Flows, and Macro Drivers

Whale Transfer and Exchange Inflow

A single 900 million DOGE movement from a long-term holding wallet to Binance between August 24–25 added fuel to price swings. Exchange inflows often raise distribution concerns because they can precede sell-side liquidity events, which is why futures open interest fell by roughly 8% as speculative traders reduced exposure.

Whale Accumulation vs. Retail Distribution

Despite the exchange inflow, on-chain metrics reveal that large holders accumulated more than 680 million DOGE in August. This accumulation by whales counterbalanced retail distribution and helped maintain price support above key levels.

Macro Context

Comments by Fed Chair Powell at Jackson Hole sparked a broader risk-on rotation that lifted the meme-coin sector by roughly 12%, aligning DOGE with wider crypto market sentiment.

Price Action and Technical Analysis

Across the 23-hour session ending August 26 at 12:00 UTC, DOGE showed a 6.06% spread, trading between $0.221 and $0.208. The most intense volatility came during the 19:00–20:00 GMT window on August 25, where DOGE plunged on heavy volume before stabilizing and rebounding.

Key Technical Levels

- Support: $0.208 — established after the high-volume drop.

- Resistance: $0.218–$0.221 — capping near-term rallies.

- Short-term consolidation: $0.210–$0.212, signaling possible accumulation.

Indicators to Watch

- RSI recovered from oversold readings near 42 to the mid-50s, suggesting stabilizing momentum.

- MACD histogram is narrowing and moving toward a bullish crossover, indicating potential upside if momentum sustains.

- Open interest in DOGE futures declined ~8%, reducing speculative leverage and potentially muting extreme volatility.

- Trading volumes above the 30-day average (+16%) while price remains over $0.21 would strengthen the bullish thesis.

What Traders Are Watching Next

Traders are monitoring the tug-of-war between exchange inflows (distribution risk) and continued whale accumulation (supportive demand). Bulls are targeting a breakout toward $0.23–$0.24 if consolidation resolves to the upside with sustained whale buying. Bears point to $0.208 as the critical downside trigger — a sustained break below that level could open the door to $0.200 tests. For investors and traders focusing on blockchain signals and on-chain analytics, the next leg for DOGE will depend on whether large holders keep accumulating and whether volumes remain elevated during any breakout attempt.

Source: coindesk

Leave a Comment