4 Minutes

New whale accumulation is changing Bitcoin's cost base

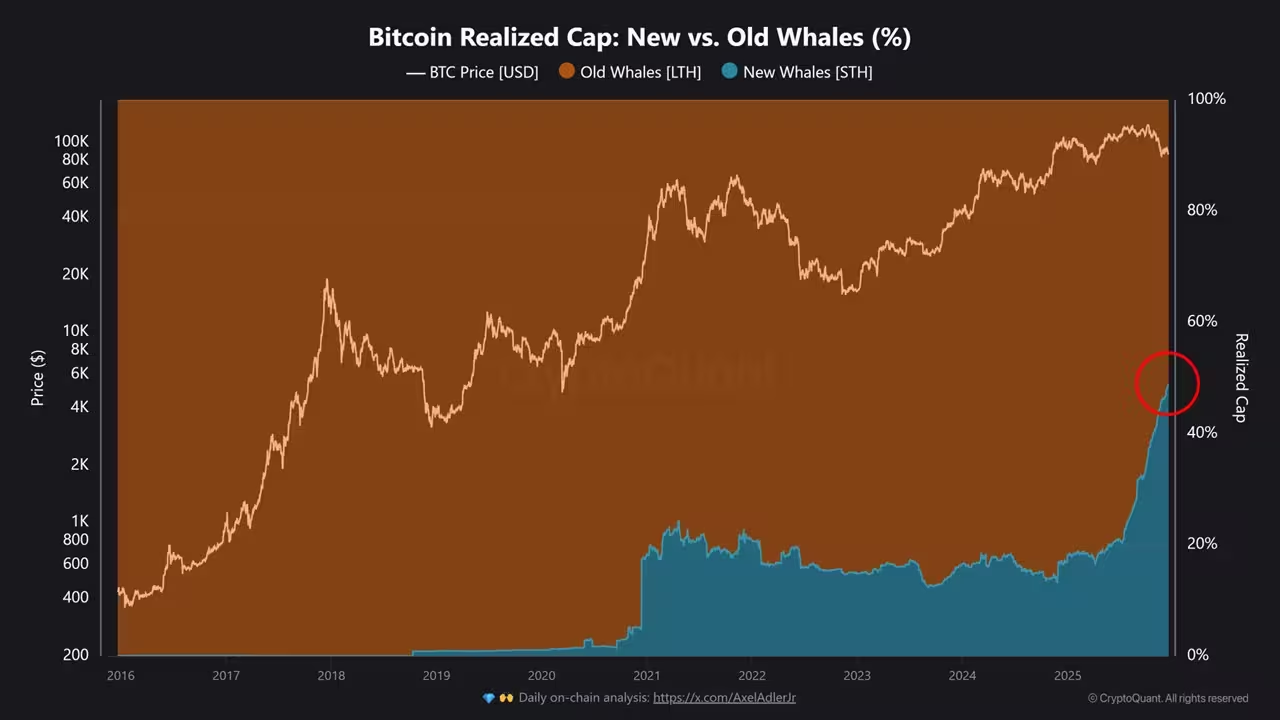

Fresh on-chain analysis shows a structural shift in how capital enters Bitcoin's market. Data from CryptoQuant and Hyblock indicates that a new cohort of large buyers—commonly called "new whales"—now represents nearly half of BTC's realized capitalization. This change signals a meaningful re-anchoring of Bitcoin's aggregate cost basis rather than the classic buy-low, sell-high whale cycles seen in past bull markets.

Bitcoin realized cap held by New Whales

Realized cap captures the value of BTC at the price each coin last moved. When nearly 50% of that metric is tied to new whales, it tells a clearer story about where fresh liquidity is entering the network—at much higher price levels than in previous cycles. Before 2025, new whales held no more than about 22% of the realized cap.

Why this matters for market structure

When large investors accumulate at elevated prices and maintain positions through pullbacks, the network's cost base resets upward. Instead of distribution from older whale cohorts that bought during deep lows, the new pattern is capital deployment at higher price points. Importantly, realized cap share held by new whales has continued rising even during market corrections, which suggests durable demand rather than short-term speculative churn.

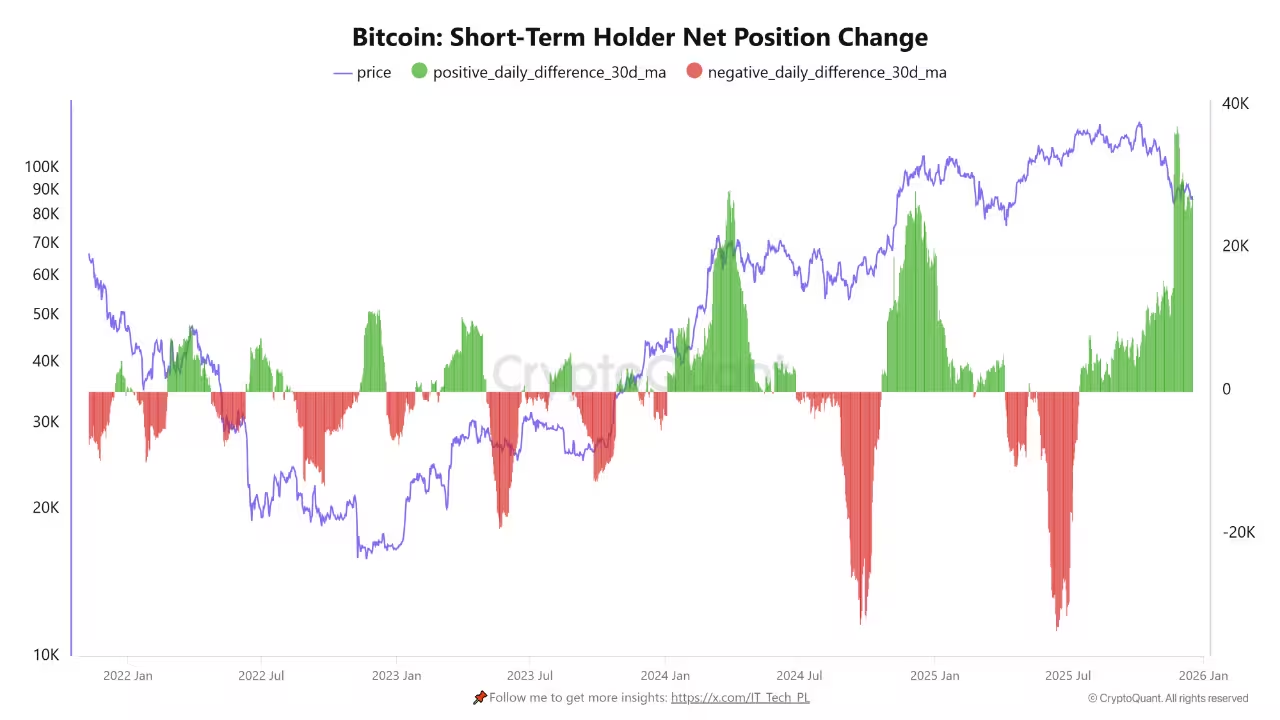

Short-term holders and on-chain demand surge

The short-term holder (STH) net position change over 30 days has surged to an all-time high near +100,000 BTC. This metric tracks coins younger than 155 days and is a reliable on-chain indicator of fresh accumulation. A rapid expansion in STH supply denotes intense buying pressure and shows that demand has outpaced available liquidity, often fueling high-momentum phases in price action.

Bitcoin short-term holder net position change

On the exchange front, Binance inflow data suggests that older coins (older than 155 days) remained largely inactive—long-term holders did not materially distribute. Selling pressure was concentrated with short-term holders reacting to intraday or short-lived volatility.

Whales absorbing retail and mid-size selling

Exchange and on-chain flow breakdowns reinforce the whale-centric buying thesis. Around 37% of BTC sent to Binance during recent activity originated from whale-sized wallets (1,000–10,000 BTC), indicating that large players were actively seeking liquidity. Hyblock's cumulative volume delta (CVD) shows whale wallets (approximately $100,000–$10 million) posted a positive $135 million delta this week, while retail and mid-size traders recorded negative deltas of $84 million and $172 million, respectively. In short, larger holders absorbed selling by smaller participants, trimming retail exposure while big capital accumulated.

Bitcoin price, and cumulative volume delta for retail, mid-size, and whale wallets

Implications for traders and longer-term investors

For traders, rising STH accumulation and whale-led absorption of sell pressure can presage extended bullish momentum, but it often accompanies heightened volatility and periods of liquidity hunting. For long-term investors, the structural shift in realized cap suggests a higher baseline for market valuation as new whales anchor cost across the network. Key on-chain metrics to watch include realized cap concentration, STH net position change, exchange inflows, and cumulative volume delta to track whether the current demand is sustainable or prone to rapid repricing.

Overall, the latest on-chain signals point to a market increasingly shaped by newly entered large players, altering Bitcoin's supply dynamics and cost basis—and redefining what future cycles may look like.

Source: cointelegraph

Leave a Comment