5 Minutes

Market snapshot: BTC futures open interest hits eight-month low

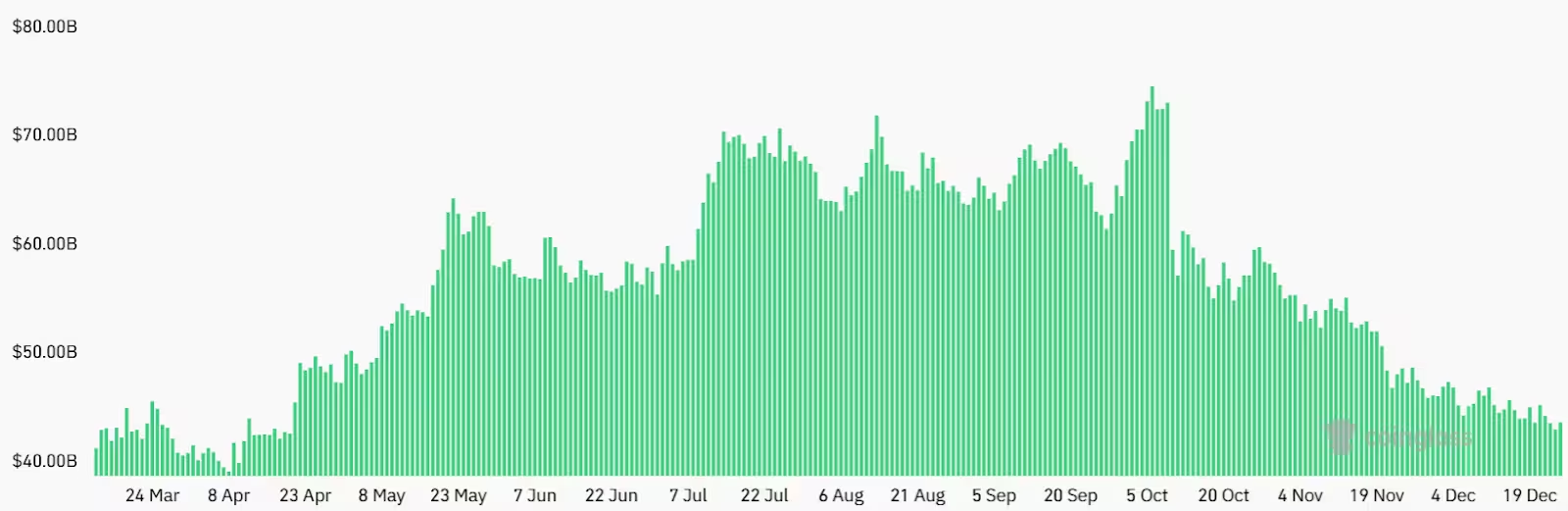

Bitcoin (BTC) briefly tested the $89,000 area before being rejected, triggering more than $260 million in liquidations across leveraged futures positions. Aggregate BTC futures open interest on major exchanges has dropped to roughly $42 billion from $47 billion two weeks earlier — the lowest level seen in eight months. While a rapid decline in open interest can alarm bulls, the data suggests this is largely a leverage flush rather than a wholesale shift to bearish bets.

BTC futures aggregate open interest, USD

Why the drop in open interest isn’t necessarily bearish

Open interest measures outstanding leveraged positions, both long and short. When open interest falls sharply, it usually indicates deleveraging — traders closing positions to reduce risk — or forced liquidations. That reduces near-term volatility pressure and can remove overstretched long positions that might have exaggerated downside moves. In this case, the fall to $42B reflects reduced leverage, not a confirmed bearish trend in Bitcoin price fundamentals.

ETF outflows and institutional sentiment

Investor nerves were further stirred by five consecutive days of net spot Bitcoin ETF outflows totaling about $825 million. Although this equals less than 1% of the roughly $116 billion in combined ETF assets, it has raised questions about whether institutional demand that helped drive October’s rally has cooled. Still, modest ETF outflows alone are insufficient evidence of a sustained bear market, especially when derivatives metrics show resilience.

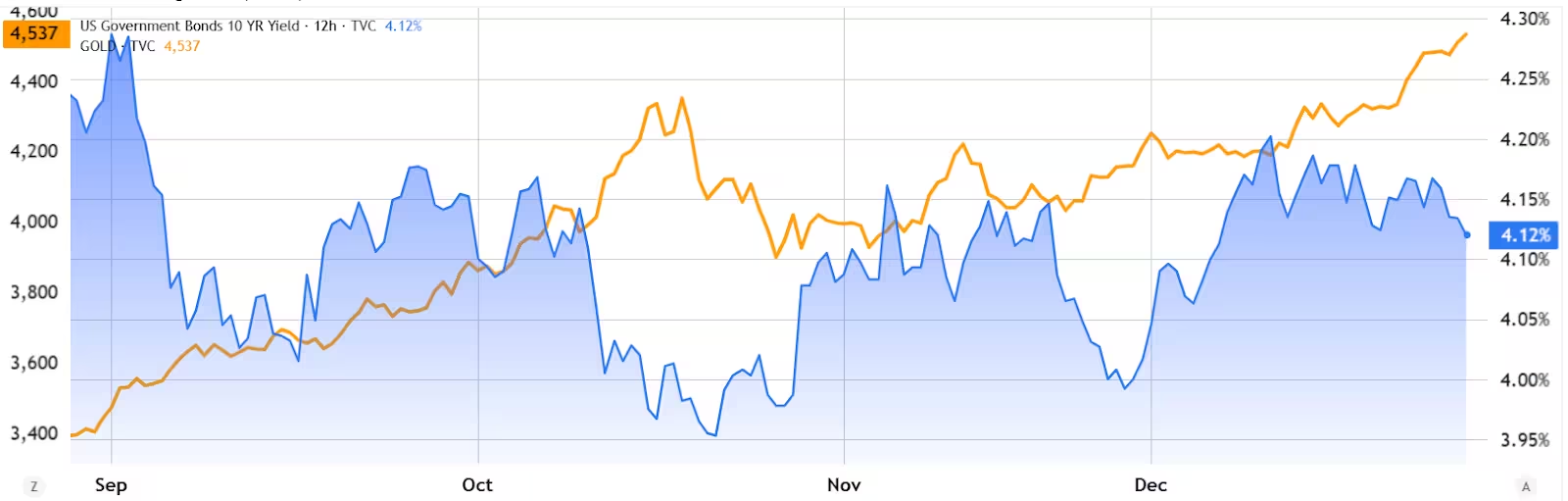

Macro context: precious metals and yields

With growing uncertainty around U.S. fiscal policy and trade measures, investors sought safe havens: gold and silver pushed to fresh highs as demand for government-backed debt rose and the U.S. 10-year Treasury yield fell to about 4.12%. These macro moves can temporarily weigh on risk assets like crypto as capital reallocates into defensive stores of value.

Gold (left) vs. US 10-year Treasury yield (right)

Futures basis and options skew signal stability

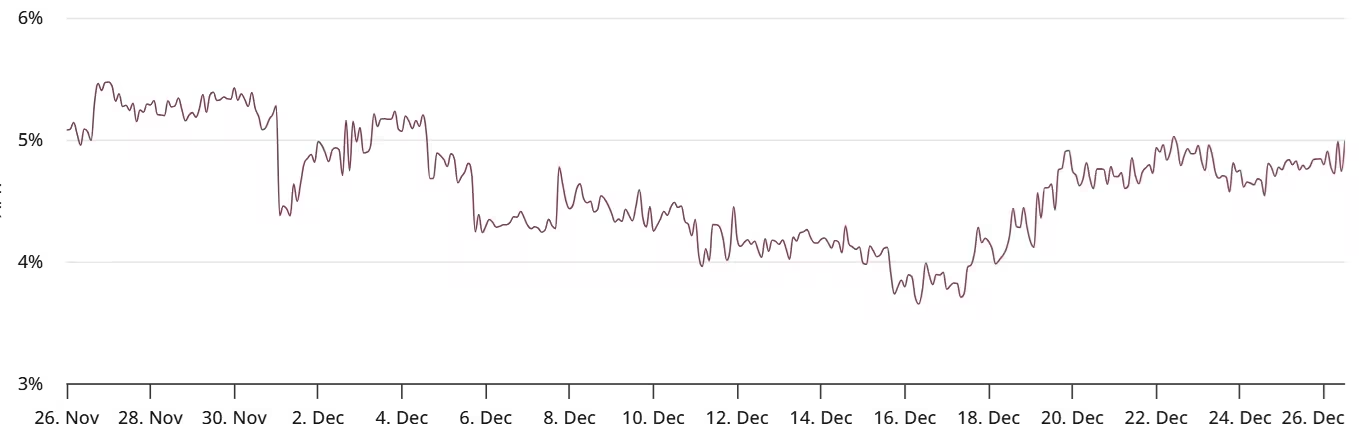

Two derivatives gauges — the BTC futures basis and options delta skew — are key to understanding whether market makers and whales expect more downside. The three-month futures basis measures the annualized premium of monthly futures versus spot; under normal conditions it ranges from 5% to 10% as compensation for the longer settlement period.

Bitcoin 3-month futures basis rate

Despite Bitcoin’s repeated failures to reclaim $90,000 since mid-October, the basis rate held around 5% last week, up from sub-4% levels when BTC traded under $85,000 in mid-December. That indicates market participants still pay a moderate premium for futures, a sign that neutral-to-mildly bullish positioning persists.

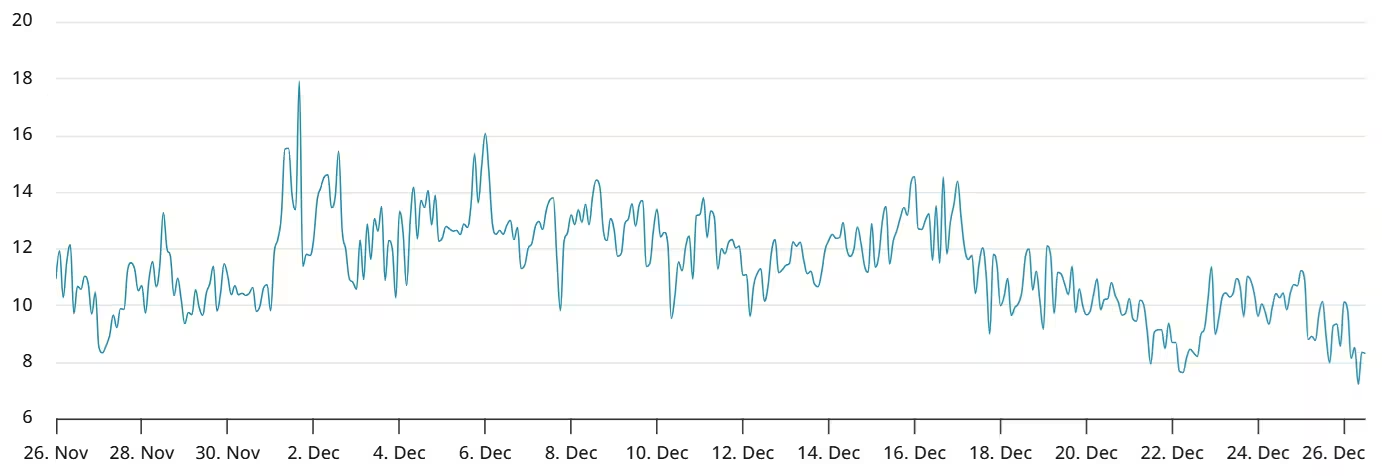

The options market adds another layer of insight. The 30-day delta skew — the cost difference between puts (downside protection) and calls — measures the market’s risk aversion. When the skew rises above the neutral threshold (around 6%), it signals greater demand for puts; when it falls into negative territory, calls are pricier and sentiment turns bullish.

Bitcoin options 30-day options delta skew (put-call) at Deribit

What options and basis data imply

Current options pricing and a stable basis rate suggest sentiment is not collapsing. Traders are not aggressively buying protection at scale, and market makers do not appear to be pricing in a deep downside scenario. Combined with reduced leverage from the futures market, this indicates Bitcoin could avoid a decisive drop below the $85,000 support level.

Outlook: catalyst required to reclaim $90,000

In the near term, BTC needs a catalyst to push above $90,000 — whether renewed institutional inflows, positive macro news, or clearer regulatory signals for crypto markets. Without that, Bitcoin may trade range-bound while bulls gradually rebuild conviction. The decline in futures open interest and ETF flows is notable, but derivatives metrics show resilience: this mix points to a neutral-to-cautious outlook rather than an imminent bear market.

For traders and long-term investors, key things to watch are changes in futures open interest, the basis rate, options delta skew, and ETF flows. A sustained rise in futures premium and a negative skew would more convincingly signal a return of bullish confidence, while growing ETF outflows and a falling basis could indicate extended weakness.

Bottom line: Bitcoin may not reach $90,000 in the immediate term, but current options and futures indicators suggest the market has limited downside risk and is positioned for a steady recovery once a strong catalyst emerges.

Source: cointelegraph

Comments

Armin

Hmm, a bit cautious here. ETF outflows tiny true, and options skew stable, but catalyst talk is vague. I'll hold, not FOMO.

coinpilot

Wait open interest dropped but futures basis still steady? Feels like a leverage cleanout, not doom... right or am I missing something?

Leave a Comment