4 Minutes

Massive liquidity injections set to reshape BTC outlook

Bitcoin (BTC) could see meaningful upside in 2026 if the prospect of renewed monetary easing materializes, according to Abra CEO Bill Barhydt. As central banks — notably the US Federal Reserve — shift toward lower interest rates and potential bond purchases, the resulting liquidity could support broader risk-on markets, including crypto. At the same time, other analysts warn that political events and longer-term bear market dynamics may temper gains.

Policy, liquidity and Bitcoin price mechanics

Barhydt told the Schwab Network he expects a “ton” of liquidity to flow into markets next year as the Fed eases policy and possibly resumes quantitative easing-like measures. Lower interest rates and renewed demand for government debt could weaken, he argued, making risk assets such as Bitcoin more attractive to investors hunting yield and real returns.

“We are seeing quantitative easing light right now. The Fed is starting to buy its own bonds. I think demand for government debt is going to fall significantly next year, along with lower rates. All of this bodes well for all assets, including Bitcoin.”

Abra CEO Bill Barhydt offers a forecast for BTC and crypto markets in 2026.

Institutional flows and regulatory clarity

Beyond macro policy, Barhydt pointed to growing institutional investment and improved regulatory clarity in the United States as additional tailwinds. Greater institutional adoption and clearer rules can increase capital inflows into crypto, enhancing liquidity and price discovery for Bitcoin and major altcoins. Combined with lower rates, these factors may help fuel what he called “a great few years” for the crypto market.

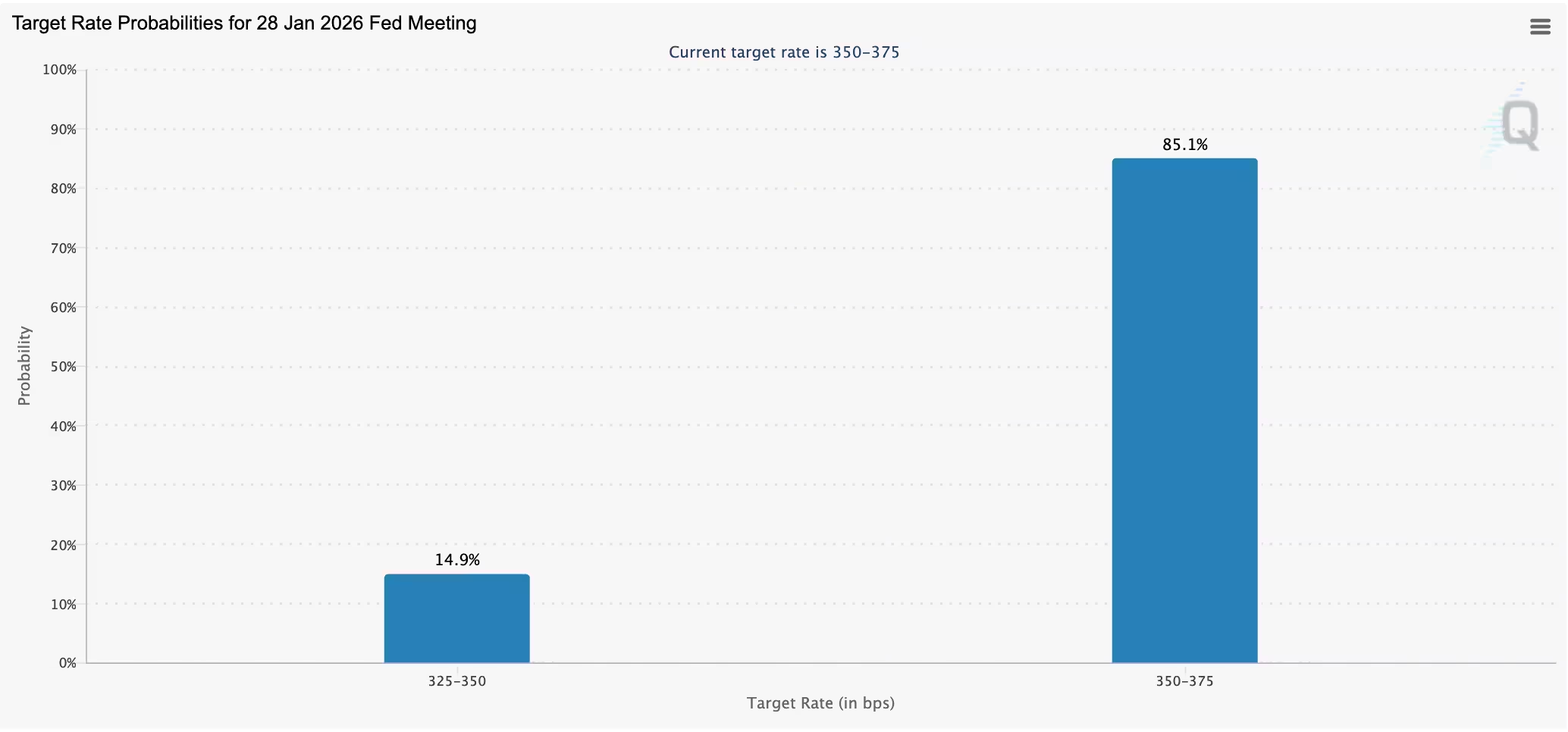

That said, markets are pricing a range of outcomes: only a minority of investors expect an interest rate cut at the January FOMC meeting, according to CME Group data, reflecting ongoing uncertainty around monetary policy timing and magnitude.

Interest rate probabilities for the January FOMC meeting.

Bearish views and political risks

Not all analysts share Barhydt’s optimism. Some early Bitcoin adopters and market strategists warn 2026 could remain challenging for BTC, suggesting the asset may be in a protracted bear market that could last months or even years. Michael Terpin, an early BTC investor, forecast a potential bottom around $60,000 in late 2026, noting that improved macro conditions might be offset by political developments.

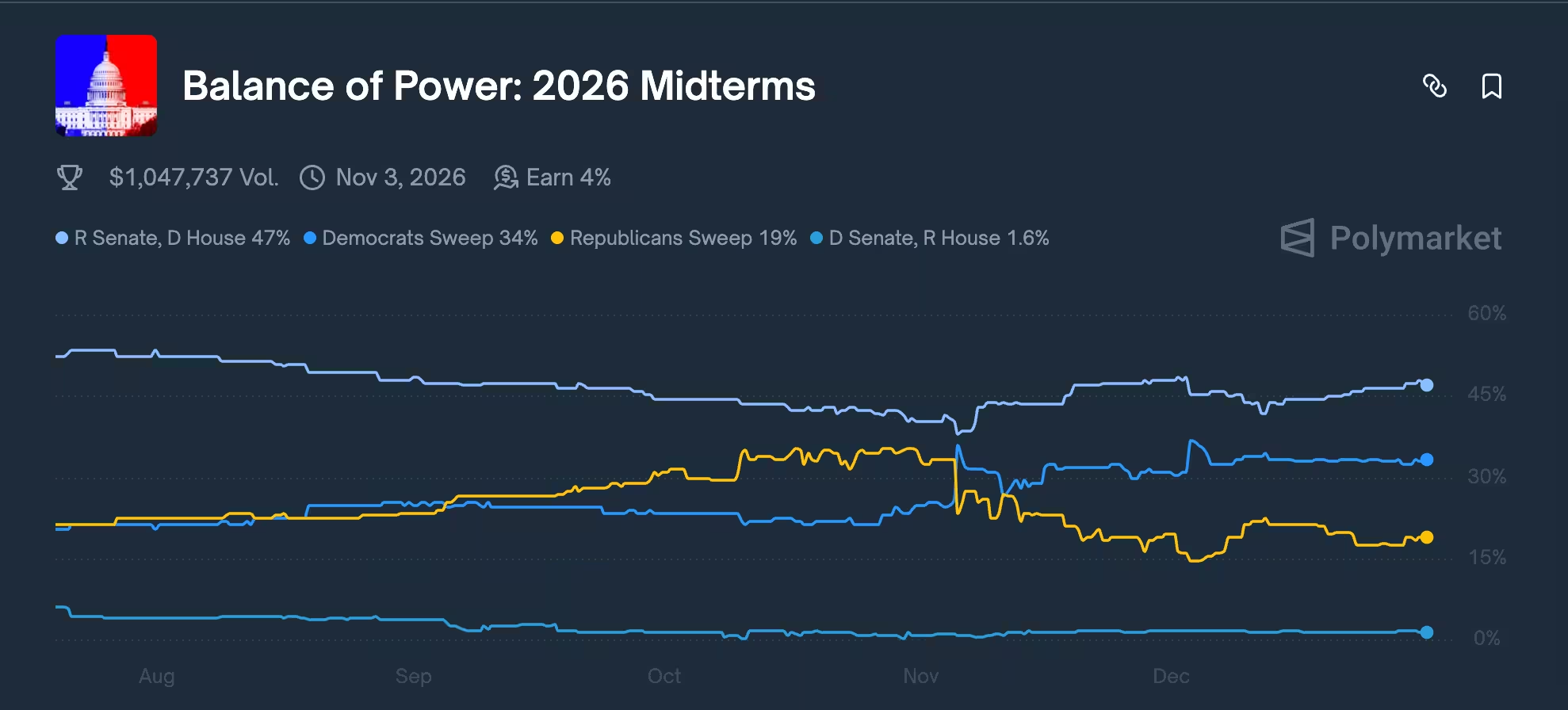

Terpin highlighted the 2026 US midterm elections as a key risk: if outcomes reduce regulatory friendliness, the crypto rally could lose momentum. Prediction markets show a wide range of scenarios, and any unexpected shift in congressional control could influence the regulatory environment for exchanges, wallets, and institutional crypto products.

2026 US midterm elections odds.

What investors should watch

Traders and investors should monitor Fed communications on rate cuts and asset purchases, institutional custody and ETF flows, and evolving US regulatory signals. Liquidity injections and quantitative easing can lift risk assets, but political risk and market structure changes will determine how sustainably BTC prices can advance through 2026.

In short, massive liquidity may be a significant catalyst for Bitcoin in 2026, but the timing, scale of Fed action, and election-driven regulatory shifts will be decisive for investors evaluating BTC and the broader crypto market.

Source: cointelegraph

Leave a Comment