4 Minutes

Kiyosaki reiterates bold targets and says he is buying hard assets

Robert Kiyosaki, author of Rich Dad Poor Dad, has doubled down on a hard-assets strategy, forecasting Bitcoin at $250,000 and gold at $27,000 by 2026. He says he is accumulating gold, silver, Bitcoin and Ethereum ahead of an anticipated market crash, calling these holdings 'real money' and long-term protection against fiat weakness.

Kiyosaki framed his outlook around a pending economic downturn and repeated his long-standing critique of the Federal Reserve and Treasury for expansive money printing and ballooning US debt. He has set clear price targets: $27,000 for gold, $100 for silver and $250,000 for Bitcoin by 2026, citing outside inputs and his own conviction that crypto and precious metals serve as hedges.

Why he is buying: inflation risk, Fed policy and classic monetary theory

Kiyosaki argues that aggressive monetary expansion creates 'fake money' and makes savers vulnerable, summarizing his thesis with the maxim that 'savers are losers.' He draws on Gresham's Law to explain why weak fiat can push out stronger stores of value, and Metcalfe's Law to justify network-driven appreciation in crypto assets like Bitcoin and Ethereum.

Ether enters the conversation: stablecoins and network utility

Shifting from a Bitcoin-only stance, Kiyosaki said he is increasingly bullish on Ether, influenced by analysts such as Fundstrat's Tom Lee. He highlighted Ethereum's role as the infrastructure for stablecoins and decentralized finance, arguing that this utility gives Ether an edge in global monetary plumbing and the broader blockchain economy.

For Kiyosaki, Bitcoin remains the ultimate scarcity asset and monetary hedge, while Ethereum provides programmable finance and network effects that could drive long-term adoption and value. He also points to ownership stakes in gold and silver mining as part of his diversified hard-assets approach.

On-chain indicators and market signals

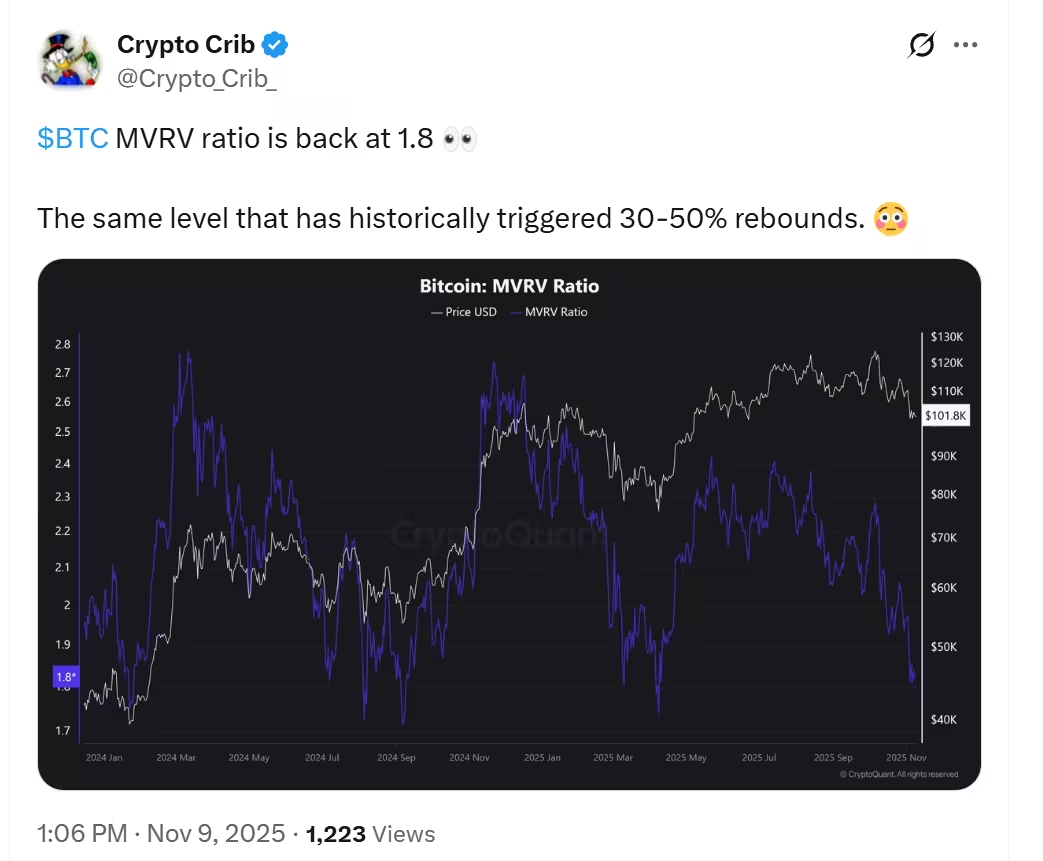

On-chain analytics provide additional context for bullish scenarios. Market tracker Crypto Crib notes that Bitcoin's Market Value to Realized Value (MVRV) ratio has climbed back to about 1.8, a level that has historically preceded rebounds in the 30-50% range. Such metrics are used by traders to assess whether BTC is fairly valued relative to realized cost basis.

Analyst Crypto Crib sees a rebound incoming

How macro flows could prop up crypto prices

Former BitMEX CEO Arthur Hayes has argued that surging US debt will force the Federal Reserve into implicit liquidity injections, a form of stealth quantitative easing executed through facilities like the Standing Repo Facility. Hayes believes this quiet expansion of dollar liquidity will be 'positive' for risk assets, particularly Bitcoin and other cryptocurrencies that benefit from inflated asset valuations.

What this means for investors

Kiyosaki's stance blends macro concern with tactical accumulation of hard assets. For crypto investors, his $250K Bitcoin prediction and renewed enthusiasm for Ether reinforce narratives around digital scarcity, network value and inflation hedging. Still, market participants should weigh these bullish scenarios against volatility, macro risk and their own risk tolerance before reallocating portfolios.

In short, Kiyosaki is buying into a mix of crypto and precious metals as protection against fiat depreciation, while on-chain data and macro commentary from market veterans provide supporting, albeit not guaranteed, signals for potential rebounds.

Source: cointelegraph

Leave a Comment