4 Minutes

Why bear markets act as a filter for crypto projects

Bear markets are painful, but they also clarify market structure. When speculative capital retreats, price momentum is no longer sufficient to sustain attention. Projects that depend on hype—memes, fleeting narratives, or marketing-driven rallies—often see trading volume evaporate. In contrast, altcoins with concrete utility, proven tokenomics, and active developer communities tend to persist. Understanding these dynamics helps investors and builders focus on sustainable crypto projects that can survive downturns and lead future cycles.

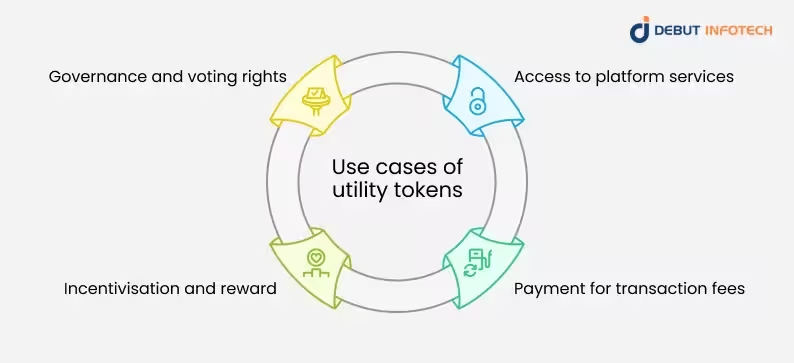

Utility creates structural demand

Tokens that represent real utility—payment rails, decentralized finance protocols, data oracles, layer-2 scaling solutions, or tokenized real-world assets—produce usage-driven demand. When networks are used for transactions, staking, or protocol fees, that activity generates continual on-chain demand that is not solely dependent on speculative flows. Utility tokens therefore establish a baseline of real users and transactions that smooths volatility and helps preserve liquidity during prolonged market stress.

Utility Token Usecase

Practical examples of utility-driven demand

Consider a DeFi liquidity protocol that charges fees for swaps, or an oracle service that sells data to multiple smart contracts. Those ecosystems create recurring revenue and token sinks—mechanisms that naturally align token value to real usage. Even if prices fall, ongoing protocol usage and fees can support token liquidity and provide a runway for further development.

Developer activity and ecosystem resilience

Developer engagement is a leading indicator of long-term project health. During bear markets many teams pause or slow roadmaps, but resilient projects keep shipping upgrades, improving security, and building partnerships. Continuous development signals to investors and users that the protocol is committed to long-term value creation rather than short-term price pumping.

How developer metrics predict recovery

Measured activity—commits, releases, integrations, and new dApp deployments—tends to attract capital first when market sentiment shifts. Liquidity often flows back to projects that demonstrated consistent progress and adoption while others were dormant. For anyone evaluating altcoins, on-chain metrics and GitHub or repository activity are essential due diligence tools.

Tokenomics: aligning incentives for the long run

Effective tokenomics distinguish survivors. Excessive inflation schedules, unrestricted team allocations, or poorly designed emission curves create persistent sell pressure that becomes fatal in down markets. By contrast, disciplined supply management, deflationary mechanisms, fee-burning models, and staking incentives align stakeholder interests with network growth.

Design elements that matter

Look for tokens with controlled issuance, fee generation that returns value to holders, and staking or locking mechanisms that reduce circulating supply. Transparent vesting schedules and governance frameworks that encourage sustainable decisions further improve a project’s chances of lasting through bear cycles.

Market expectations for future cycles

As the crypto ecosystem matures, market cycles will increasingly reward substance over spectacle. Bull markets will still generate headlines for hype-driven tokens, but the projects most likely to outlast downturns are those with demonstrable utility, healthy tokenomics, and active ecosystems. Long-term participants should treat bear markets as discovery periods: identify teams that continue to build, communities that keep using the product, and networks that produce measurable on-chain activity.

Practical takeaways for investors and builders

Investors should prioritize altcoins with clear use cases—DeFi infrastructure, payment protocols, oracles, and layer-2 scaling solutions are examples where utility translates to sustained demand. Check developer activity, monitor fee and transaction metrics, and evaluate tokenomic structures for alignment with long-term growth. Builders should focus on delivering real utility, transparent economics, and partnerships that expand network effects rather than short-term marketing pushes.

Bear markets are less an end than a selection mechanism. They remove speculative noise and reveal projects with genuine product-market fit. In the long run, utility-driven tokens and robust ecosystems will not only survive but set the foundation for healthier, more sustainable crypto cycles.

Source: crypto

Comments

labcore

Seen this IRL. Team kept shipping small releases during the crash, community stayed active, fees helped bridge payroll for months. not sexy but works

coinpilot

Interesting take, but is utility really enough? Speculative buyers often kickstart liquidity, without hype some useful projects still struggle to get attention, idk...

Leave a Comment