4 Minutes

Ethereum ETFs Reverse Year-End Sell-Off with $174M Inflows

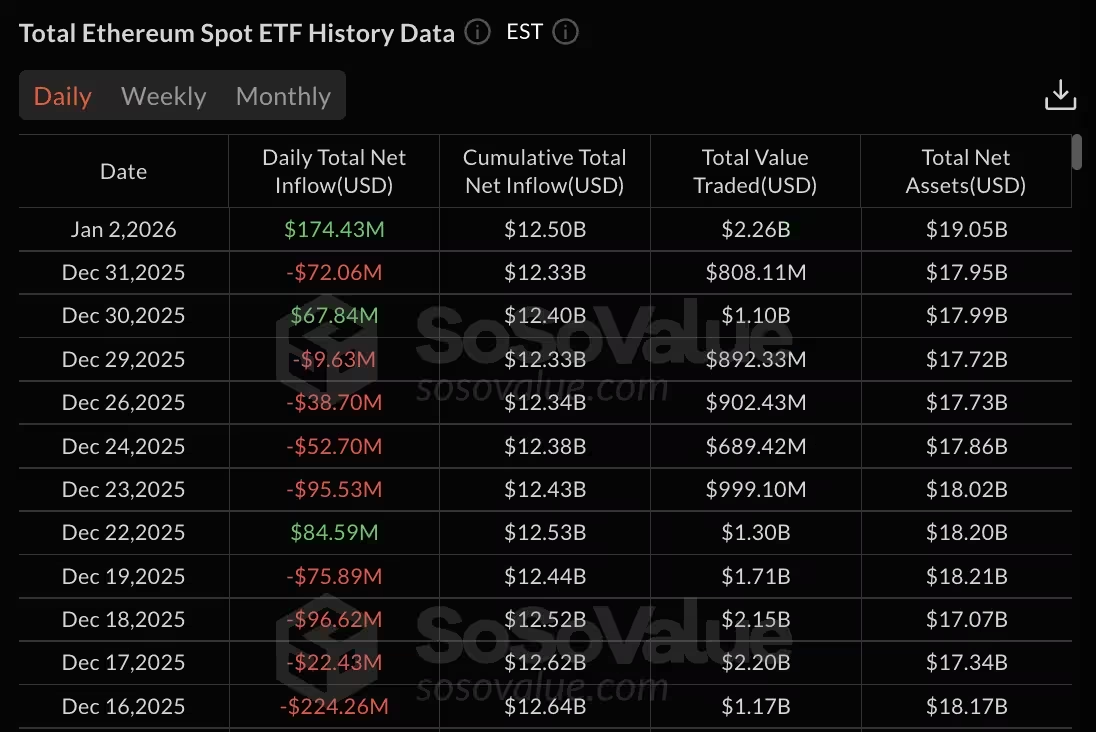

Ethereum spot ETFs recorded a net inflow of $174.43 million on January 2, marking a clear reversal from the December redemption trend. After weeks of volatile daily flows and holiday selling pressure, the inflows on Jan. 2 pushed weekly flows back into positive territory and lifted total assets under management (AUM) across Ethereum funds.

Fund-level leaders and notable flows

Grayscale’s flagship ETHE led all Ethereum-based funds, attracting approximately $53.69 million on the session. Grayscale’s smaller ETH trust followed closely with $50.03 million. BlackRock’s ETHA drew $47.16 million, while Bitwise’s ETHW added $18.99 million and VanEck’s ETHV saw $4.56 million. Several funds reported no net movement for the day: Fidelity’s FETH, Franklin’s EZET, 21Shares’ TETH and Invesco’s QETH registered zero flow activity.

Weekly context and year-end volatility

The January 2 inflows lifted weekly totals to $160.58 million — the first positive week for Ethereum spot ETFs since the week ending December 12, when funds attracted $208.94 million. In contrast, the two prior weeks showed heavy redemptions: the week ending December 26 posted $102.34 million in outflows and the week ending December 19 recorded $643.97 million in withdrawals. Daily movements around year-end were choppy, including $67.84 million in inflows on December 30, then $72.06 million in outflows on December 31.

Trading volume and AUM rebound

Investors returning after the holiday break helped total trading volume across Ethereum ETFs climb to $2.26 billion on January 2, up from $808.11 million on December 31. Net assets under management for Ethereum ETFs rose to $19.05 billion from $17.95 billion the previous trading day. Cumulative net inflows across all Ethereum spot ETFs reached $12.50 billion, a recovery from $12.33 billion recorded on December 31.

Longer-term fund flows and cumulative positions

Grayscale’s ETHE still shows a net outflow of roughly $5.00 billion since its conversion from a trust structure, even as it led daily inflows. BlackRock’s ETHA remains the largest cumulative recipient with about $12.61 billion in total inflows, and Fidelity’s FETH has accumulated approximately $2.65 billion to date. These figures highlight both ongoing investor appetite for regulated Ethereum exposure and the shifting market share among issuers.

Bitcoin ETFs mirrored the strength

Bitcoin spot ETFs also posted sizeable inflows on January 2, totaling $471.14 million and reversing a $348.10 million outflow from December 31. BlackRock’s IBIT led Bitcoin funds with roughly $287 million in inflows. Total AUM for Bitcoin ETFs rose to $116.95 billion from $113.29 billion, and cumulative net inflows climbed to $57.08 billion from $56.61 billion. On the same trading day, Bitcoin ETF volume reached $5.36 billion, nearly double the $2.83 billion seen the prior session.

What this means for crypto investors

The return of inflows to both Ethereum and Bitcoin ETFs signals renewed institution-aligned demand for spot crypto exposure after the year-end sell-off. Rising volumes and AUM suggest that investors are re-engaging with regulated ETF wrappers to access Ethereum and Bitcoin price exposure. Market participants should continue monitoring daily ETF flows, trading volumes and fund-level leadership — notably Grayscale, BlackRock and Fidelity — as indicators of institutional sentiment in the crypto markets.

Source: crypto

Leave a Comment