4 Minutes

Market recap: Bitcoin ETFs post fifth straight day of net redemptions

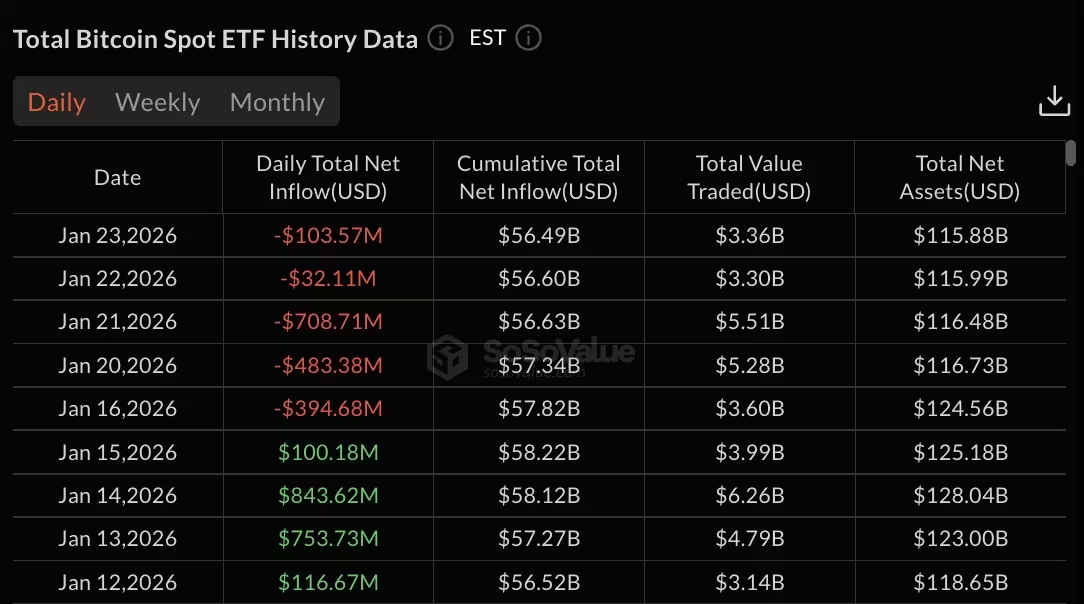

Bitcoin exchange-traded funds (ETFs) recorded $103.57 million in net outflows on January 23, marking a fifth consecutive session of redemptions that has erased much of the mid-January institutional buying momentum. The sell-off has now pulled roughly $1.72 billion from Bitcoin products since January 16, sending total ETF assets under management (AUM) down materially.

Key figures and fund flows

- January 23 outflows: $103.57 million for Bitcoin spot ETFs.

- Five-day cumulative outflows from Jan 16–23: about $1.72 billion.

- Total Bitcoin ETF AUM: fell to $115.88 billion from $124.56 billion on Jan 16.

- Cumulative total net inflow for Bitcoin ETFs: declined to $56.49 billion from $57.82 billion.

BlackRock’s IBIT led withdrawals on January 23 with $101.62 million in redemptions, while Fidelity’s FBTC reported $1.95 million in outflows. Most other major Bitcoin ETFs recorded zero flows for the day, underscoring that the selling activity was concentrated in a small number of large funds.

Timeline of the recent sell-off

The downturn began on January 16 with $394.68 million in outflows, reversing a prior four-day inflow streak that had brought roughly $1.81 billion into Bitcoin ETFs. After the weekend, trading resumed with heavy redemptions of $483.38 million on January 20 and a single-day peak outflow of $708.71 million on January 21. Subsequent days saw smaller but steady withdrawals, culminating in the Jan 23 figure of $103.57 million.

Bitcoin ETFs data: SoSo Value Total value traded also contracted, dropping to $3.36 billion on January 23 from $5.51 billion on January 21. That decline in trading volume has amplified the impact of redemptions, quickening AUM declines and trimming short-term liquidity for some products.

Broader ETF positioning and notable funds

BlackRock’s IBIT still reports strong cumulative inflows overall, holding about $62.90 billion in total net inflows since launch, while Fidelity’s FBTC has accumulated $11.46 billion. Grayscale’s GBTC, after converting from a trust to an ETF structure, remains in net outflow territory with -$25.58 billion since the conversion.

Other spot Bitcoin products—including Grayscale’s mini BTC trust, Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI—reported zero flows on Jan 23, highlighting the concentrated nature of recent withdrawals.

Ethereum spot ETFs also see pressure

Ethereum spot ETFs extended their outflow streak to four sessions on January 23, posting $41.74 million in net redemptions. BlackRock’s ETHA led withdrawals with $44.49 million, while Grayscale’s ETHE logged $10.80 million in outflows. Offset gains included Grayscale’s mini ETH trust, which attracted $9.16 million, and Fidelity’s FETH with $4.40 million in inflows.

The four-day Ethereum outflow window totaled roughly $611 million, reducing Ethereum ETF AUM to $17.70 billion from $20.42 billion on January 16. Total traded volume across Ethereum ETFs fell to $1.31 billion on Jan 23 from $2.20 billion on Jan 21.

What this means for investors

The recent withdrawals reflect short-term profit-taking and rebalancing by institutional investors rather than a structural rejection of spot crypto ETFs. However, sustained outflows and lower trading volumes could increase price sensitivity to large redemptions and amplify short-term volatility for Bitcoin and Ethereum ETFs. Investors should monitor AUM trends, individual fund liquidity, and institutional positioning when evaluating ETF exposure in crypto portfolios.

Source: crypto

Leave a Comment