5 Minutes

Major inflows into spot Bitcoin and Ether ETFs

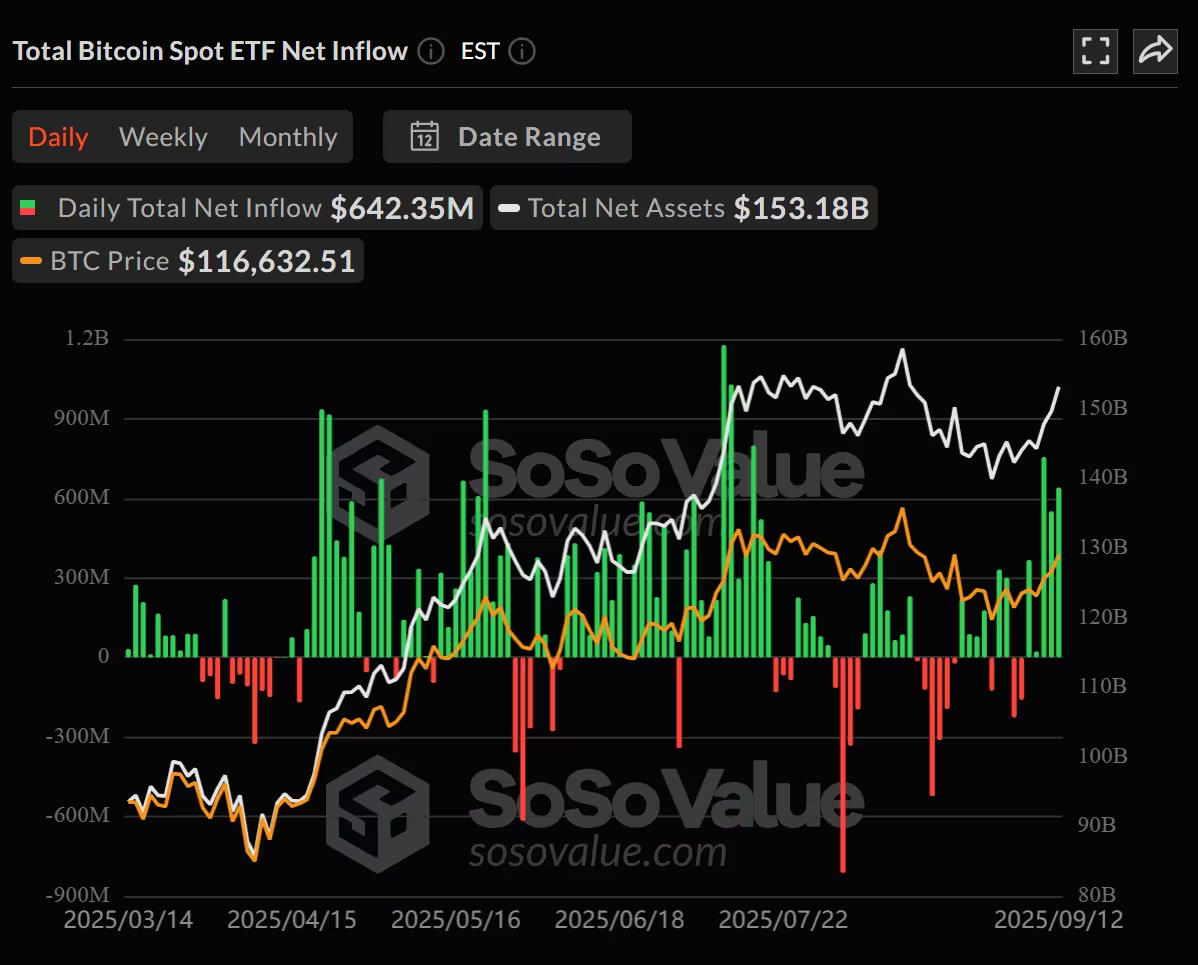

Spot Bitcoin and Ether exchange-traded funds (ETFs) posted strong inflows on Friday, signaling renewed institutional interest in crypto exposure. According to SoSoValue data, spot Bitcoin ETFs recorded $642.35 million in net inflows — the fifth consecutive day of gains — while spot Ether ETFs attracted $405.55 million, marking their fourth straight day of positive net flows. These figures underscore growing demand from institutional investors seeking regulated, liquid access to Bitcoin and Ethereum.

Spot Bitcoin ETFs have now accumulated $56.83 billion in total net inflows, with aggregate net assets reaching $153.18 billion. That represents roughly 6.62% of Bitcoin’s overall market capitalization, highlighting how ETF adoption is beginning to represent a meaningful portion of the on-chain asset base. Combined trading volumes across all spot Bitcoin ETFs exceeded $3.89 billion for the day, reflecting heightened market activity and positioning among large-scale investors.

Spot Bitcoin ETFs see inflows. Source: SoSoValue

Which funds led Friday’s inflows?

Fidelity’s FBTC spearheaded the day’s Bitcoin inflows, drawing $315.18 million in fresh capital, while BlackRock’s IBIT contributed $264.71 million. Both funds recorded daily gains of over 2%, consistent with the broader market momentum. On the Ether side, Fidelity’s FETH took in $168.23 million and BlackRock’s ETHA added $165.56 million. ETHA alone reported $1.86 billion in traded value during the session, indicating robust interest in Ethereum-based ETF products.

What this means for institutional confidence and market liquidity

The continued inflows into spot Bitcoin and Ether ETFs point to rising institutional confidence in crypto markets. Market participants and fund managers are increasingly using ETF wrappers to access Bitcoin and Ethereum exposure without the operational complexities of self-custody. Vincent Liu, chief investment officer at Taiwan-based Kronos Research, told Cointelegraph that sustained inflows could boost liquidity and reinforce momentum for both assets if macroeconomic conditions remain stable.

ETF inflows have been an important metric for traders and portfolio managers assessing long-term adoption trends. Besides direct capital movement into the funds, the emergence of large ETF vehicles tends to deepen on-chain and off-chain liquidity, narrow bid-ask spreads at scale, and improve price discovery for both Bitcoin and Ethereum.

Broader market context

The latest surge follows a quieter start to the month, suggesting sentiment has shifted as macro indicators stabilize and the crypto market displays renewed strength. With spot Bitcoin ETFs now holding substantial assets and Ether ETFs building scale, digital-asset funds are increasingly seen as a mainstream channel for treasury allocations, pension exposure, and institutional trading desks.

BlackRock explores ETF tokenization and potential DeFi integration

Following the initial success of spot Bitcoin ETFs, asset manager BlackRock is reportedly evaluating the tokenization of ETFs on blockchain networks. The plan would focus on tokenized funds tied to real-world assets (RWA), which could bring features such as 24/7 trading, programmable settlement, and integration with decentralized finance (DeFi) protocols. Tokenized ETFs could lower barriers to programmatic strategies, enable fractional ownership, and connect traditional asset management to on-chain liquidity pools.

Regulatory considerations remain the primary hurdle for tokenized ETFs. Successful implementation would require clear frameworks for custody, KYC/AML compliance, secondary trading venues, and investor protections. Still, the concept is gaining traction among asset managers and custodians as they explore how blockchain technology can enhance ETF distribution and accessibility.

What crypto investors should watch next

Key indicators to monitor include continued net inflows into spot BTC and ETH ETFs, trading volumes across major providers, and any regulatory developments around tokenized funds. Market participants should also watch how ETF flows interact with on-chain metrics such as exchange balances and realized cap, as that combination can offer insight into supply dynamics and future price pressure.

In short, the latest wave of ETF inflows reinforces a narrative of growing institutional adoption. Whether this momentum translates into sustained price appreciation will depend on macro conditions, regulatory clarity, and how quickly tokenization and DeFi integration progress in the institutional space.

Source: cointelegraph

Leave a Comment