3 Minutes

Step into any carrier store and the evidence is hard to miss: iPhones are everywhere. Small displays of accessories. Long lines for trade-ins. Sales reps pushing the latest model with the kind of confidence that usually follows a runaway winner.

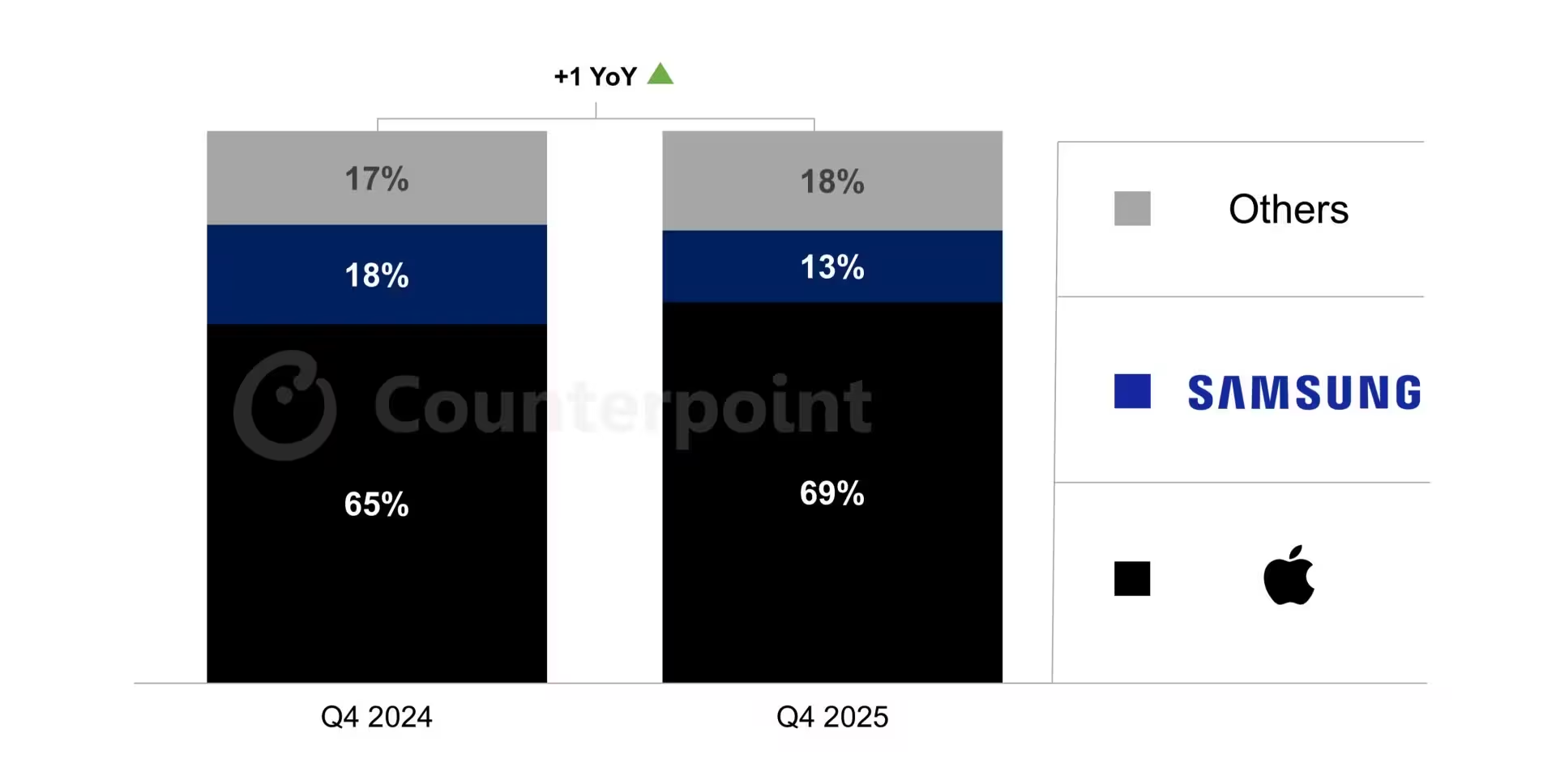

Apple’s Q1 2026 revenue — $143.756 billion — carried a familiar rider: the iPhone. More than half of that haul came from smartphone sales, and Counterpoint Research says those figures helped push Apple’s U.S. market share to an eye-popping 69% in Q4 2025, a four-point jump from the quarter before. Samsung, long the closest rival, slipped to roughly 13% in the same period.

Apple now controls nearly seven in ten U.S. smartphone sales.

Carrier behavior matters. AT&T, T-Mobile and Verizon dialed up promotions during the iPhone 17 rollout, and AT&T reported that 89% of its smartphone mix were iPhones, with the iPhone 17 Pro Max taking the top-seller slot across all three networks. Those kinds of offers do more than move units — they shape what becomes the mainstream phone on American pockets.

Does that mean Samsung is out of moves? Not quite. The Galaxy S26 family is lined up to launch, and history shows Samsung leans hard on trade-in deals, freebies and aggressive promotions to win back attention. Foldable flagships will also keep the company in the conversation; they may not topple Apple overnight, but they can nibble at market share and generate headlines that matter to image-conscious buyers.

The product calendar also favors a short window of dominance. Apple likely won’t reveal the iPhone 18 family until Q3 2026, yet the company has an interim release — the iPhone 17e — that can stabilize sales through the spring. Then there’s the supply-side drama: rising DRAM prices. Analyst Ming-Chi Kuo has suggested Apple could absorb those costs rather than pass them to buyers, a strategy its Services business is well-equipped to bankroll. Services pulled in about $30.013 billion for fiscal Q1 2026, giving Apple a cushion other vendors lack.

For rivals, the path forward is tactical and narrow: win carrier partnerships, create compelling incentives, and push unique hardware that breaks the monotony. For consumers, the immediate effect is familiar — more trade-in credits, aggressive financing and a dizzying row of iPhone trade displays.

Will Samsung’s S26 or the next wave of foldables reshuffle the deck? Maybe. But for now, the American market is a field where Apple sets the tempo — and everyone else is trying to find the next note to counter it.

Source: wccftech

Leave a Comment