4 Minutes

Arthur Hayes, crypto entrepreneur and co‑founder of Maelstrom, says the widening gap between Bitcoin and technology stocks is a clear signal that fiat liquidity stress may be imminent. Hayes argues that an AI‑driven wave of white‑collar job losses could trigger a consumer credit collapse and force central banks back into aggressive money printing, which in turn would lift Bitcoin toward new all‑time highs.

Why the Bitcoin–Nasdaq divergence matters

Hayes points to the recent decoupling between Bitcoin and the Nasdaq 100 — two assets that have often moved in parallel — as a warning flag. When previously correlated markets diverge sharply, that divergence can indicate a hidden macroeconomic risk, such as a sudden contraction in fiat credit or a banking shock.

Bitcoin as a gauge of fiat liquidity

In Hayes’ view, Bitcoin functions as a real‑time liquidity gauge for global fiat systems. Because BTC trades freely across markets, price moves can be one of the fastest signals of changing expectations about dollar and credit supply. If market participants increasingly price in more fiat creation, Bitcoin often reacts before traditional indicators catch up.

AI job losses and the route to a credit crunch

Hayes highlights AI adoption as a major structural risk. Corporations have increasingly cited AI as a reason for job cuts: CBS News reported that companies referenced AI in 55,000 layoffs in 2025, a dramatic rise over recent years. Hayes’ scenario suggests that substantial white‑collar unemployment would first pressure consumer credit and mortgage servicing.

Modeling potential losses

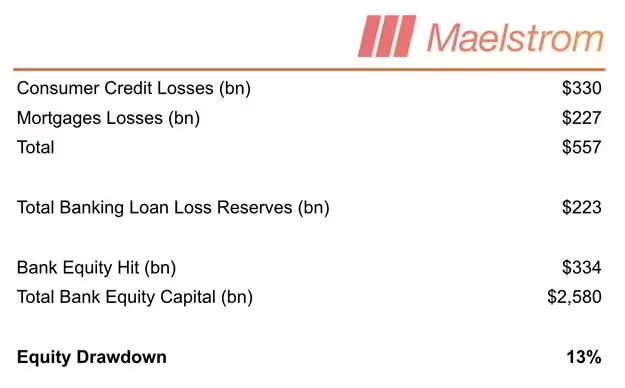

Using a high‑level stress scenario, Hayes contends that a 20% reduction among an estimated 72 million US knowledge workers could translate into hundreds of billions in consumer credit and mortgage write‑downs, potentially eroding a significant portion of US regional bank equity. Predicted losses assuming a 20% AI job loss. Source: Maelstrom

He expects weaker regional banks to be the most vulnerable: deposits could flee, credit intermediation would freeze, and contagion could spread across credit markets. That, Hayes argues, would eventually force the Federal Reserve and other central banks to restart large‑scale liquidity programs.

Monetary reaction and the crypto upside

Hayes warns that the Fed’s likely response — renewed balance‑sheet expansion or bespoke liquidity tools — would be interpreted by markets as fresh fiat creation. Historically, expectations of monetary easing have bolstered risk assets and scarce stores of value; in this thesis, Bitcoin would be a primary beneficiary as investors hedge against future currency dilution.

Altcoin exposures Hayes mentions

Beyond Bitcoin, Hayes says Maelstrom plans to allocate stablecoin reserves into select privacy and liquidity projects once central banks relent. He specifically names Zcash ZEC $283.04 and Hyperliquid HYPE $29.19 as targets for deployment after a decisive policy pivot.

Context and caveats

This is not Hayes’ first prediction linking central‑bank intervention to crypto rallies. He has previously suggested the Fed could intervene in foreign bond stress and forecast sharp BTC upside after new liquidity measures. Such macro narratives carry uncertainty: outcomes depend on job‑market resilience, the severity of credit losses, regulatory responses, and how investors price inflation and systemic risk.

Takeaway

For traders and long‑term crypto investors, Hayes’ thesis is a reminder to monitor cross‑market signals — especially the relationship between Bitcoin and tech equities — as potential leading indicators of monetary stress. While models vary, the possibility of AI‑driven credit strain is one scenario that could push central banks back toward large‑scale money printing, a development many in the crypto community view as bullish for BTC and certain altcoins.

Source: cointelegraph

Leave a Comment