3 Minutes

Bitcoin's share of global money rises amid monetary expansion

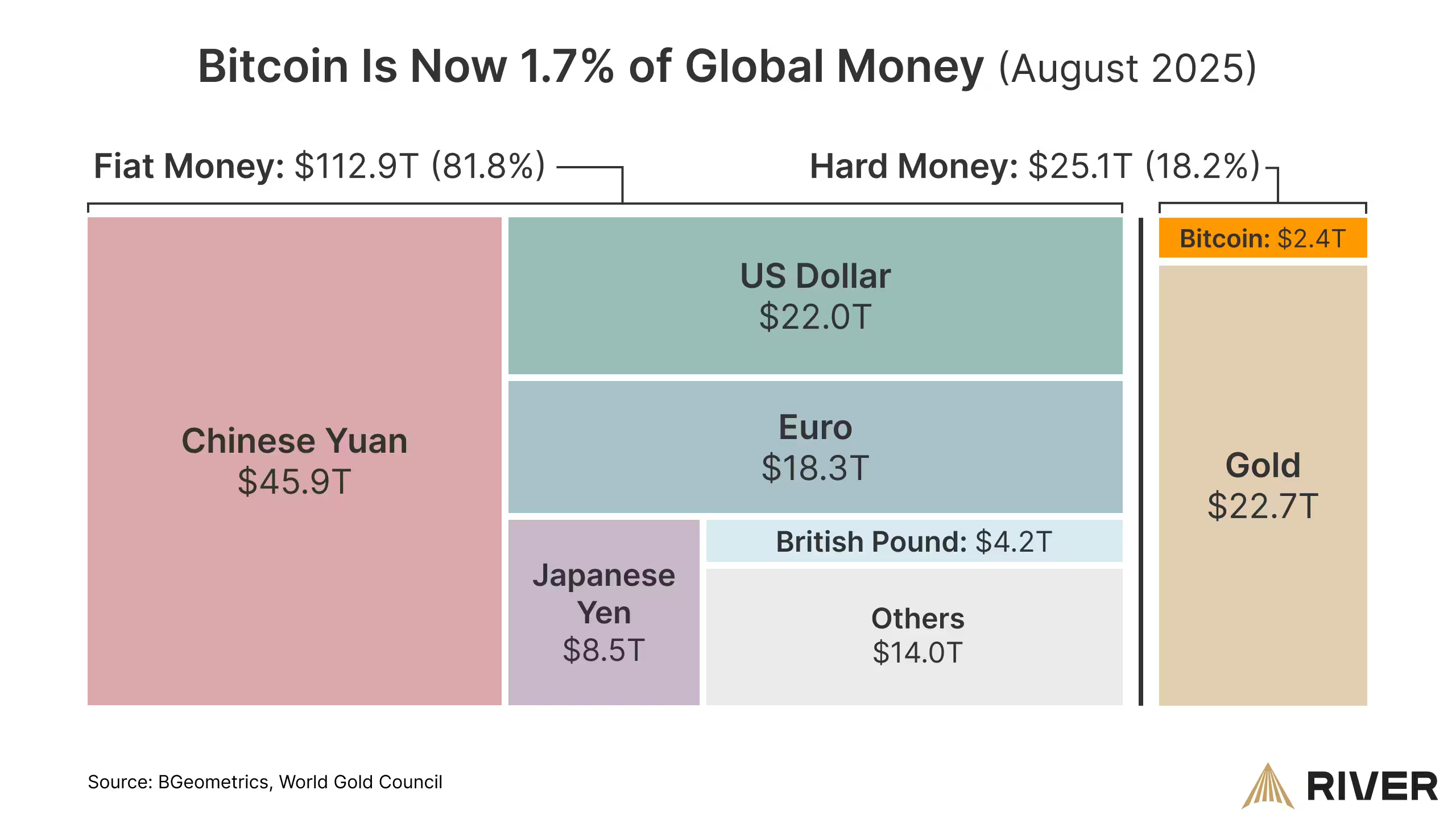

Bitcoin has climbed to roughly 1.7% of global money, according to analysis by River, a Bitcoin financial services firm. River compared Bitcoin's market capitalization with a combined basket that includes the aggregate M2 money supply of major fiat currencies, a range of significant minor currencies, and gold's market capitalization. That basket totals about $112.9 trillion in fiat plus $25.1 trillion in hard money, excluding silver, platinum, and other exotic metals.

The analysis used a Bitcoin market cap of $2.4 trillion, a level BTC surpassed earlier in August. At the time of writing, Bitcoin's market capitalization sits near $2.29 trillion, which places its share of global money at about 1.66%. Nonetheless, the long-term trend shows Bitcoin and gold gaining share as central banks expand money supply and erode fiat purchasing power, pushing investors toward hard money alternatives.

Powell signals rate cuts, markets respond

Federal Reserve Chair Jerome Powell's keynote at the Jackson Hole Economic Symposium signaled that the US central bank is moving closer to easing policy. Powell noted that the policy rate is approximately 100 basis points closer to neutral than a year ago and that labor market stability allows the Fed to proceed carefully as it considers adjustments. The market interpreted his comments as confirmation of impending rate cuts and continued monetary expansion.

Immediate market reaction

Cryptocurrencies reacted quickly. Bitcoin price surged more than 2% after the speech, briefly reaching a notional level reported at around $116,000 per BTC on Friday. Digital assets historically appreciate during periods of monetary expansion, as higher global liquidity often correlates with rising crypto valuations. Data from the Chicago Mercantile Exchange Group shows about 75% of investors now expect a 25-basis-point rate cut in September, reinforcing a narrative of looser monetary policy ahead.

What this means for investors

For crypto investors, the twin trends of expanding central bank balance sheets and market expectations of rate cuts create a favorable macro backdrop for Bitcoin and other digital assets. Key metrics to watch include Bitcoin market cap, global liquidity measures, M2 money supply trends, and central bank guidance. As always, investors should balance macro-driven opportunities with volatility and risk management strategies.

Source: cointelegraph

Leave a Comment