3 Minutes

Whale Accumulation Pulls Back Despite Market Strength

On-chain metrics show that Bitcoin’s largest holders — often called whales — have steadily trimmed positions during the recent rally, pushing average balances for mid-to-large wallets down to levels not seen since 2018. Market observers point to profit-taking and renewed activity from long-dormant addresses as primary drivers behind the reduction in whale supply.

Glassnode: Average Whale Balances Hit Multi-Year Lows

Glassnode reported on Sept. 3 that wallets holding between 100 and 10,000 BTC now average approximately 488 BTC each — a trough last observed in December 2018. Analysts note that this decline is part of a trend that began in November 2024, when large holders started to monetize gains accrued over the extended bull market.

On-Chain Signals Point to Realized Profit-Taking

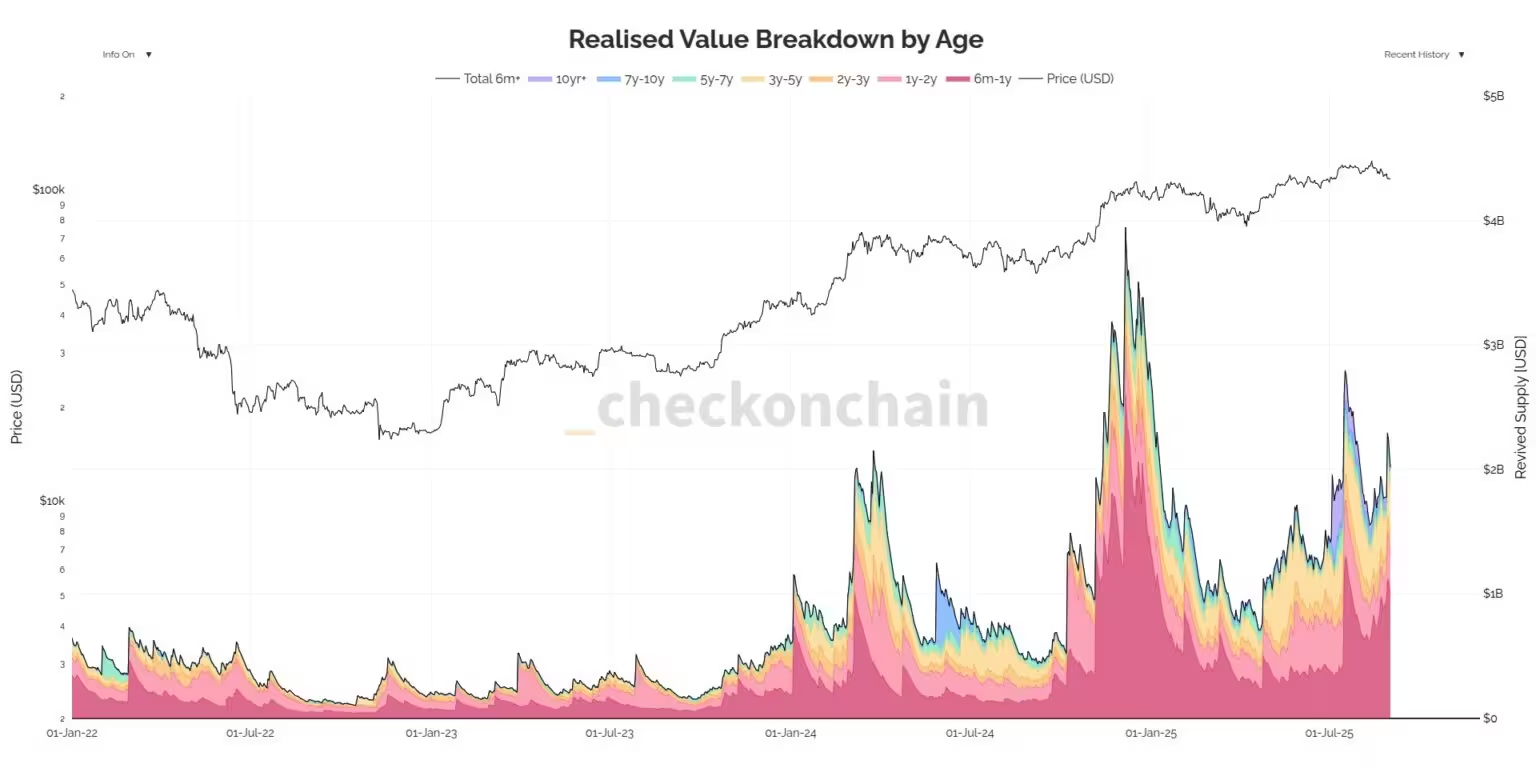

Checkonchain analytics indicate that long-term Bitcoin holders realized between $3 billion and $4 billion during market peaks in January and July of this year. These realizations show a clear pattern: as prices climbed past five-figure and then six-figure milestones, holders who had been dormant or accumulating began converting large portions of their paper gains into cash or other investments.

Why This Matters for Bitcoin Price and Market Health

Profit-taking by whales can increase short-term volatility, but it does not necessarily signal a sustained downtrend. Despite the withdrawals from large wallets, Bitcoin continues to trade near $110,000, indicating there is still ample demand from retail buyers, institutional entrants, and algorithmic liquidity providers. The market’s ability to absorb significant realized sales suggests that buyer interest remains robust even as large holders cash out partial positions.

Active Dormant Wallets and Market Dynamics

The reactivation of dormant wallets is a common hallmark of late-cycle behavior. When long-silent addresses move coins, the market often interprets this as wealth taking — especially when prices are elevated. That said, not all whale distributions lead to sustained selling pressure; many large holders rebalance portfolios or redeploy capital into other crypto assets, derivatives, or fiat positions.

What to Watch Next: Key On-Chain Metrics

Traders and analysts will be monitoring several indicators to gauge whether the profit-taking by whales is a short-term event or part of a larger distribution phase. Important metrics include realized value by age bands, changes in supply concentration among wallets, exchange inflows/outflows, and whether whale selling coincides with spikes in spot or derivatives liquidity.

Ultimately, the current decline in average whale holdings highlights the growing importance of on-chain analytics like Glassnode and Checkonchain for interpreting market moves. While whale profit-taking reduced holdings to levels unseen since 2018, the sustained price around $110,000 demonstrates that demand has kept pace — for now — with large-scale selling.

Source: cryptoslate

Leave a Comment