5 Minutes

Bitcoin Trust Score and Survey Background

On Sept. 3, the Cornell Bitcoin Club published a cross-country survey revealing that Bitcoin (BTC) averaged a 4.67 out of 10 trust score across 25 nations. The findings highlight that public confidence in Bitcoin is far from uniform, and tends to track local economic conditions, levels of institutional trust, and perceptions of financial stress.

Key Findings: Regional Differences and Asset Comparisons

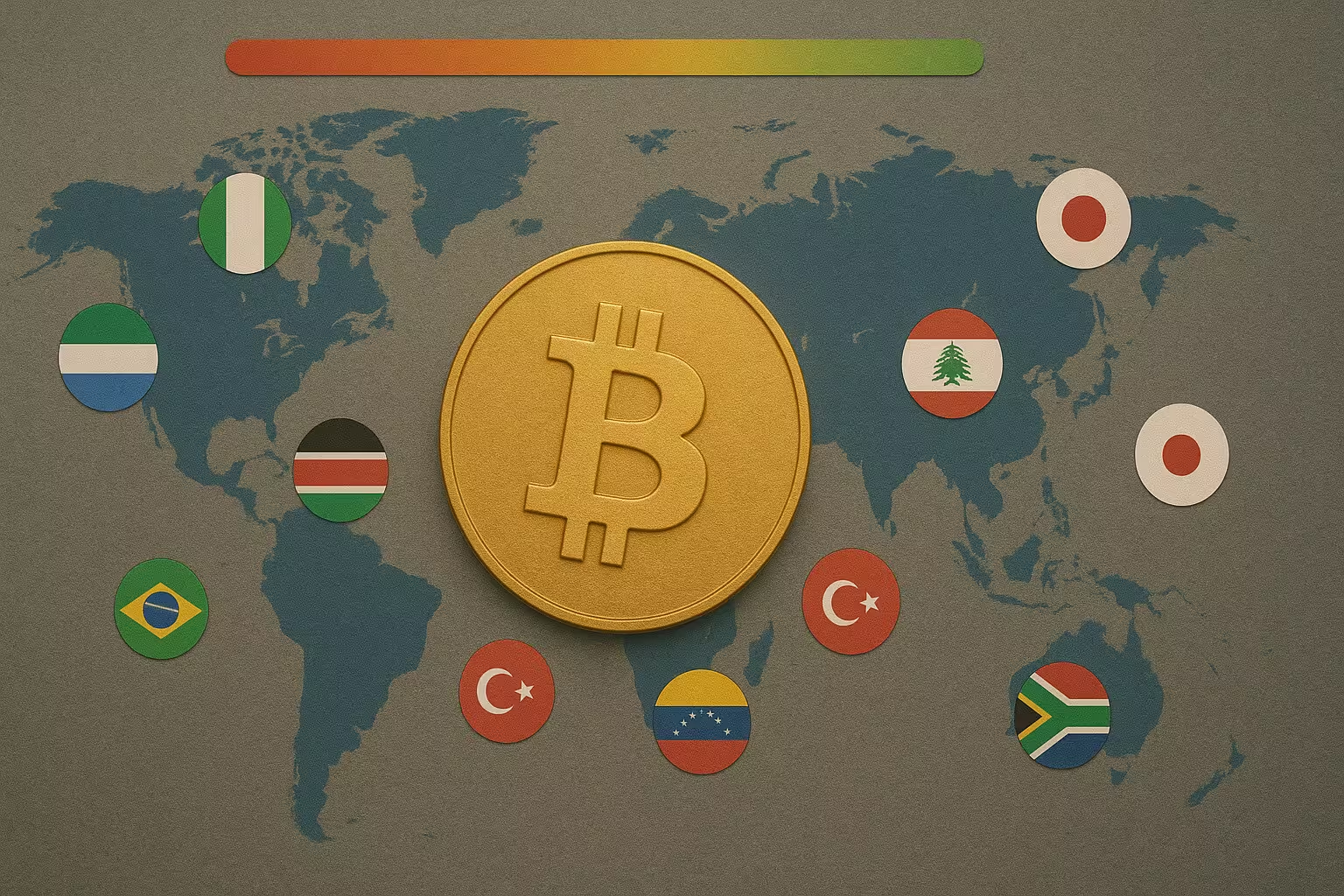

The survey exposed substantial regional variation in attitudes toward cryptocurrency. Nigeria topped the list with the highest trust rating for Bitcoin among surveyed countries, while Japan ranked lowest. Across the board, respondents rated Bitcoin as riskier than traditional assets such as gold, real estate, and leading fiat currencies.

Even though Bitcoin remains a high-profile asset in digital finance and blockchain conversations, it did not outrank conventional investment vehicles in perceived safety. When asked to compare risk levels, 45% of participants viewed Bitcoin as about as risky as stocks, and 43% equated it with corporate bonds. These responses suggest some respondents consider Bitcoin comparable to established but volatile asset classes rather than as a uniquely safe or dangerous option.

Where Bitcoin Surpasses Government Trust

One of the report's most revealing outcomes was the list of countries where citizens reported higher trust in Bitcoin than in their national governments. These countries are:

- Brazil

- Indonesia

- Kenya

- Lebanon

- Nigeria

- The Philippines

- South Africa

- Turkey

- Ukraine

- Venezuela

Most of these nations are emerging markets or are experiencing political instability, suggesting that Bitcoin and other cryptocurrencies can gain traction where institutional confidence is weak and citizens seek alternatives to centralized financial and political systems.

Government Trust and Institutional Confidence

By contrast, the United Arab Emirates, China, and Saudi Arabia showed high levels of public trust in government institutions, which outpaced confidence in Bitcoin. That pattern reinforces the idea that Bitcoin adoption and trust are strongly influenced by local institutional contexts rather than global marketing or technology trends alone.

Survey responses about Bitcoin's practical benefits were often neutral rather than strongly positive or negative. Questions concerning Bitcoin's ability to reduce fraud, protect privacy, or ensure trustworthy service provision generally produced ambivalent answers. This tendency toward neutrality indicates uncertainty about the real-world advantages of Bitcoin, not necessarily outright rejection.

Risk Perception and Market Positioning

For crypto investors and blockchain industry observers, the results underscore that Bitcoin is perceived largely as a speculative or high-volatility instrument. The alignment with stock and corporate bond risk perceptions points to how many participants mentally categorize Bitcoin: as an alternative asset with high return potential and corresponding risk, instead of as a mainstream store of value on par with gold or major fiat currencies.

Financial Stress and Bitcoin Adoption

Another important theme in the Cornell analysis is the correlation between financial stress and Bitcoin ownership. The survey asked participants to respond to statements such as 'my finances control my life' to gauge financial strain. Countries reporting elevated financial stress—specifically Turkey, India, Kenya, and South Africa—also showed higher rates of Bitcoin ownership and trust.

Conversely, El Salvador, Switzerland, China, and Italy reported the lowest levels of financial stress in the survey and showed less interest in Bitcoin. Mexico, Italy, and Japan ranked lowest for both financial stress and cryptocurrency adoption. While the study emphasizes that correlation does not imply causation, the pattern suggests that Bitcoin may be seen as an alternative financial outlet in places where citizens feel economic pressure or face limited trust in conventional financial infrastructure.

What This Means for Crypto Markets and Policy

For crypto market participants, policy makers, and institutional investors, the Cornell survey provides actionable insights. Regions with weakened institutional trust or higher financial strain may be more receptive to crypto adoption, payments innovation, and blockchain-based financial services. Conversely, high trust in government and established financial systems may slow grassroots adoption of Bitcoin and similar digital assets.

Policy makers should note that public uncertainty about Bitcoin's fraud protection and privacy benefits represents an opportunity for education, clearer regulation, and improved consumer protections. For the crypto industry, strengthening service-provider trust and communicating tangible use cases will be central to broadening adoption beyond speculative investment.

Conclusion: Local Context Shapes Global Bitcoin Perception

The Cornell Bitcoin Club survey paints a nuanced picture: Bitcoin's global reputation is not monolithic but is shaped by national economic conditions, levels of institutional trust, and the public's lived experience of financial stability. Rather than a uniform wave of adoption, BTC's position in each country depends on local realities, regulatory environments, and how convincingly the crypto ecosystem can address concerns about risk, fraud, and privacy.

As regulators, institutions, and crypto projects evaluate market strategies, they should factor in these regional differences and prioritize transparency, education, and consumer protections to convert neutral or skeptical respondents into confident users of blockchain technology and digital assets.

Source: cryptoslate

Leave a Comment