5 Minutes

Quantum computing and Bitcoin’s security

Quantum computing is advancing rapidly, and with it comes renewed debate about the future of Bitcoin security. While today’s classical cryptography has protected the network for years, powerful quantum machines could one day expose private keys and unlock dormant wallets. This article explains how quantum technology interacts with Bitcoin’s cryptography, the potential to recover lost BTC, and practical steps users and developers can take to reduce risk.

What is quantum technology?

Quantum technology harnesses the behavior of matter and energy at atomic and subatomic scales to perform computations far beyond classical computers. Many modern devices — from MRI machines to advanced transistors — rely on principles rooted in quantum physics. Quantum computers process information using qubits, allowing them to tackle certain problems exponentially faster than conventional systems. Tech firms and research labs are racing to scale qubit counts, with current machines typically in the low hundreds of qubits and rough estimates suggesting millions may be required to threaten Bitcoin’s cryptography.

Why quantum matters for blockchain and cryptography

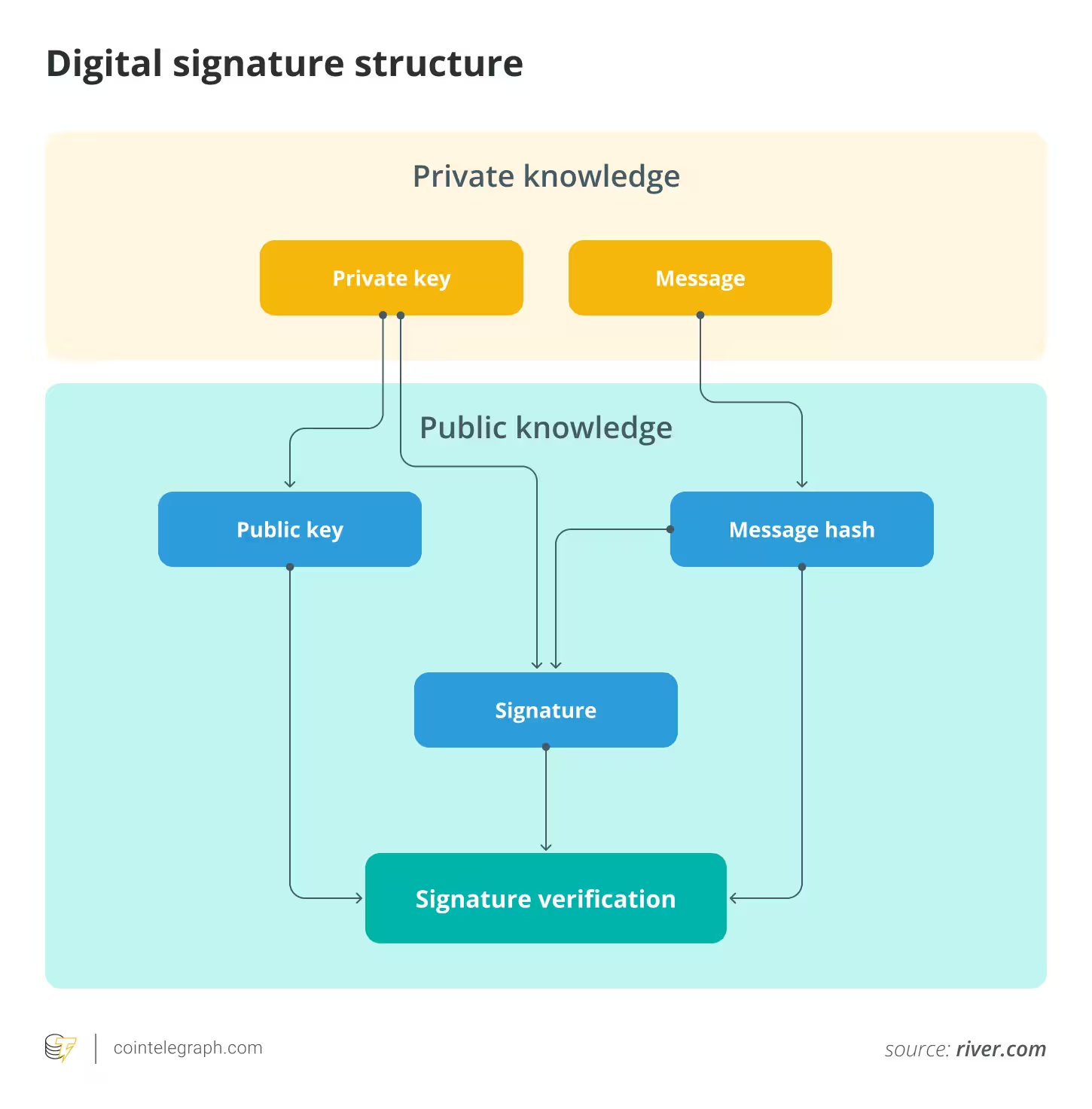

Bitcoin and most cryptocurrencies depend on asymmetric cryptography to secure transactions. Bitcoin’s signatures rely on the Elliptic Curve Digital Signature Algorithm (ECDSA), which resists classical attacks but is vulnerable to quantum algorithms like Shor’s. If a sufficiently powerful and fault-tolerant quantum computer runs Shor’s algorithm at scale, it could derive private keys from public keys — allowing unauthorized spending from exposed addresses.

How quantum computing could break Bitcoin wallets

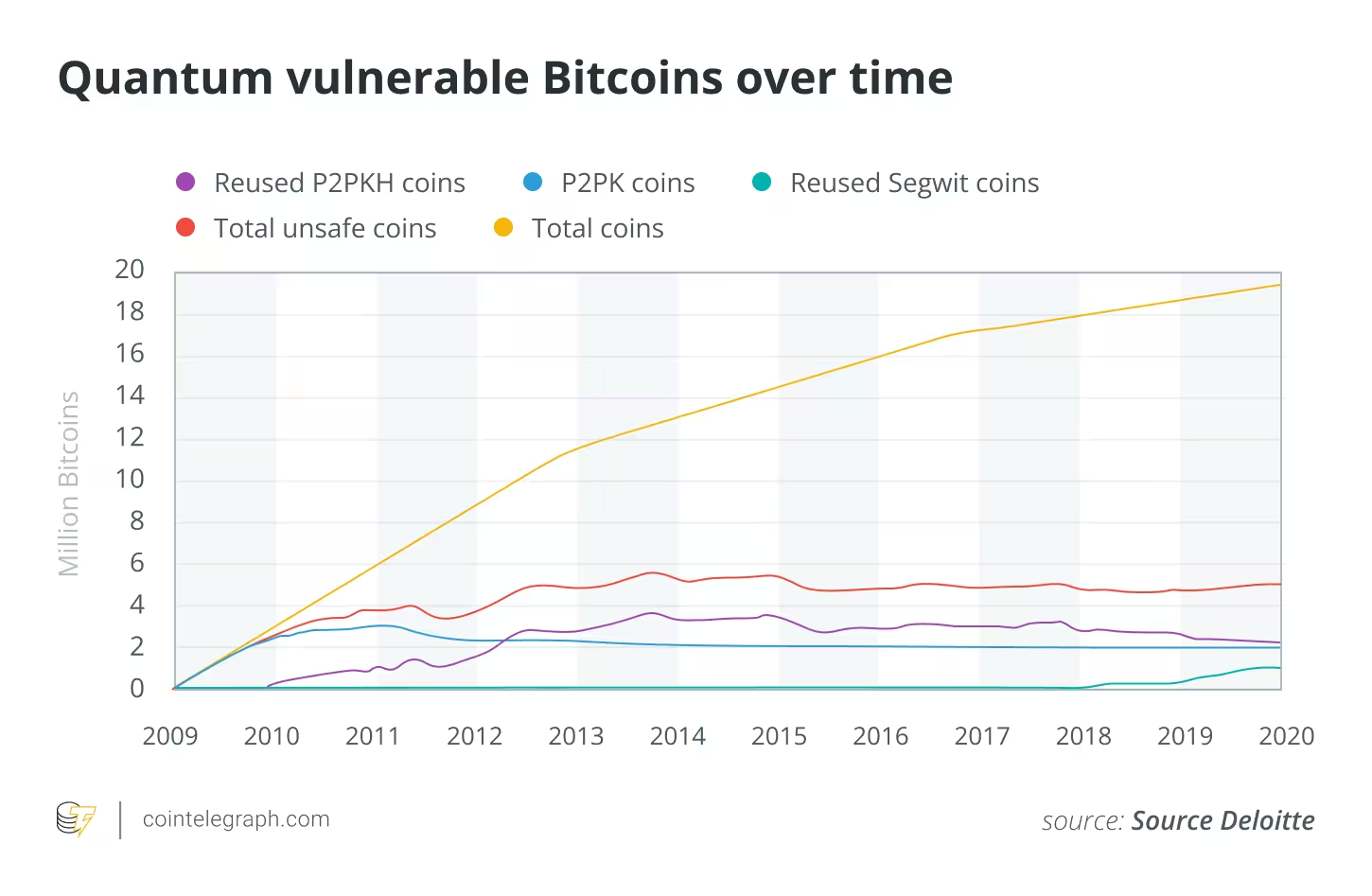

Bitcoin private keys control coins. When a public key is revealed on-chain (for example, after spending from some address types), it becomes a potential target. Older address formats such as pay-to-public-key (P2PK) and reused pay-to-public-key-hash (P2PKH) can expose public keys, making them more susceptible to quantum attacks. Shor’s algorithm reduces the time required to compute discrete logarithms on elliptic curves, which underpins ECDSA security. While building a quantum computer capable of reversing these keys remains a monumental engineering challenge, progress in hardware and algorithms keeps the risk relevant for long-term planning.

Can quantum computers recover lost Bitcoin?

Estimates suggest between 2.3 million and 3.7 million BTC may be effectively lost — coins with inaccessible private keys or holdings from early addresses. In theory, a quantum computer that can break ECDSA could restore access to those dormant wallets by deriving their private keys from public information. If such a recovery occurred for large allocations (including Satoshi-era coins), it could trigger significant market volatility and ethical debates about redistribution versus destruction.

Economic and ethical considerations

Recovering lost BTC would alter Bitcoin’s perceived scarcity and might impact prices. Discussions among experts range from proposals to destroy recovered coins to preserve scarcity, to redistributing them for social or network-beneficial purposes. Any practical solution would need broad consensus in the community and careful protocol-level consideration to avoid undermining trust.

How to protect your Bitcoin today

Although a fully capable quantum attacker is not imminent, users should adopt best practices now: avoid address reuse, use modern wallets supporting Taproot and SegWit, and generate fresh addresses for each transaction. Custodial platforms and wallet providers should prioritize quantum-resistant upgrades and automatic address rotation. Awareness of phishing techniques like address poisoning remains critical regardless of quantum risk.

Bitcoin’s quantum resilience and future defenses

Bitcoin is decentralized and upgradeable. Researchers and developers are exploring quantum-resistant cryptography and proposals such as QRAMP (Quantum-Resistant Asset Mapping Protocol) to protect supply limits and cross-chain interactions without compromising custody. Implementing quantum-safe signature schemes, improving wallet hygiene, and advancing protocol-level defenses will help ensure Bitcoin remains secure as quantum hardware progresses.

In short, quantum computing presents both a long-term threat and an opportunity for stronger cryptography. Users should follow best practices today while the community develops quantum-resistant solutions for the blockchain ecosystem.

Source: cointelegraph

Leave a Comment