9 Minutes

Who controls the largest share of XRP in 2025?

As XRP continues to draw institutional attention following regulatory clarity in 2025, scrutiny of ownership has intensified. The single largest holder remains Ripple Labs, which controls roughly 42% of the total 100 billion XRP supply. That dominant stake is split between a small liquid treasury and a much larger escrow program designed to manage token issuance over time.

Ripple’s stake and escrow mechanics

How Ripple’s holdings are structured

Ripple’s balance sheet includes about 4.5 billion XRP available for operational use plus a much larger 35 billion XRP held in escrow. The escrow is a core part of Ripple’s supply-management strategy and uses the XRP Ledger’s native capabilities to unlock a predictable monthly allotment.

Monthly releases and relocking policy

Typically, the escrow mechanism releases 1 billion XRP per month via a smart-contract-like process on the XRP Ledger. These unlocked tokens are used to finance corporate operations and to provide liquidity for Ripple’s On-Demand Liquidity (ODL) service.

Ripple practices conservative treasury management: rather than dumping all monthly releases into the market, it relocks a substantial portion. Public reporting shows that 60% or more of each month’s unlocked XRP is re-escrowed because Ripple does not need the full amount for operational spending. This relocking policy helps avoid abrupt increases in circulating supply and supports price stability.

What if relocking stopped?

If Ripple ceased relocking freshly released tokens, the 35-billion escrow would be exhausted in roughly three years at the 1 billion per month release cadence. That hypothetical highlights how much influence Ripple has over future circulating supply and why many analysts view the company’s holdings as a critical market variable.

Individual ownership: Chris Larsen and other top holders

Chris Larsen’s position in the XRP ecosystem

Ripple co-founder and executive chairman Chris Larsen is the largest individual XRP holder. Public blockchain records show Larsen controls multiple tagged wallets totaling in the low billions of XRP. Across these addresses he has retained founder allocations, and he also moved and sold portions of his holdings during 2025.

During July 2025 Larsen drew headlines for transfers that resulted in roughly $175 million of XRP being moved to exchanges after July 17 — a period when XRP traded near seven-year highs above $3. Some of Larsen’s wallets have remained static since they received founder allocations in 2013, while others have seen activity and sales during 2025. Collectively his personal holdings amount to several percent of the total XRP market cap, which is enough to influence market flows if large sums are deployed.

Why individual holdings matter

High-net-worth holders like Larsen can affect liquidity and short-term sentiment. Even when tokens are distributed across multiple addresses, large concentrated ownership means single actors can introduce notable sell-side pressure—or provide signals of confidence when they accumulate or hodl. For institutional investors and traders, tracking these wallet movements is a routine part of market analysis.

Exchange custody and what on-exchange balances reveal

Major exchanges and their XRP custody

A substantial quantity of XRP is held on exchange wallets as custodial balances for users. In 2025, South Korea’s Upbit topped the list of exchanges holding XRP with roughly 6 billion XRP under custody — an indicator of strong Korean retail demand and local trading volume. Binance follows with approximately 2.7 billion XRP across its custody wallets. Uphold and Coinbase also rank among the top custodians, with Uphold near 2 billion XRP and Coinbase holding about 780 million XRP as reported in mid-2025.

Trends and strategic repositioning

Coinbase’s XRP balance declined sharply during Q2–Q3 2025, falling by roughly 57% over a single month. Market observers largely interpret that reduction as a strategic repositioning of customer custody rather than a simple regulatory retreat. That interpretation gained traction after the U.S. Securities and Exchange Commission dropped its long-running enforcement case against Ripple in August 2025, granting XRP clearer legal standing in the United States and prompting renewed institutional interest.

Interpreting exchange balances

It’s important to emphasize that most exchange-held XRP represents customer funds rather than proprietary exchange inventory. High exchange custody figures therefore point to strong retail and institutional demand for custody and trading services, but they should not be conflated with a single actor’s market control.

Whale accumulation and concentration dynamics

Record whale counts in 2025

The year 2025 proved to be a breakout period for XRP accumulation by so-called whales—addresses that hold large amounts of tokens. In June 2025 the number of wallets containing more than 1 million XRP rose to 2,708, the highest count in XRP’s history. At prevailing prices in 2025, each of those wallets represents over $2 million in XRP value, signaling substantial institutional and high-net-worth participation.

Active addresses and on-ledger activity

XRP Ledger activity spiked in tandem with accumulation. Daily active addresses climbed to approximately 295,000 in June 2025, compared with a trailing three-month average of 35,000–40,000 addresses. That multi-fold increase demonstrates renewed interest across both retail traders and more sophisticated market participants.

Concentration of supply

Despite rising participation, ownership concentration remains stark. Roughly 100 addresses controlled about 68% of XRP’s circulating supply in 2025, one of the highest concentration rates among the top market-cap cryptocurrencies. This degree of centralization is often framed as a dual-edged sword: it can support liquidity and large-block trades, but it also raises legitimate questions about decentralization and governance.

What the rich list means for traders and long-term holders

Implications for price action and liquidity

Large custodial and treasury holdings translate into a market where a relatively small number of actors can move meaningful amounts of XRP. For traders, this creates both opportunities and risks. On one hand, institutional custody and whale accumulation suggest robust demand and deep liquidity for large trades. On the other, sudden reallocation from a few major holders—or a sudden stop to relocking activity—could exert downward pressure on prices.

Decentralization concerns and the narrative shift

Many in the crypto community remain uneasy about Ripple’s concentrated supply control. That critique is especially vocal among proponents of decentralized networks and community-led governance. However, the narrative has shifted in 2025: legal clarity following the SEC’s decision and growing institutional adoption have tempered some of the prior stigma around centralized token distribution.

Practical takeaways for crypto investors

Watch the escrow and relocking trends

Monitor Ripple’s escrow activity and monthly relocking statistics. Changes in the percentage of tokens relocked versus those allowed to circulate are a leading indicator of potential supply-side pressure.

Track whale wallets and exchange flows

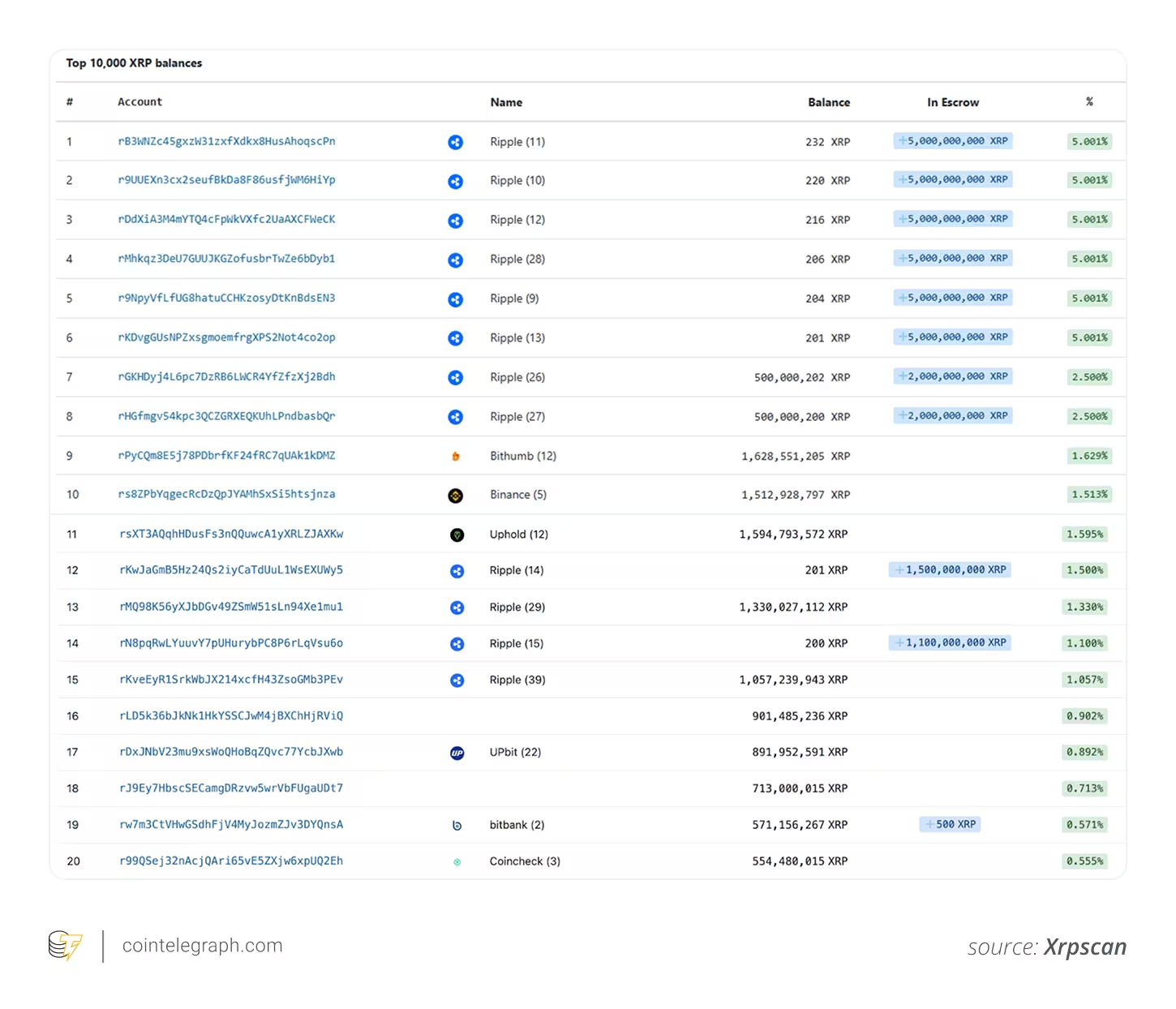

On-chain analytics platforms and explorers like XRPScan offer transparency into large wallet balances and exchange inflows/outflows. Observing where XRP is moving—whether into cold storage, into exchange custody, or between large wallets—can provide early signals of market intentions and sentiment.

Understand the difference between custody and control

High exchange balances reflect customer custody rather than exchange ownership. Distinguishing custodial holdings from treasury or founder-controlled addresses is vital for accurate supply-concentration analysis.

Data points worth noting

- Ripple controls roughly 42% of the total 100 billion XRP supply: ~4.5B liquid + ~35B escrow.

- Escrow releases typically 1 billion XRP per month; more than 60% of monthly releases have been relocked historically.

- Chris Larsen remains the largest individual holder, with wallets in the low billions of XRP and notable 2025 sell-side activity.

- Top exchanges custody large amounts: Upbit (~6B), Binance (~2.7B), Uphold (~2B), Coinbase (~780M, down 57% since Q2 2025).

- In June 2025, wallets holding >1 million XRP reached 2,708 — a record high.

- Daily active addresses on the XRP Ledger surged to ~295,000 in June 2025 versus a three-month average of 35k–40k.

- Approximately 100 addresses control about 68% of circulating XRP in 2025, highlighting high concentration.

- To be in the top 10% of XRP holders, an address needs roughly 2,396 XRP (~$7,000 as of August 2025).

Conclusion: dominance, distribution and what to expect next

XRP’s 2025 rich list paints a picture of concentrated ownership, decisive escrow mechanics, and renewed institutional interest. Ripple’s outsized holding and escrow program give the company powerful levers over supply, but the relocking policy and transparent monthly releases have helped temper market volatility. Meanwhile, growing whale counts, rising institutional custody, and increasing on-ledger activity suggest that demand is shifting from speculative sidelining to strategic accumulation.

For market participants, the key items to monitor are escrow release and relocking rates, large wallet flows (especially from founders and exchanges), and exchange custody trends. These factors, combined with macro crypto sentiment and regulatory developments, will be the leading drivers of XRP price action and investor confidence going forward.

Source: cointelegraph

Leave a Comment