3 Minutes

Diverging ETF Flows Signal Shifting Institutional Interest

Spot Ethereum exchange-traded funds have recorded outflows for a second consecutive week as investor demand cools following months of heavy inflows. Meanwhile, spot Bitcoin ETFs showed renewed strength, drawing significant institutional capital and reinforcing Bitcoin's narrative as a store of value.

Ether ETF performance and metrics

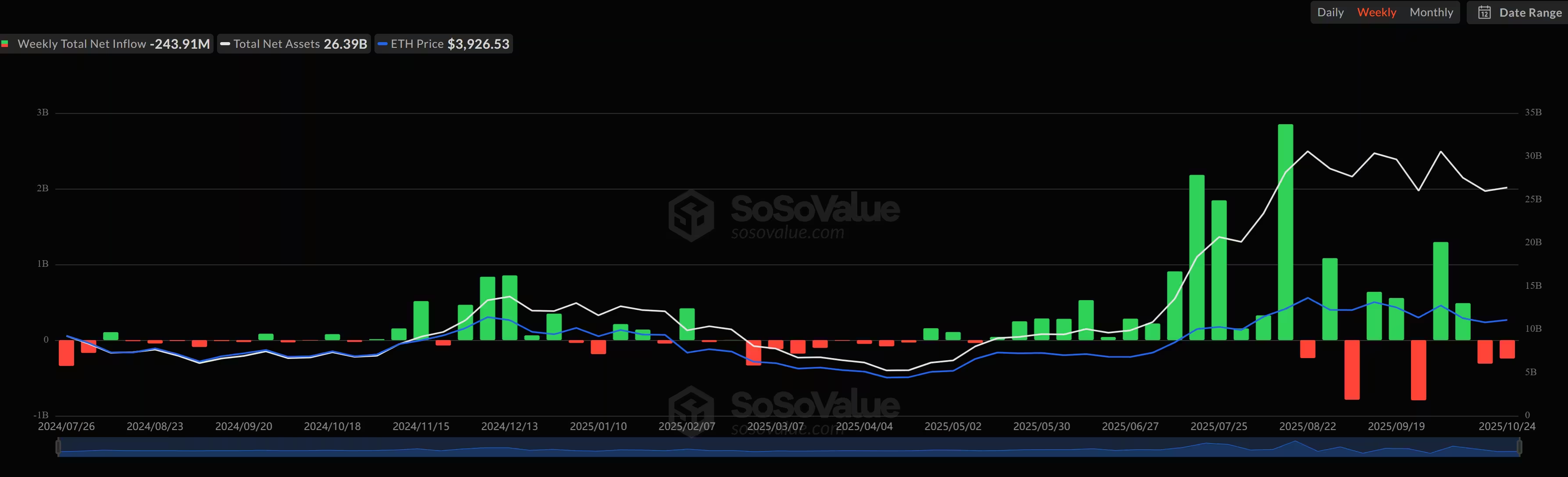

According to data from SoSoValue, spot Ether products posted net redemptions of $243.9 million for the week ending Friday, following the prior week's $311 million outflow. Cumulative inflows across all Ether spot ETFs still total $14.35 billion, while aggregate net assets stand at $26.39 billion, roughly 5.55% of Ethereum's market capitalization.

On Friday alone, Ether funds recorded $93.6 million in outflows. BlackRock's ETHA led withdrawals with $100.99 million exiting, while Grayscale's ETHE and Bitwise's ETHW registered modest inflows.

Ether funds see outflows for second week

Cooling on-chain activity and muted institutional appetite suggest investors are awaiting fresh catalysts before re-entering Ether-focused ETFs. Metrics such as network activity, DeFi growth, and major protocol upgrades will likely influence future flows.

Bitcoin ETFs: renewed inflows and institutional confidence

Spot Bitcoin ETFs attracted $446 million in net inflows for the week, with an additional $90.6 million added on Friday. Year-to-date cumulative inflows have reached $61.98 billion, and total net assets now sit at $149.96 billion, approximately 6.78% of Bitcoin's market cap.

BlackRock's iShares Bitcoin Trust (IBIT) and Fidelity's FBTC led the charge, with IBIT adding $32.68 million and FBTC contributing $57.92 million during the week. IBIT holds roughly $89.17 billion in assets, while FBTC manages about $22.84 billion.

Bitcoin funds see inflows

Market implications and expert views

Vincent Liu, CIO at Kronos Research, told Cointelegraph that ETF flows indicate a strong rotation into Bitcoin as investors favor assets seen as resilient amid macro uncertainty and the prospect of future interest rate cuts. Liu expects Bitcoin inflows to remain robust if traders position for potential monetary easing, while Ethereum and other altcoins may only recover if on-chain activity picks up or new fundamental catalysts emerge.

For portfolio managers and crypto investors, these divergent ETF trends highlight two themes: Bitcoin's growing role as institutional digital gold, and Ethereum's need for renewed network demand to sustain ETF inflows. Monitoring ETF flows alongside on-chain metrics, macro indicators, and regulatory developments will be critical for assessing near-term market direction.

Source: cointelegraph

Leave a Comment