3 Minutes

Solana reclaims $200 as buying and ETFs drive momentum

Solana (SOL) has pushed back above the psychologically important $200 mark as renewed buyer interest and steady institutional activity lift trader sentiment across the network. After a recent low near $177, SOL gained more than 10% across four trading sessions and is trading near $204, up roughly 5% in the past 24 hours according to market feeds.

Key drivers: institutional flows, staking ETFs and network upgrades

A wave of institutional signals has supported the breakout. The REX-Osprey Solana + Staking ETF has seen consistent inflows and now oversees assets north of $400 million, while Fidelity’s new custody and trading support for SOL adds further legitimacy for big-ticket investors. These institutional developments, combined with on-chain improvements such as record stablecoin growth and the Alpenglow upgrade, are strengthening Solana’s medium-term narrative.

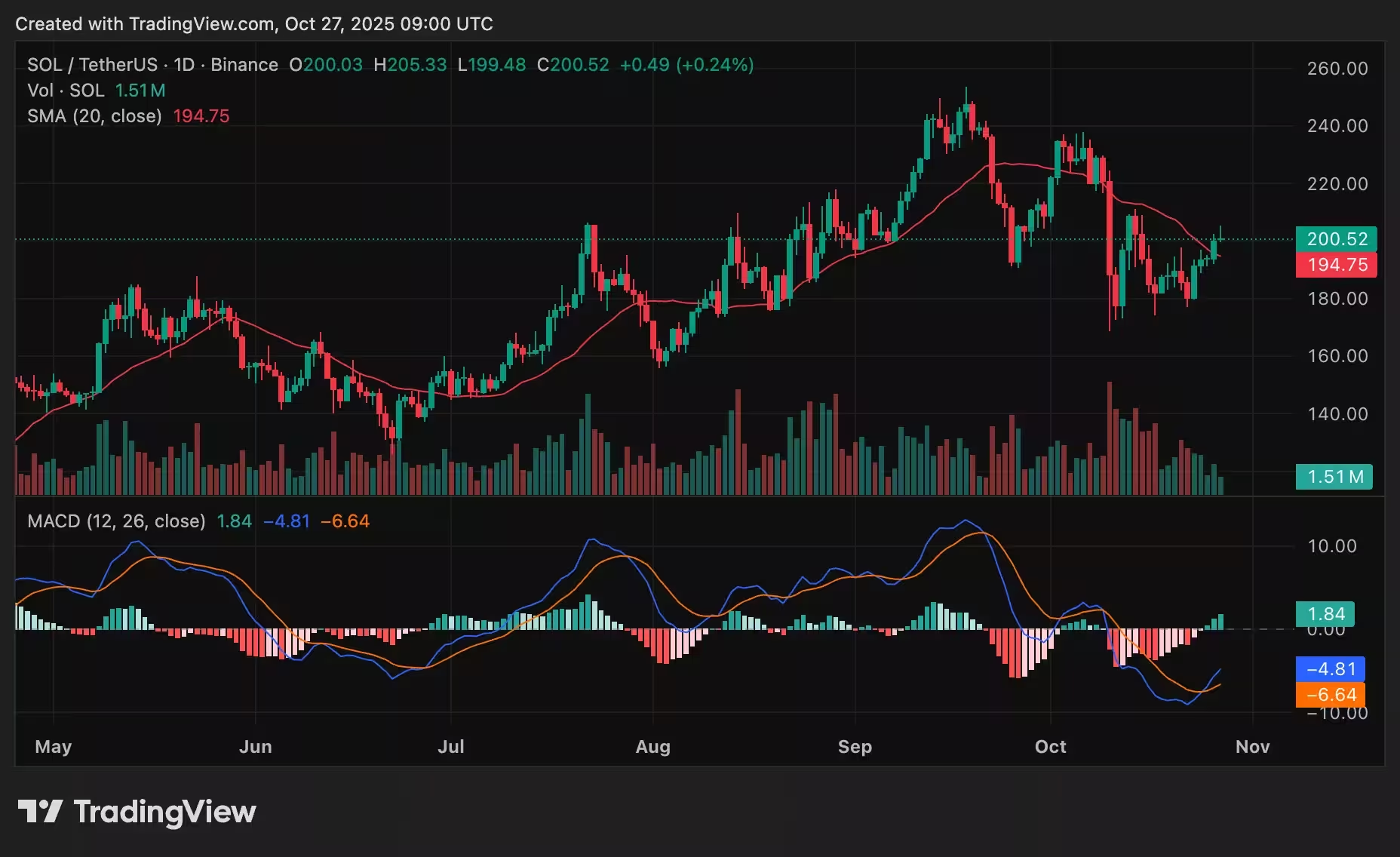

Solana price chart

Short-term technical picture

Technically, SOL printed a higher-low cluster after reclaiming $200, with intraday ranges showing a high near $205 and a low around $199. Volume has increased week to date, indicating improving participation. Key indicators like the RSI and MACD currently signal improving momentum, though they are not yet in overbought territory. Traders should watch the 20-day EMA near $197 as a near-term structural pivot.

For bullish continuation, market participants want to see $200 hold as support and for buyers to clear the immediate $205 shelf. A sustained move above $210–$215 could open the door to $230–$235 as the next logical target band if momentum and volume continue to expand.

On the downside, failure to sustain gains at $205 followed by a break below the 20-day EMA around $197 would weaken the setup and could prompt a retest of $190. A deeper deterioration in risk appetite would expose lower support around $182.

Balancing profit-taking with fresh demand

Despite the upward push, some traders booked profits near intraday highs, keeping volatility elevated. Oscillators would refute the bullish case if the RSI rolls back below 50 or if MACD crosses negative, a scenario that would likely lead to consolidation before another leg higher.

Fundamentals and institutional adoption remain the backdrop for today’s move, framing the breakout as part of an ongoing tug-of-war between new large-scale demand and short-term profit-taking. With ETFs, staking interest, and major custodial support now in play, Solana’s price action over the next sessions will hinge on whether buyers can convert recent strength into a durable support base above $200.

What to watch

- Institutional inflows and ETF flows into REX-Osprey.

- Fidelity custody and exchange support announcements.

- On-chain metrics: stablecoin growth and upgrade adoption.

- Technicals: $200 support, $205–$215 resistance band, 20-day EMA, RSI and MACD signals.

This mix of fundamental adoption and technical dynamics makes SOL one of the more closely watched large-cap altcoins as traders and institutions reassess exposure to Solana’s blockchain and staking ecosystem.

Source: crypto

Leave a Comment