8 Minutes

Corporate treasuries shift from holdings to income

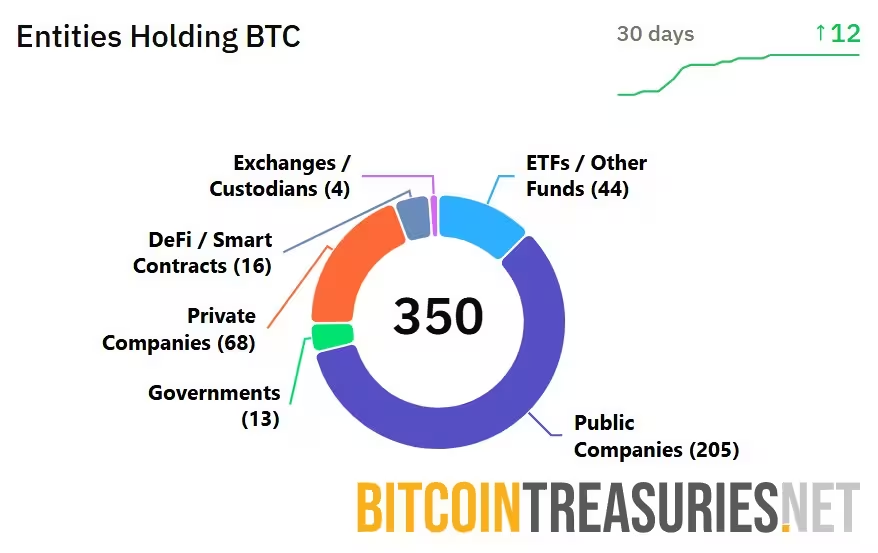

Public and private firms have accumulated a substantial share of Bitcoin supply — and an increasing number of executives and treasury teams are asking whether those holdings should remain idle or be activated to generate yield. Corporate Bitcoin reserves, combined with private-company holdings, now amount to roughly 1.33 million BTC, representing a meaningful slice of circulating supply. That shift is changing how companies, institutional investors and builders think about Bitcoin's role as both a store of value and a productive financial asset.

At least 273 public and private corporations have reported Bitcoin investments

From passive vaults to potential cash-flow engines

For decades, many firms viewed Bitcoin as a modern form of digital gold: a capital allocation for long-term preservation. But with corporate balance sheets swelling with BTC, some founders and fund managers are exploring ways to monetize those positions without compromising custody or long-term appreciation. Botanix Labs founder Willem Schroé is among the leading advocates for turning corporate treasuries into working capital via Bitcoin-native yield strategies.

Schroé, whose background includes cryptography research and a Harvard Business School stint, argues that once investors embrace Bitcoin's full potential, the logical next step is to seek more Bitcoin — achieved by responsibly harvesting yield. His company, Botanix Labs, is building a sidechain and protocol suite designed to let holders earn yield while keeping control of their keys.

Why ETFs can’t put Bitcoin to work

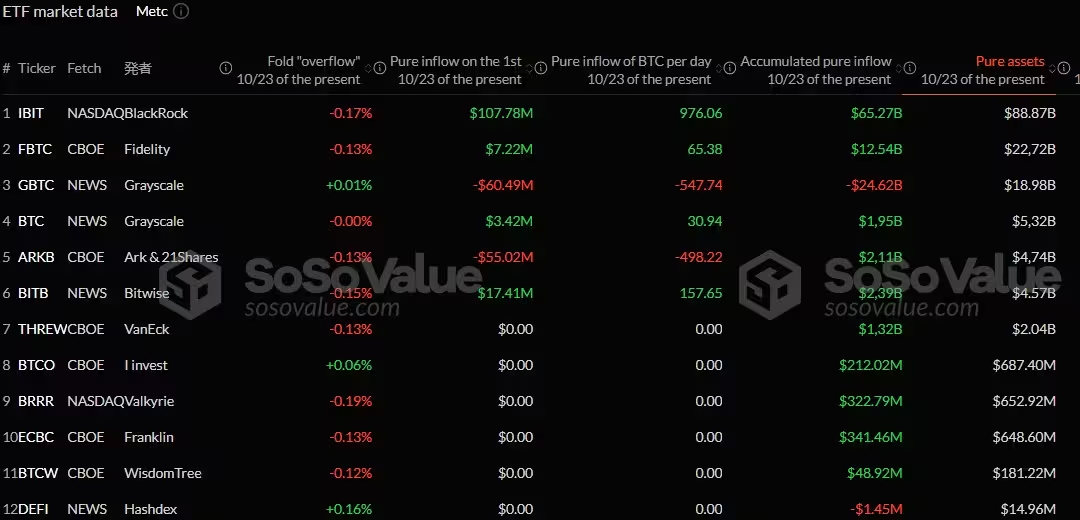

Spot Bitcoin exchange-traded funds now hold more BTC than many corporations combined, with almost 1.7 million BTC under management. Yet the ETF structure under U.S. securities law explicitly restricts how those assets can be used. Spot ETFs are typically registered as passive commodity trusts and operate under regulations that prohibit lending, rehypothecation or other active deployment of the underlying Bitcoin.

BlackRock’s IBIT holds the most Bitcoin among ETFs

Because ETF sponsors rely on custodians and file prospectuses that explicitly disallow lending or pledging of assets, those funds are effectively locked into price exposure only. That regulatory design protects investors seeking pure price tracking, but it also means a large portion of institutional Bitcoin capital will not be available to generate on-chain yield unless regulations and fund structures evolve.

Custody, regulation and the yield trade-off

The decision to activate Bitcoin holdings comes down to custody and risk profile. When fund sponsors or treasurers control the keys and governance, they can choose non-custodial yield strategies. But for many institutional products, custody is outsourced to regulated firms like Coinbase or Anchorage, and prospectuses restrict any active use of the asset. Firms that want yield must either adopt new legal wrappers or rely on non-custodial solutions that maintain direct ownership.

Non-custodial yield: new architectures for Bitcoin

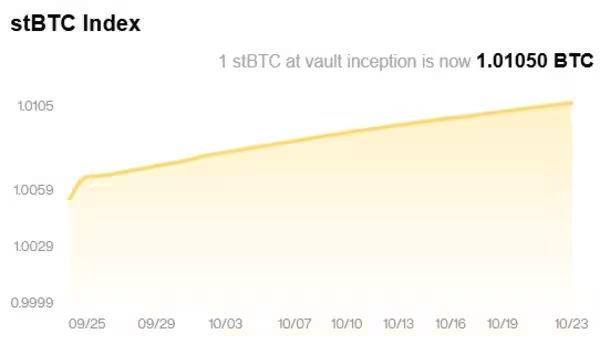

Botanix and other Bitcoin-native initiatives propose a different path: sidechains and smart-contract frameworks that let holders stake BTC, participate in lending, or provide liquidity without surrendering custody. In Botanix's model, users stake Bitcoin into smart contracts on a Bitcoin-denominated sidechain and receive a yield-bearing token in return. The protocol’s yield is designed to come from network activity — transaction fees, liquidity flows and protocol-native incentives — rather than opaque off-chain lending.

Botanix currently offers a 3.46% annual percentage rate (APR) on 100 staked BTC across 13,144 wallets.

This approach aims to balance the desire for productive capital with the fundamental Bitcoin principle of self-custody. It also acknowledges the lessons of the 2022 crypto crisis, when centralized lenders that promised high returns collapsed under leverage and counterparty risk. By keeping custody with the user and tying returns to on-chain mechanics, sidechain architectures attempt to reduce systemic counterparty exposure.

Risks and maturity of the Bitcoin yield space

Yield is a sensitive topic in crypto history. Past failures like Celsius and BlockFi exposed risks tied to centralized custody, leverage, and liquidity mismanagement. That legacy has made corporate treasurers cautious. Yet decentralized finance has also matured: lending and staking protocols such as Aave and Dolomite have multi-year track records and billions in assets, providing a model for safer, permissionless yield.

Proponents argue the industry has learned from earlier errors and that well-designed smart contracts, rigorous audits, improved bridge security and conservative risk parameters can mitigate many threats. Still, smart-contract exploits, bridge failures and governance attacks remain material risks that treasurers must weigh against expected yield.

How Bitcoin-native finance differs from traditional models

Traditional banks and custodial lenders often deployed customer assets into off-chain loans and complex rehypothecation chains. Bitcoin-native financial systems, by contrast, aim to generate returns through transparent, on-chain activity. That can include staking, liquidity provision, algorithmic market-making, or fees generated by layer-2 and sidechain transaction throughput. The emphasis is on immutable rules, verifiable reserves and minimized counterparty exposure.

Schroé emphasizes that Bitcoin’s evolution should be Bitcoin-native rather than a copy of legacy finance. Botanix’s architecture leverages an Ethereum Virtual Machine–compatible environment where gas fees, collateral and settlement are settled in BTC. The design is intended to enable lending, borrowing and liquidity services while keeping Bitcoin at the center of economic activity.

Philosophical divides and practical adoption

Not everyone agrees that Bitcoin should become a broader financial platform. Purists worry that adding yield and complex financial primitives could reintroduce the kind of contagion and counterparty risks that harmed the industry. Builders who favor utility counter that a medium of exchange and programmable money layer are natural progressions after monetary adoption.

Schroé sees the debate as healthy: codebases, client implementations and governance must adapt and respond to real-world market signals. The broader market will determine which models scale responsibly. As companies and treasurers look for yield, they will also pressure builders and regulators to produce safer rails and clearer compliance frameworks.

What this means for corporate treasuries and the market

As adoption deepens, corporate balance sheets could become active participants in a Bitcoin-denominated financial ecosystem. That shift could reduce the floating supply available to pure spot ETFs, introduce new sources of on-chain liquidity, and change how firms manage liquidity and capital allocation.

For CFOs and treasurers, the choice comes down to risk tolerance, custody preferences and regulatory constraints. Institutions that prioritize regulatory clarity and passive exposure will remain with ETFs and custodial solutions. Those prioritizing yield and active use may explore non-custodial protocols, sidechains and carefully audited staking mechanisms.

Companies now face a strategic decision: hold Bitcoin as an inert reserve or allow it to generate returns that compound holdings over time. The market’s answer will shape Bitcoin’s next evolution — whether it remains predominantly a store of value or becomes a functioning medium for finance and commerce.

Looking ahead

Corporate and institutional interest in Bitcoin yield is unmistakable. As protocols, regulatory frameworks and custodial products evolve, more treasuries could adopt conservative, Bitcoin-native yield strategies. That evolution will depend on robust security practices, transparent mechanics and legal clarity — but if executed responsibly, it could transform billions of dollars of dormant Bitcoin into productive capital that benefits holders and the broader Bitcoin economy.

Source: cointelegraph

Comments

Armin

I've sat on a treasury desk, we toyed with yield ideas, saw gains but also crazy legal hoops and liquidity snags, if that scales..?

blockrift

Wait, so corps could stake BTC but keep keys? Sounds tempting, but who audits these sidechains, really... risky.

Leave a Comment