3 Minutes

Solana spikes as large SOL withdrawals hit exchanges

Solana (SOL) surged to its strongest levels since January, climbing roughly 5% in 24 hours to trade near $240 and posting an 18% gain on the week. The token's outperformance has drawn attention from traders and institutional observers as it outpaced larger rivals Bitcoin and Ether during the same period.

Galaxy Digital moves millions of SOL off exchanges

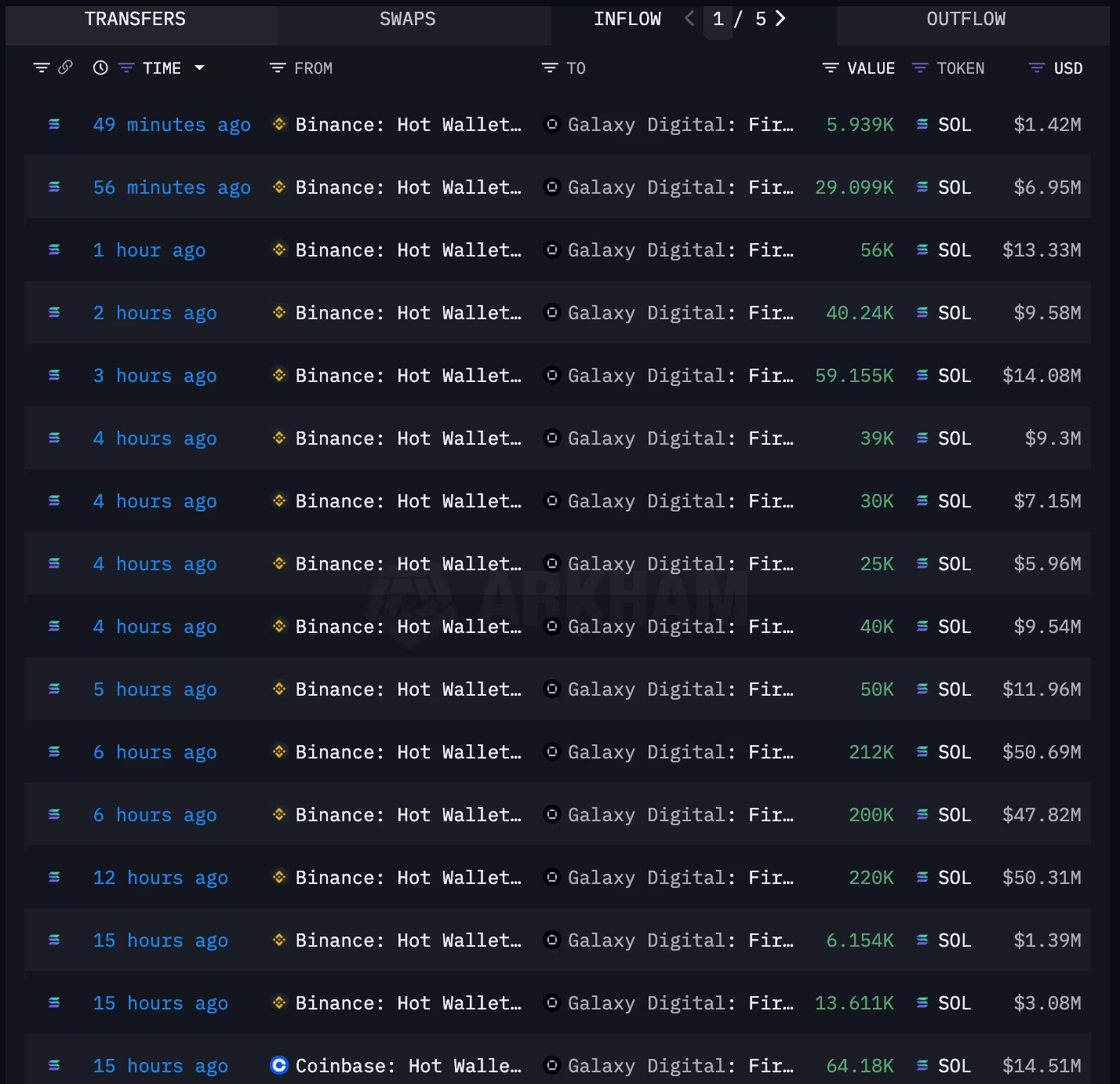

Blockchain analytics firm Arkham Intelligence reported that Galaxy Digital withdrew about 3.1 million SOL from major exchanges — primarily Binance and Coinbase — over two days, equal to roughly $724 million. The concentrated off-exchange transfers coincided with the price uptick and suggest growing institutional accumulation or treasury positioning.

Galaxy withdrawing SOL from exchanges (Arkham Intelligence)

Potential link to Forward Industries' treasury plan

Industry sources tie these withdrawals to Forward Industries (FORD), a newly formed digital-asset treasury vehicle that raised $1.65 billion to amass SOL for its corporate treasury. Galaxy was listed as a lead backer in Forward's fundraising round and its asset management arm has been described as overseeing the deployment of the firm's capital, which may explain Galaxy's large SOL movements.

Why this matters for SOL and markets

Market strategists say demand from treasury companies — plus growing speculation about spot Solana ETFs — could amplify price pressure on SOL. Because Solana's market capitalization is smaller than Bitcoin and Ether, targeted buying by large treasuries or ETF inflows would likely have a pronounced price impact.

Bitwise's CIO Matt Hougan noted that incoming demand from corporate treasuries and potential ETF approvals could disproportionately benefit SOL. Mike Novogratz, Galaxy Digital's CEO, echoed this sentiment in recent interviews, suggesting the industry may be entering a "season of SOL." He also highlighted other institutional moves into the Solana ecosystem, including Pantera's planned Solana treasury vehicle and tokenization efforts like Superstate.

Outlook and implications for crypto investors

For traders and long-term crypto investors, the combination of large off-exchange withdrawals, institutional treasury strategies, and ETF speculation creates a constructive technical and fundamental backdrop for SOL. However, market participants should weigh liquidity risks, regulatory developments around spot ETFs, and Solana-specific network factors before reallocating capital.

This episode underscores an accelerating trend: institutional-grade treasury allocation and tokenized securities are becoming an active force in crypto markets, and assets with smaller market caps can react sharply when large investors concentrate purchases.

Source: coindesk

Leave a Comment