8 Minutes

Shiba Inu gains momentum as Shibarium TVL climbs and exchange reserves fall

Shiba Inu (SHIB) continued its recovery on Saturday after a notable rise in the total value locked (TVL) across the Shibarium layer-2 network and a steady decline in SHIB token balances held on exchanges. The token climbed to roughly $0.000014 — its highest level in over a month and about 25% above the intra-month low — as on-chain indicators and protocol-level upgrades combined to boost investor confidence.

Key takeaways

- Shiba Inu price has moved higher amid a surge in Shibarium's TVL and declining SHIB exchange reserves.

- An upgrade to ShibaSwap and a subsequent security incident involving a flash-loan-based exploit attempt drove on-chain activity.

- Technical indicators suggest room for further upside, with a near-term resistance target at $0.00001770, roughly 20% above current levels.

Shibarium TVL jumps after ShibaSwap upgrade

Data from DeFi Llama showed that Shibarium's TVL rose sharply over the past 24 hours, gaining nearly 40% to reach approximately $2.28 million. That marks the highest TVL figure for Shibarium since June and signals growing capital flow into the network's DeFi ecosystem.

The surge followed a ShibaSwap upgrade that introduced a unified trading module prominently placed on the dApp's homepage. The patch aimed to streamline trading UX and to standardize liquidity formation across the Shibarium environment. Beyond UI improvements, the update expanded Shibarium’s interoperability: it enabled multi-chain integrations that make it easier to bridge assets to and from Ethereum, Polygon, and Arbitrum. Those cross-chain capabilities are an important step for any layer-2 that wants to attract broader liquidity and DeFi activity.

The upgrade’s timing coincided with renewed interest from traders and liquidity providers. A combination of improved throughput, clearer liquidity formation rules and multi-chain support appears to have contributed to both higher TVL and renewed token movement across wallets.

ShibaSwap update and the role of unified modules

By consolidating trading functionality into a unified module on the ShibaSwap homepage, developers reduced friction for newcomers and active traders alike. Standardized liquidity creation also helps automated strategies and market makers onboard more reliably, reducing slippage and creating deeper pools. From an SEO and adoption perspective, better UX and clearer liquidity standards can drive both search interest and sustained inbound capital.

Security scare: attempted bridge exploit on ShibaSwap

The TVL uptick happened as ShibaSwap — Shibarium’s largest decentralized application — faced an attempted exploit. According to developer updates, an attacker used a flash loan to buy 4.6 million BONE tokens after obtaining access to validator keys. The attacker then leveraged majority validator power to sign a malicious state intended to drain bridge assets.

Shibizen, one of the teams addressing the incident, clarified that only a small amount of ETH and SHIB were moved. Importantly, the 4.6 million BONE stayed locked and was subsequently frozen, which limited the attacker’s ability to cash out. That containment likely prevented a more serious capital flight and contributes to the explanation for why BONE’s price spiked over 40% during the same period.

While any incident involving validator keys and cross-chain bridges raises alarm bells, quick mitigation and freezing of suspicious balances demonstrate the importance of active developer governance and rapid incident response on layer-2 networks.

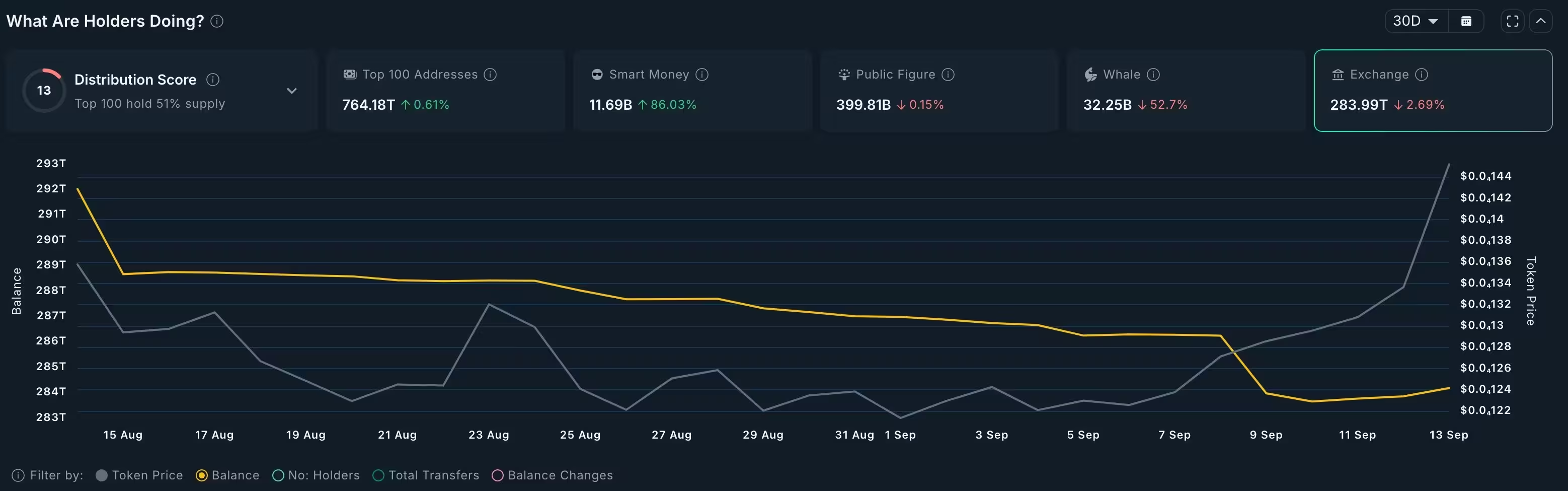

Exchange reserves fall as investors hold SHIB

On-chain analytics show that SHIB reserves on centralized exchanges have declined, suggesting holders are moving tokens off exchanges and are less likely to sell in the immediate term. Current totals indicate about 283 trillion SHIB are held on exchanges, down from roughly 292 trillion in August.

SHIB balances on exchanges | Source: Nansen

Reducing centralized exchange reserves is often interpreted as a bullish signal: it can mean long-term holders are accumulating or staking, and short-term selling pressure diminishes. However, this metric should be weighed alongside order book depth, derivatives positioning, and macro crypto sentiment.

Technical analysis: momentum flipping bullish

On the daily chart, SHIB has recovered from a low near $0.00001170 late last week to trade around $0.000014–$0.000015. Price action shows the token remains above an ascending trendline that captures the series of higher lows dating back to April. SHIB has also crossed above the 50-day moving average (50-DMA), a sign that mid-term momentum may be shifting from bearish to bullish.

SHIB price chart | Source: crypto.news

The Percentage Price Oscillator (PPO), a momentum-based indicator similar to the MACD, shows its two signal lines have moved above the zero line — another technical confirmation of positive price momentum. Taken together, these signals argue that bulls retain control in the short term.

Near-term targets and risk levels

With current momentum, bulls are eyeing the $0.00001770 zone as the next significant resistance. Hitting that level would represent roughly a 20% gain from the current price and could be driven by continued TVL growth, more on-chain activity, or broader market strength.

On the downside, an invalidation of the bullish thesis would involve a decisive break below the ascending trendline and the 50-DMA, potentially exposing SHIB to a decline toward the $0.00001170 region.

What this means for investors and traders

For longs and DeFi participants, the Shibarium upgrade and ongoing multi-chain push are constructive for adoption. Increased TVL and improved UX can attract liquidity providers, traders and new dApp developers — all positive for network effects and token utility.

However, the ShibaSwap incident underscores persistent security risks, especially for projects relying on bridging and validator-based consensus models. Flash loan strategies and validator key compromises remain common attack vectors in DeFi; investors should monitor official developer communications, on-chain audits and bridge status updates before deploying large sums.

Portfolio managers should also keep an eye on the following indicators:

- Exchange reserves and big-wallet transfers: declining exchange balances generally reduce sell pressure but can also indicate centralized accumulation.

- TVL and liquidity pool depth: rising TVL improves DeFi utility but must be paired with sustainable liquidity to reduce slippage.

- Bridge activity and paused contracts: active or paused bridges can materially affect token flow and risk.

- Technical levels: a confirmed breakout above $0.00001770 would invite momentum traders, while a break below the key trendline could accelerate downside moves.

Suggested risk-management measures

- Use position sizing to limit exposure to volatility: SHIB has both large upside potential and notable downside risk.

- Consider layered entries and exits: averaging into positions can reduce timing risk during volatile environments.

- Monitor smart contract audits and developer transparency: projects with audited contracts and clear incident reports present lower operational risk.

- Keep an eye on broader crypto market trends: Bitcoin and Ethereum price action often influences altcoin flows and liquidity.

Outlook: cautious optimism for SHIB and Shibarium

Short-term momentum is supportive for SHIB, driven by Shibarium’s rising TVL, reduced exchange reserves, and the positive technical picture. The multi-chain integrations and ShibaSwap’s upgraded trading module should help on-chain adoption if they perform as intended.

Still, investors and developers must remain vigilant. The attempted exploit demonstrates that even with strong community backing and rapid responses, layer-2s and DeFi dApps face persistent security challenges. Sustained price appreciation will likely require continued developer transparency, successful audits, and tangible growth in real economic activity on Shibarium.

For traders, the immediate setup suggests a potential path to a 20% move if bulls can overcome resistance near $0.00001770. For long-term holders, the network-level improvements — especially multi-chain bridges and standardized liquidity mechanisms — are the more consequential developments that could underpin future SHIB use cases and demand.

As always, balance the potential upside with protocol-level risks and broader market dynamics before making investment decisions. Keep watching on-chain metrics, official updates from the Shiba Inu and Shibarium teams, and liquidity conditions across centralized and decentralized venues.

Source: crypto

Leave a Comment