3 Minutes

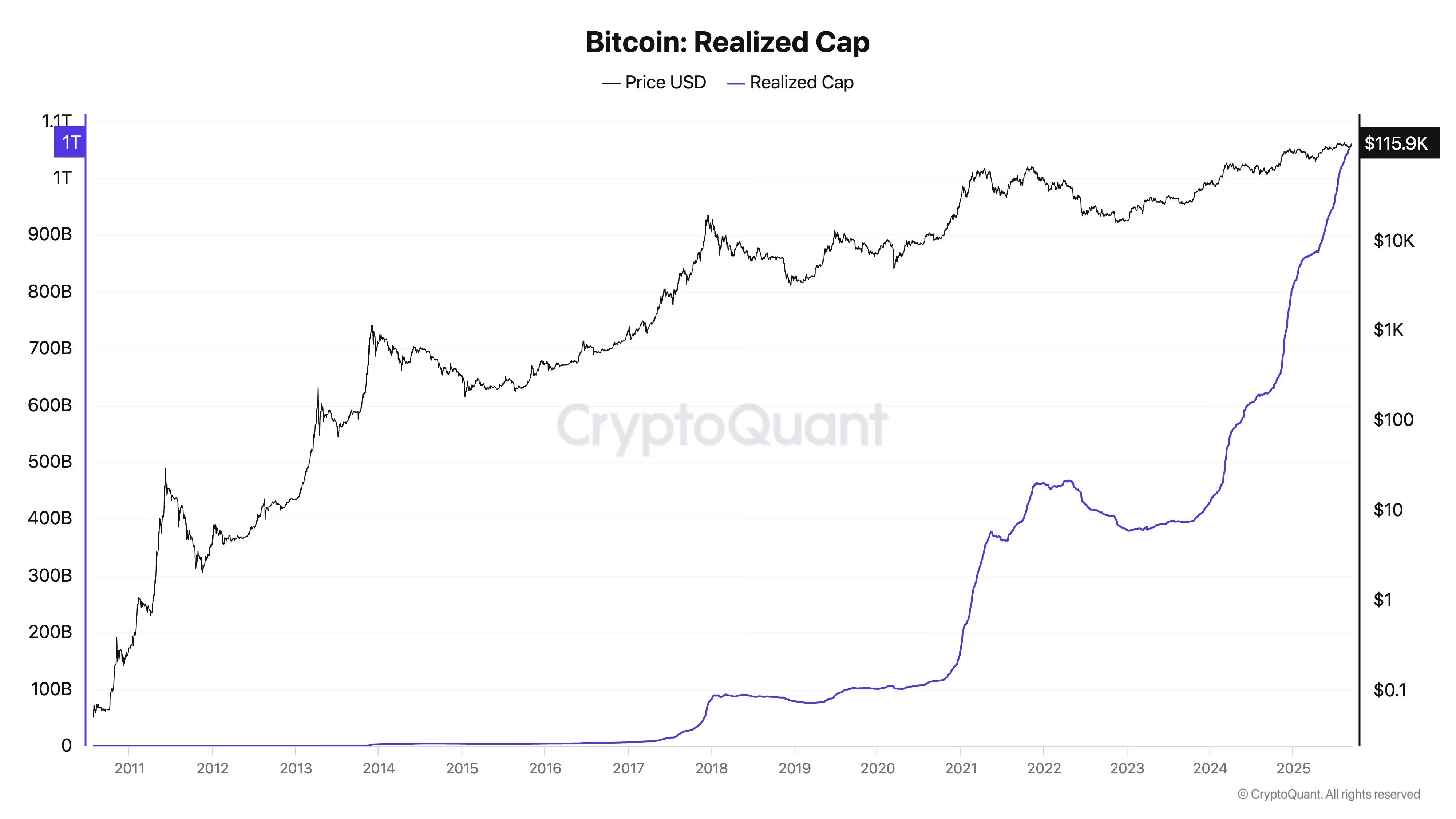

Bitcoin’s on-chain capital inflows between 2024 and 2025 have surged to unprecedented levels, eclipsing the accumulated inflows from 2009 through 2024 by roughly $200 billion. CryptoQuant CEO Ki Young Ju’s on-chain analysis shows realized capital tied to BTC has climbed to about $625 billion in the past 18 months, outpacing the $435 billion recorded across the previous 15 years.

Key data and chart

Chart depicting the realized on-chain capital from Bitcoin in the past few years

What the numbers mean

Realized on-chain capital tracks the value of Bitcoin when each unit last moved on-chain, offering a clearer picture of how much capital has been committed to the network over time. The recent spike signals a powerful rotation of fresh funds into BTC, reflecting both new buyers and reactivation of older coins.

Main drivers of the inflows

Institutional adoption and spot Bitcoin ETFs

A primary catalyst for the flow is institutional demand. Spot Bitcoin ETFs, corporate treasury allocations, and sovereign or institutional investors have increased exposure to BTC, bringing substantial capital on-chain. According to Bitcoin Treasuries, corporate and institutional treasuries now hold about 3.71 million BTC across 325 entities, with 190 of those being publicly listed firms. MicroStrategy (Michael Saylor’s Strategy) remains the largest corporate holder, with 638,460 BTC.

Macro tailwinds and market structure

Softer inflation readings and expectations of Federal Reserve rate cuts have amplified the capital rotation toward risk assets, including Bitcoin. Long-term holders appear to be accumulating while illiquid supply tightens, suggesting many investors are positioning for a prolonged bull cycle rather than short-term speculation.

Price action and technical context

Price chart for Bitcoin, showing the price movement from 2024 to 2025

Bitcoin’s rising price has also fed investor interest. Over the past year, BTC has climbed roughly 93.3%, helping drive FOMO among traders and fueling additional inflows. Technically, monthly RSI readings are hovering near historically high, ‘overbought’ levels around 70, which points to strong bullish momentum but increases the likelihood of short-term consolidation or pullbacks as participants take profits. Given the scale and quality of fresh inflows, analysts view potential retracements as healthy corrections inside a larger uptrend.

Outlook

With institutional adoption, ETF liquidity, and favorable macro dynamics combining, on-chain capital inflows into Bitcoin are now at a scale not seen in the asset’s history. Investors should monitor realized capital metrics, exchange flows, and macro policy shifts as key indicators for how sustainable the current cycle may be.

Source: crypto

Leave a Comment