3 Minutes

Fidelity projects growing illiquid Bitcoin supply

Investment firm Fidelity Digital Assets forecasts that roughly 8.3 million BTC — about 42% of the current Bitcoin supply — could be held in illiquid wallets by 2032. The projection, published in a September 16 research note, highlights how long-term holders and publicly listed companies are locking up a growing share of circulating Bitcoin, potentially tightening available supply for traders and investors.

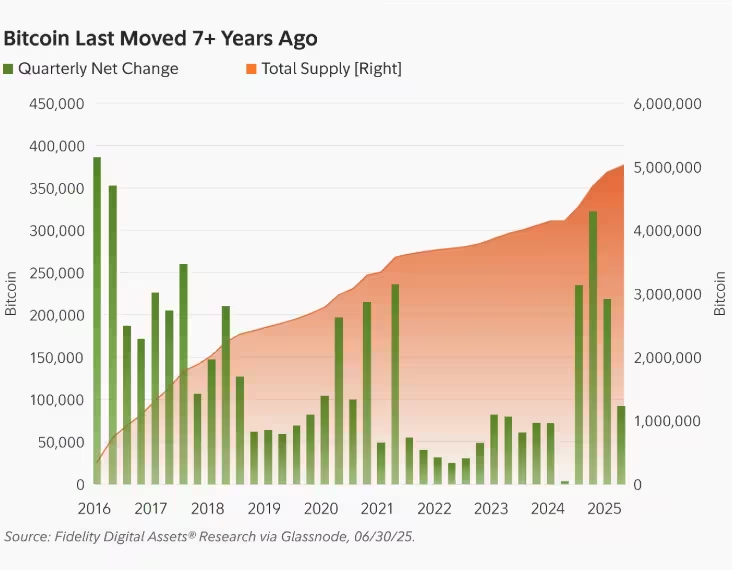

According to Fidelity’s analysis, the trend toward longer holding periods is already visible in on-chain data. Bitcoin balances that haven’t been moved for seven years or more have risen steadily, with the report noting that this cohort now exceeds 350,000 BTC. If accumulation patterns observed in the past decade continue, the proportion of BTC effectively out of active circulation could reach the mid-40s by the end of the next decade.

Quarterly net change and total supply of Bitcoin balances that did not decrease in seven years

Public companies and long-term holders driving scarcity

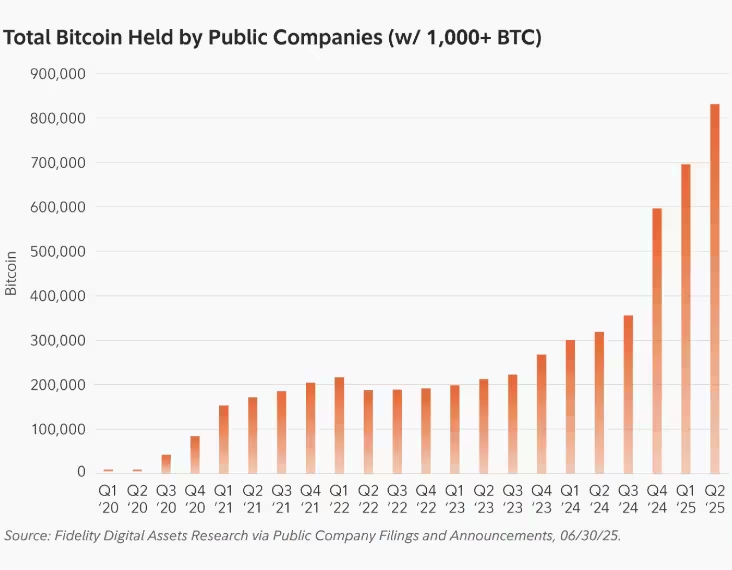

Publicly traded companies represent a major piece of the illiquid supply story. Fidelity reports that corporate holdings accelerated after Q4 2024 and currently top 830,000 BTC, with the majority concentrated among the largest 30 corporate holders. These institutional allocations, combined with an expanding base of long-term retail and whale holders, have applied upward price pressure by reducing the proportion of BTC available to buy or sell on exchanges.

Total number of BTC held by public companies

Market impact and caveats

If Fidelity’s baseline accumulation rate persists, limited liquid supply could translate into stronger supply/demand dynamics and higher sensitivity of Bitcoin price to buy-side flows. Scarcity narratives often amplify volatility; when a substantial share of supply becomes illiquid, relatively small changes in active demand can move prices more sharply.

Fidelity’s report, however, also stresses uncertainty. On-chain behavior can shift: in July 2025, holders moved roughly 80,000 BTC that had been dormant for more than ten years, demonstrating that even long-established patterns can reverse. Changes in corporate strategy, macro conditions, taxation, or regulatory developments could prompt some illiquid holders to rebalance.

What crypto market participants should watch

Traders, institutional investors and analysts should monitor on-chain metrics (age of coins, exchange balances, and accumulation by public firms) as indicators of liquidity trends. While an increasing illiquid supply supports narratives of long-term scarcity for Bitcoin, the timing and magnitude of any price effects remain contingent on demand, macro factors and policy developments across global markets.

Source: crypto

Leave a Comment