5 Minutes

Bitcoin posts 8% September gain, second-best in 13 years

Bitcoin (BTC) has risen roughly 8% so far this September, positioning the leading cryptocurrency for its strongest month since 2012 and its second-best September on record. According to historical price data from CoinGlass and BiTBO, the current monthly advance makes September 2025 a standout period in the ongoing bull market.

BTC was quoted at $116,359 as earlier reporting noted, with the broader market environment — including gold and the S&P 500 trading near or at new highs — supporting risk-on flows that have helped Bitcoin avoid the seasonal weakness historically associated with September, often dubbed "Rektember."

Key data points

- Bitcoin has gained 8% this September, its largest September move since 2012; that year saw roughly 19.8% gains.

- For September 2025 to become the single best September in Bitcoin history, BTC would need an additional ~20% upside before month-end.

- On-chain and market analytics show volatility has contracted sharply during this bull run, unusual compared with prior cycles.

Image references from source

BTC/USD monthly returns

Seasonality: Rektember avoided so far

September is historically Bitcoin's weakest month, often producing average losses near 8%. The current 8% gain therefore represents a notable deviation from that trend and highlights how the 2025 rally differs from past cycles. After setting new highs the month prior, BTC/USD has consolidated through September rather than suffering a significant pullback.

Why this September stands out

Several factors help explain the divergence from historical seasonality. First, traditional risk assets such as equities and precious metals are in price discovery, creating positive correlations that can buoy Bitcoin. Second, market participants are noting a lower incidence of the deep drawdowns that characterized earlier bull markets. Finally, lower implied volatility readings have changed trader expectations about short-term price swings.

Volatility has tapered in an unusual bull cycle

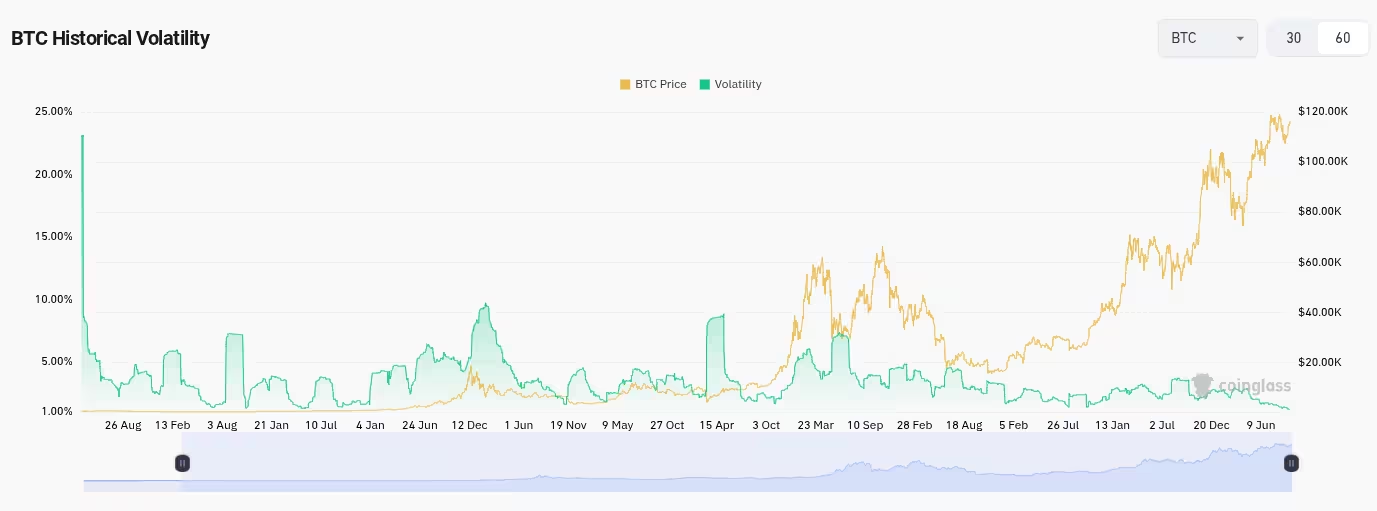

Data from CoinGlass indicates a pronounced drop in Bitcoin's historical volatility in 2025, with readings falling to levels not seen in over a decade and dipping significantly since April. This lower volatility environment is drawing attention because previous Bitcoin bull markets typically featured sharp, recurring sell-offs and volatile upswings.

Bitcoin historical volatility

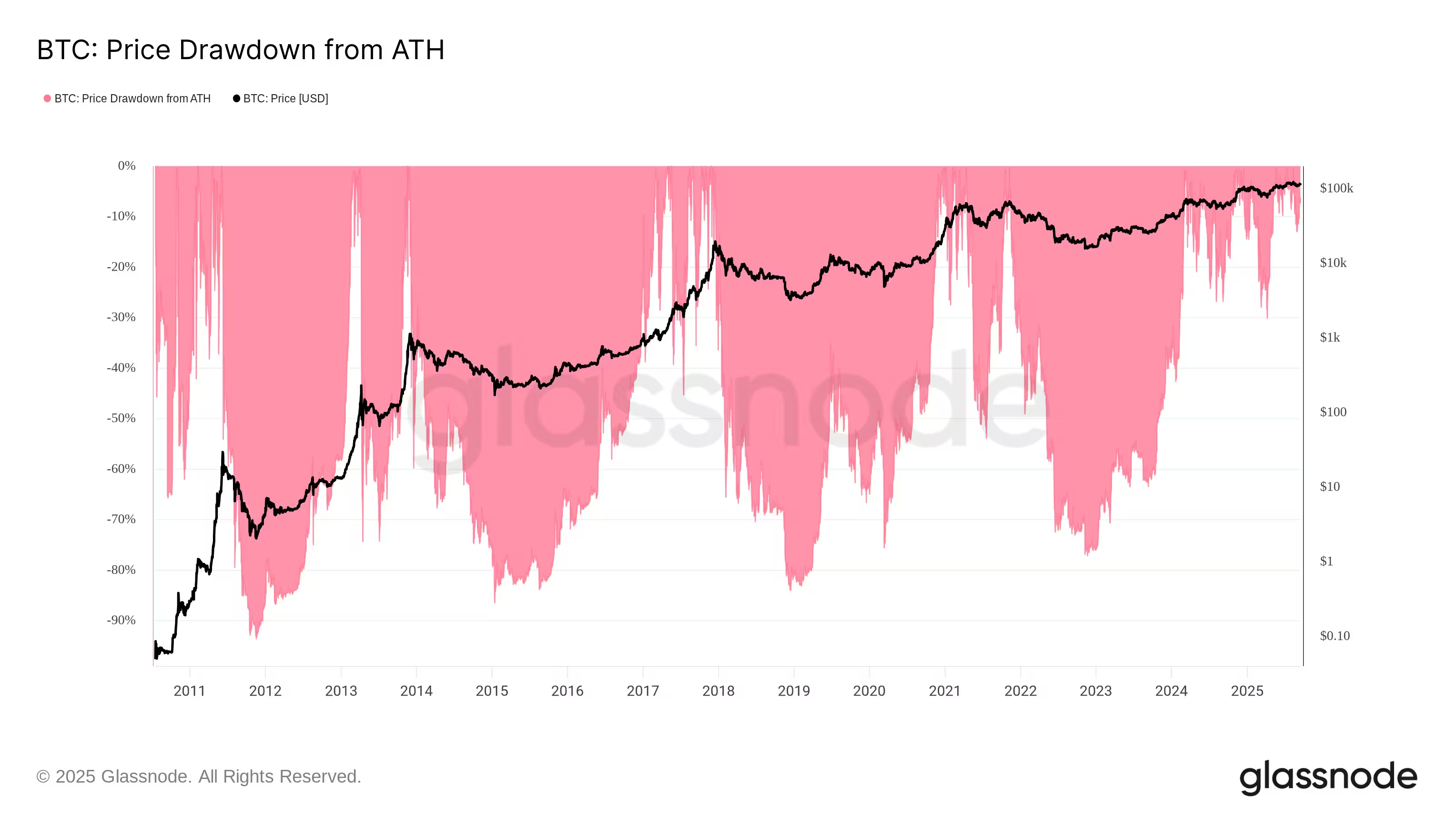

On-chain analytics firm Glassnode echoes this assessment, showing that drawdowns from all-time highs have been materially less severe this cycle. Whereas past bull markets produced drawdowns up to 80%, the largest retracement so far in 2025 has been roughly 30%.

BTC price drawdowns from all-time highs

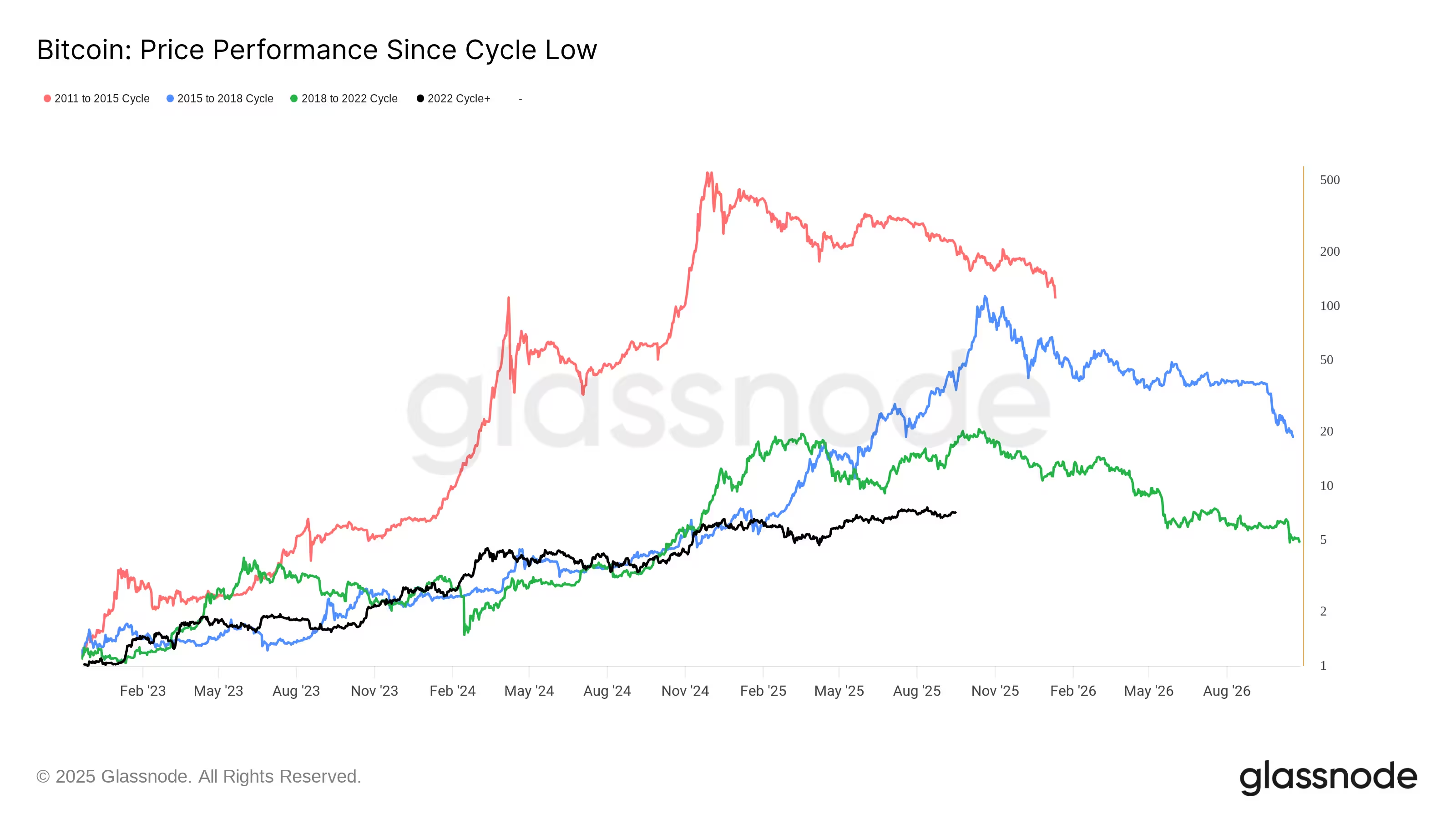

Bitcoin price performance since cycle low

Implications of lower volatility

Reduced volatility changes trade dynamics and risk management. Lower realized and implied volatility can discourage short-term speculative trading but may encourage longer-term allocations from institutions and allocators seeking exposure with a smoother risk profile. Conversely, subdued volatility can also precede larger moves; some analysts cited unusually low readings on Bitcoin's Implied Volatility Index as a catalyst for expectations of sizable upside — with some models pointing to potential 50% gains under certain scenarios.

What traders and investors should watch

Key indicators to monitor in the near term include implied volatility metrics, on-chain activity, exchange flows, and correlations with equities and gold. Sustained price discovery in other asset classes could keep supporting BTC, while renewed volatility would test positioning and stop levels across the market.

Outlook and risk considerations

While the current September performance is notable, it remains a single-month snapshot within a larger macro and on-chain context. Market participants should weigh the relative calm in volatility against the possibility of sudden regime shifts, especially as macroeconomic news, regulatory developments, and liquidity events can rapidly alter price dynamics. For long-term holders and institutional allocators, the current environment may present an opportunity to reassess exposure as part of a diversified crypto allocation strategy.

Overall, Bitcoin’s 8% September advance highlights the evolving character of the 2025 bull market: strong price gains so far, compressed volatility, and a new pattern of risk-on interest that differs from prior cycles. Traders and investors will be watching whether this reduced volatility persists and whether BTC can continue to outperform seasonal expectations.

Source: cointelegraph

Leave a Comment