4 Minutes

Bitcoin's current correction mirrors past post-ATH consolidation

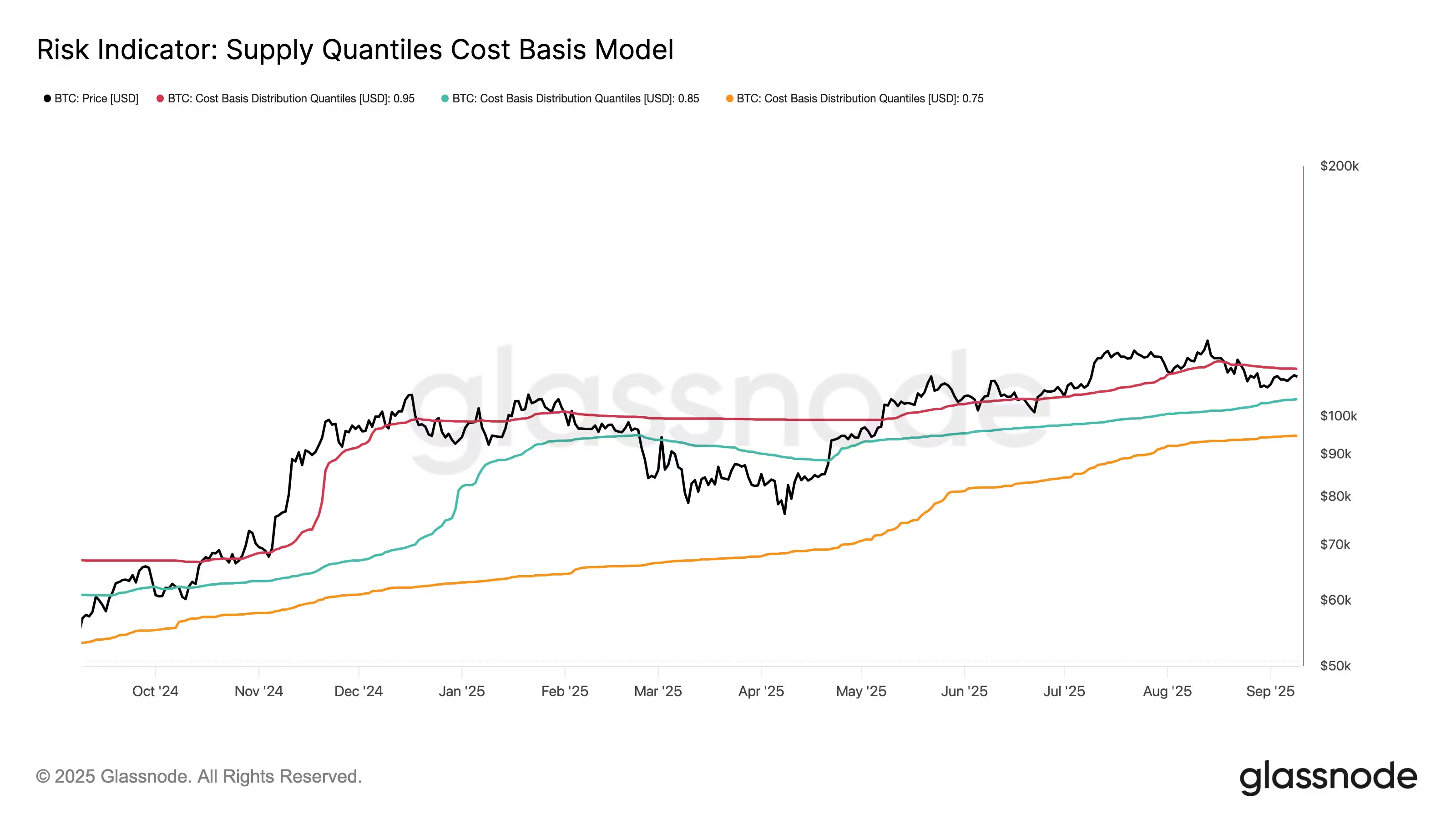

New on-chain analysis from Glassnode suggests Bitcoin is navigating a familiar consolidation corridor after its mid-August all-time high. Rather than signaling an immediate bear market, the analytics firm frames the recent volatility as a textbook post-euphoria contraction that often follows parabolic rallies.

Where BTC stands now

Bitcoin (BTC) has traded in a tight range roughly 10–15% below its August peak, sliding to about $108,000 before rebounding toward $112,000. That price action sits between the 0.85 and 0.95 supply quantiles — a region Glassnode identifies as historically prone to choppy sideways movement rather than swift trend reversals.

According to the report, the critical boundaries of this consolidation corridor sit at approximately $104,100 on the downside and $114,300 on the upside. Falling below $104,100 would mirror previous post-ATH exhaustion phases, while clearing $114,300 would indicate that demand is reasserting control and the uptrend could resume.

Bitcoin supply quantile

Profit quantiles and what they reveal about market psychology

Glassnode's approach breaks down the active BTC supply into profit quantiles — price bands showing where different shares of coins last moved. The 0.95 quantile is especially important because it represents the price at which 95% of supply would be in profit. When price sits near this band, small moves can flip the majority of holders from profitable to underwater and vice versa.

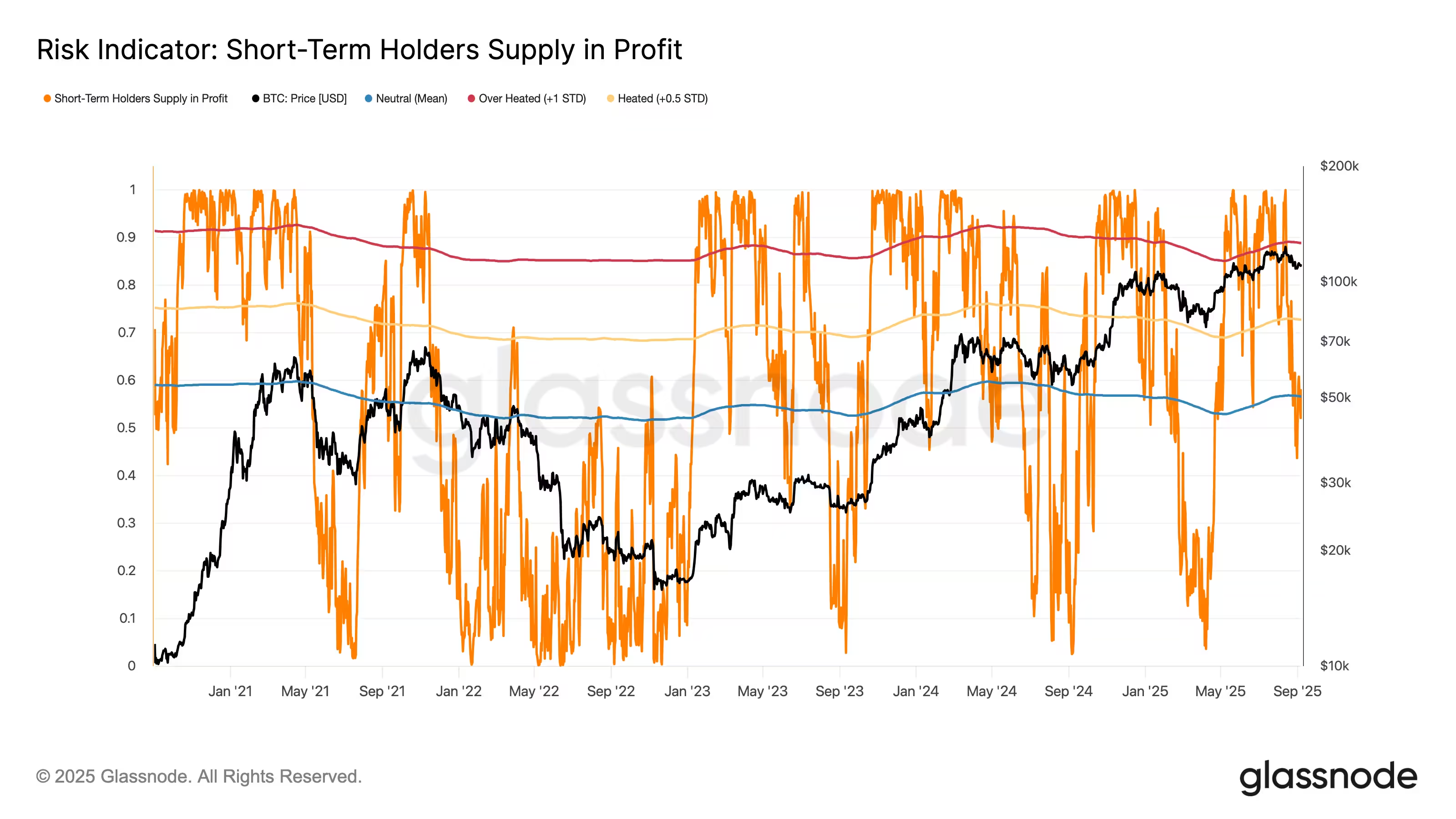

Short-term holders: the swing factor

Short-term holders (STHs), defined by Glassnode as entities holding BTC for up to six months, have historically provided support during corrections. In this cycle, their profitability swung dramatically: when BTC dipped to $108,000 their profitable share plunged from above 90% to around 42%.

This rapid shift matters because STHs can become sellers if losses deepen, accelerating a decline. Conversely, if selling exhausts STHs — meaning they stop selling at a loss — the market can stabilize and bounce, which helps explain the recent recovery from $108K back toward $112K.

Bitcoin STH supply in profit

What to watch next: key price levels and scenarios

For traders and investors focused on Bitcoin price mechanics and market structure, two levels are pivotal. A drop beneath ~ $104,100 would likely replicate earlier post-euphoria exhaustion phases and could extend consolidation or deepen a correction. A decisive move above ~ $114,300 would suggest demand is reasserting itself and the bull trend could regain momentum.

Glassnode also highlights that the run to August highs represented the third euphoric leg of this bull market. Such euphoric spikes tend to be unsustainable over long periods, which makes measured consolidation a healthy and expected dynamic for BTC.

Implications for investors

Market participants should monitor supply quantiles, STH profitability, and trading volume around the $104K and $114K thresholds. These on-chain indicators provide actionable insight into whether the market is entering a deeper correction, experiencing seller exhaustion, or simply undergoing a temporary consolidation before the next leg up.

In short, Bitcoin's current behavior fits historical patterns: it is correcting after a euphoric peak, and the next meaningful directional confirmation may depend on whether BTC revisits the $104K floor or reclaims territory above the $114K ceiling.

Source: cointelegraph

Leave a Comment