3 Minutes

Bitcoin rallies above $117,000 as traders await Fed guidance

Price action and market context

Bitcoin BTC $116,327 rose to a four-week high above $117,000 on Wednesday, as market participants prepared for potential volatility around the US Federal Reserve's policy decision. With expectations firming for interest-rate cuts, traders pushed BTC toward critical resistance levels that could determine whether the uptrend continues to all-time highs.

Fed rate-cut odds and market signals

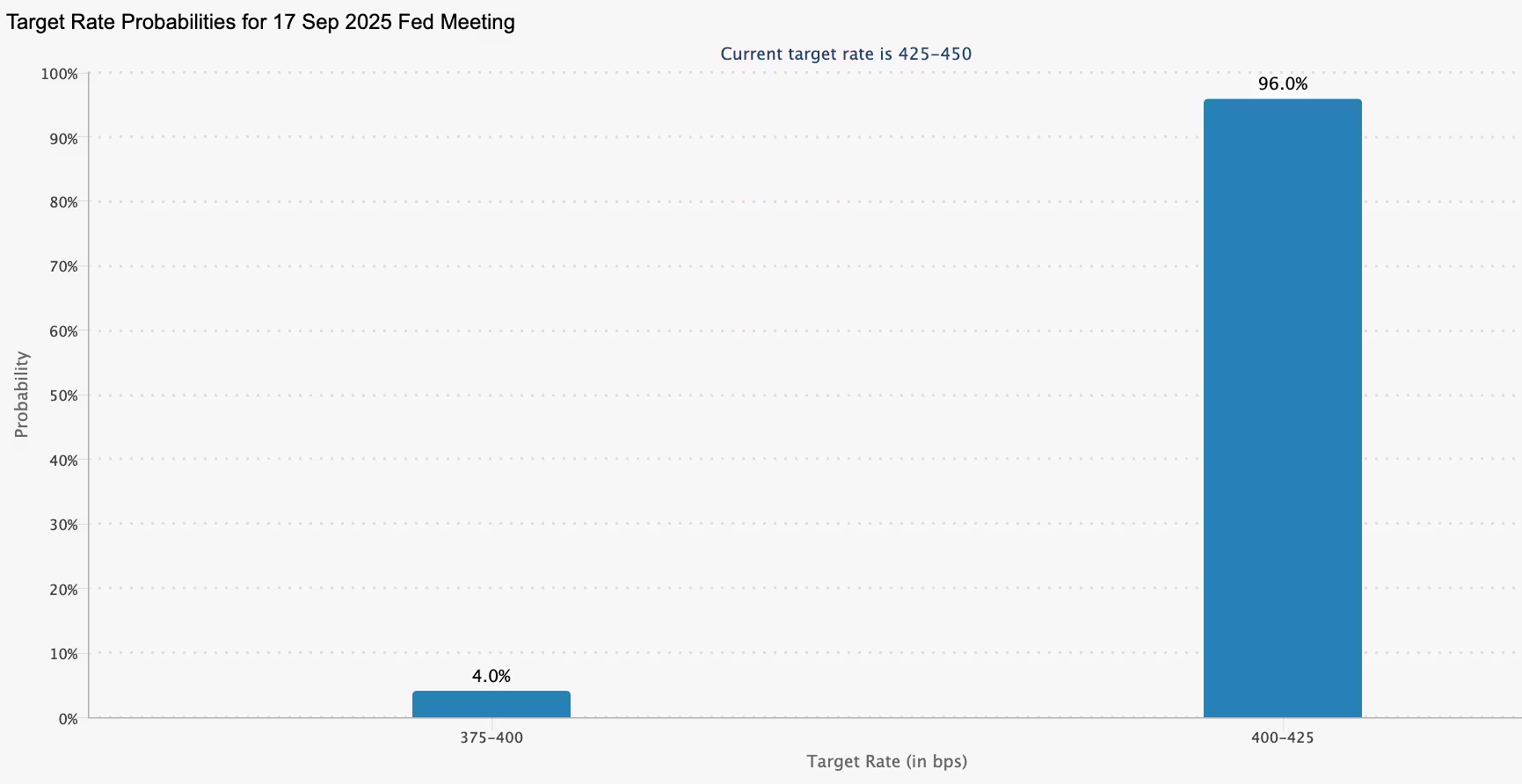

There is strong market pricing for a near-term easing cycle. CME Group's FedWatch tool implied a 96% probability of a 25-basis-point cut at the FOMC meeting, with a smaller probability of a 50 bps reduction. Polymarket markets showed a similar consensus, locking in a 25 bps move at roughly 93% and assigning only modest odds to a larger 50 bps cut.

Fed target rate probabilities for Wednesday FOMC meeting

Odds from both CME FedWatch and Polymarket indicate a path that could include multiple cuts by year's end, a scenario traders are already positioning for across risk assets including Bitcoin and altcoins.

Focus on Powell — language will matter

Traders have shifted their attention to Fed Chair Jerome Powell’s post-FOMC remarks. Markets will parse Powell’s tone for guidance on the pace and sequencing of cuts, and whether any dovish bias is confirmed. Some strategists caution that much of the expected volatility may already be priced in, while others expect sharp intraday moves as the news is digested.

Analyst views and technical levels to watch

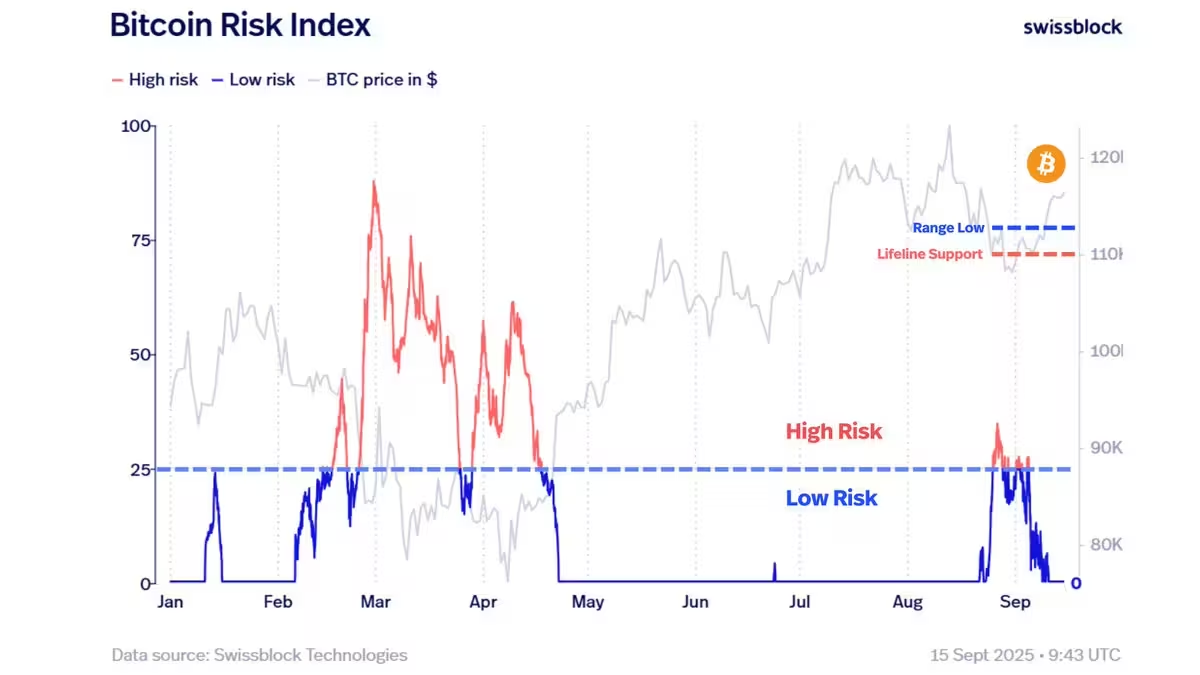

“Markets are locked on the FOMC Wednesday, with a 25 bps cut priced in,” said private wealth manager Swissblock in a post on X, noting traders will be watching “Powell’s stance under the spotlight for hints.”

Bitcoin’s Risk Index will guide whether BTC’s bullish structure holds or if a sell-off looms on the horizon.

Bitcoin risk index

Crypto analysts are focused on the key resistance band around $118,000. AlphaBTC suggested BTC could push to $118,000 before a typical retracement following an FOMC confirmation. Data from Cointelegraph Markets Pro and TradingView showed BTC “attacking” resistance near $117,500–$118,500 — an observation echoed by MN Capital founder Michael van de Poppe.

BTC/USD four-hour chart

Van de Poppe outlined a bullish scenario where a clean breakout above $118,000 would open the path toward $120,000 and potentially retest the all-time high near $124,500. Conversely, downside interest remains between $116,800 and $114,500 — a range that held price action earlier in the month. A decisive move below that zone could target the $112,000 psychological level, which also aligns with the 100-day simple moving average.

What traders should monitor

Key drivers for Bitcoin in the near term include FOMC rate-cut confirmation, Powell’s press conference tone, order flow around the $118,000 resistance, and liquidity at support bands near $116,800–$114,500. Risk management and attention to on-chain and derivatives indicators will remain important for traders navigating potential volatility in BTC price, crypto markets, and correlated macro assets.

Source: cointelegraph

Leave a Comment