4 Minutes

Bitcoin outlook: onchain signals point to renewed upside

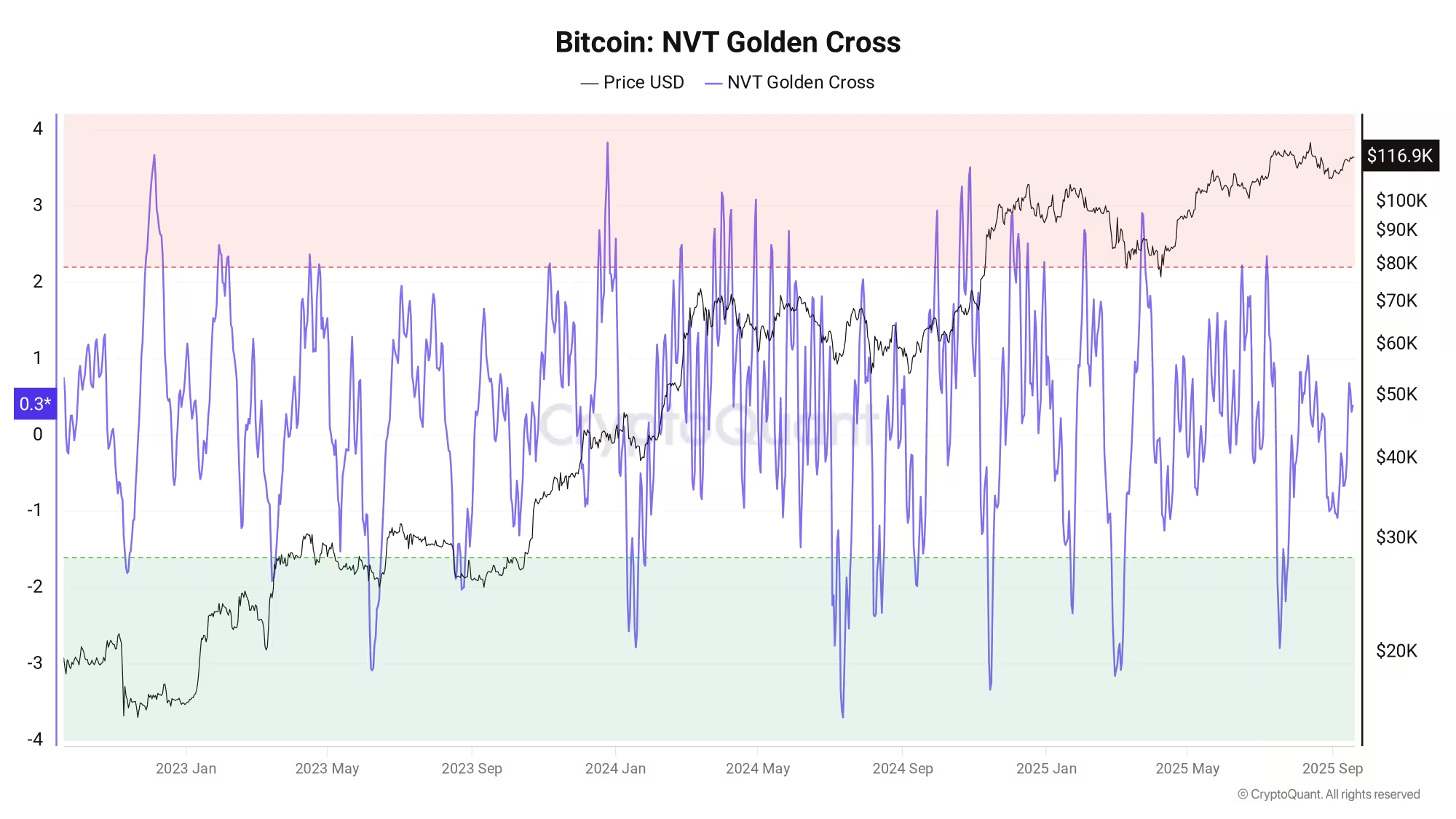

Bitcoin (BTC) remains in a steady uptrend, and fresh onchain research from CryptoQuant suggests there is room for price "expansion" toward $117,000 and potentially higher in the months ahead. With BTC trading around $115,884, several leading indicators—including the network value to transactions (NVT) golden cross—are signaling that market conditions are not yet overheated and could support another leg up.

What the NVT golden cross indicates

The NVT golden cross (NVT-GC) compares market capitalization to the value of onchain transactions and is widely used as a leading indicator for Bitcoin tops and bottoms. Historically, NVT-GC readings dipping into strongly negative territory have preceded substantial BTC rallies, while readings above certain positive thresholds have correlated with corrections.

Bitcoin NVT-GC

CryptoQuant’s latest Quicktake highlights that the current NVT-GC sits in a neutral zone. Readings below about -1.6 typically signal bullish conditions and precede upward momentum, while a sustained move above roughly 2.2 has historically been associated with a higher chance of a bearish reversal. The most recent long signal arrived in July when NVT-GC reached roughly -2.8 before moving back toward neutral levels.

Why this matters for traders and investors

A neutral or modest NVT-GC—combined with other metrics—suggests Bitcoin is not yet in bubble territory. CryptoQuant contributor Pelin Ay summarized the data as implying a healthy uptrend rather than extreme overvaluation or undervaluation, leaving room for further price discovery. For market participants, that means the risk of an immediate, sharp reversal may be lower than during previous blow-off tops.

Supporting indicators: MACD, STH metrics and realized price

Beyond NVT, additional onchain and technical indicators reinforce the view that the bull market may still have legs. July produced a buy signal from the moving average convergence/divergence (MACD), a commonly used momentum indicator. Short-term holder (STH) MVRV Z-scores for both 155-day and 365-day windows are hovering near zero, signaling a balance between profit-taking and accumulation.

CryptoQuant contributor Axel Adler Jr. noted that BTC recently traded just above the STH Realized Price—the average cost basis for wallets holding coins up to six months—implying a period of consolidation could precede another push toward new all-time highs (ATH). Adler suggested that price discovery could resume in the coming weeks.

Price targets and timeline

CryptoQuant’s analysis outlines a conservative near-term expansion level around $117,000 and a broader Q4 range that could see BTC testing $120,000–$150,000 if historical patterns repeat. While forecasts are not guarantees, the combination of neutral NVT-GC, balanced STH metrics, and momentum confirmation from MACD supports a scenario where new ATHs could arrive within weeks to a few months.

Risk factors and balanced view

Despite constructive signals, analysts emphasize caution. NVT and other indicators can flip quickly, and macroeconomic or regulatory developments may alter market trajectories. CryptoQuant’s takeaway is that Bitcoin is presently in a lower-risk zone compared with prior peaks, but investors should monitor NVT-GC thresholds, realized price levels, and macro catalysts for signs of changing market structure.

In summary, CryptoQuant’s onchain research points to continued upside potential for BTC, with technical and onchain indicators leaving room for price discovery toward $120K–$150K over the coming months provided current conditions persist.

Source: cointelegraph

Leave a Comment