4 Minutes

PC gaming hardware heads for a record year

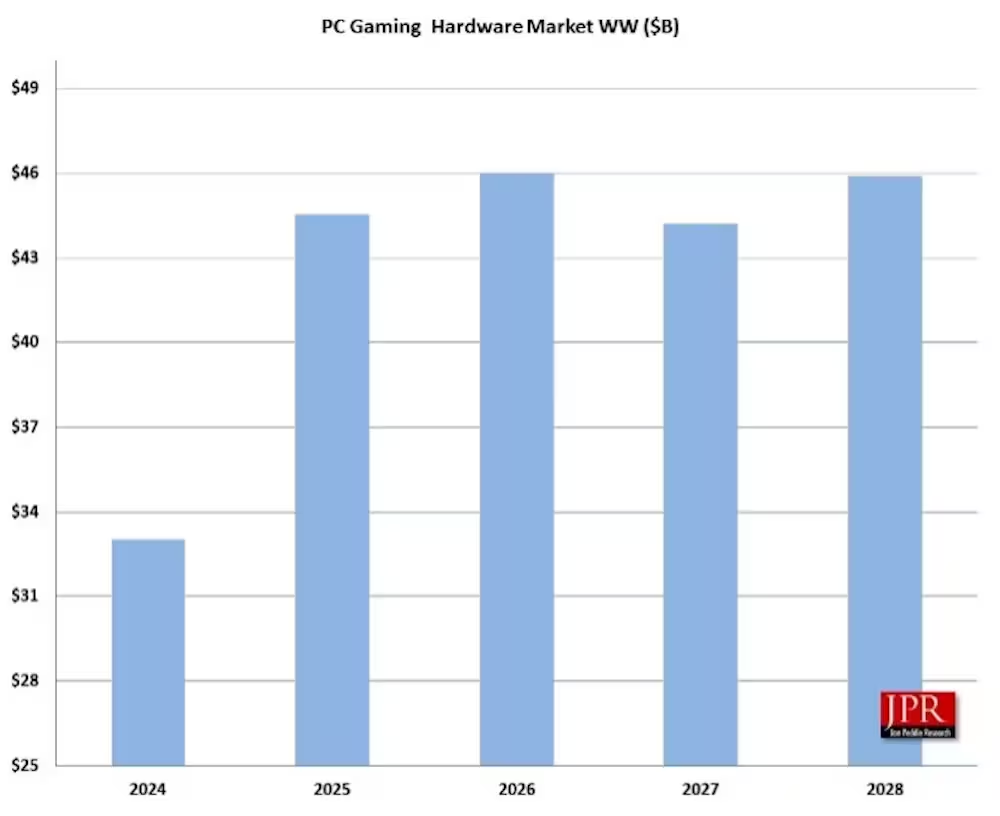

A new market analysis from Jon Peddie Research (JPR) predicts a dramatic bounce for PC gaming hardware in 2025: a projected 35% year-over-year increase that would lift worldwide sales to roughly $44.5 billion. The firm expects the sector to remain above the $40 billion mark through 2028, signaling renewed momentum for desktops, gaming laptops, graphics cards and peripherals.

What's driving the surge?

Several converging factors are nudging gamers and system builders to upgrade. JPR and market observers point to three main drivers:

- Windows 11's updated system requirements, which are prompting many players to replace entire systems rather than swap a single component.

- The arrival of increasingly demanding AAA titles and modern engines (notably Unreal Engine 5) that benefit from newer GPUs and CPU architectures.

- Platform-level innovations such as GPU upscaling, AI-driven frame generation and CPU technologies (for example, AMD's 3D V-Cache) that create a clear performance gap between older and current hardware.

These forces are nudging large swaths of the install base toward mid-range and high-end parts, and they’re reshaping buying behavior: consumers are buying new prebuilt systems in greater numbers, while the DIY community is planning fresh builds rather than continually modifying aging Windows 10 rigs.

"Windows 11 has introduced a level of hardware-driven migration we haven't seen before," says Ted Pollak, JPR’s senior analyst for game technology. He notes the upgrade path often involves more than a graphics card: for many users a CPU replacement leads to motherboard and memory upgrades as well, increasing the average spend per upgrade.

Who gains and who shrinks?

JPR’s report highlights a mixed picture beneath the headline growth. While overall hardware revenue climbs, the entry-level PC segment is forecast to shrink by approximately 13% over the next five years. Analysts estimate that around 10 million entry-level PC gamers could migrate to consoles, handhelds or mobile platforms driven by cost sensitivity and the improved value of competing platforms.

Yet that migration doesn't necessarily mean fewer PC gamers: a significant portion of entry-level users are expected to remain on PC but move into mid-range or higher tiers. Historically, many lower-tier customers upgrade their rigs within two to four years, which can boost average selling prices and vendor margins.

Market implications and use cases

For component makers and OEMs, the current cycle offers several commercial advantages:

- Higher ASPs (average selling prices) as buyers choose 8-core+ CPUs and VRAM-heavy GPUs.

- Stronger demand for prebuilt gaming desktops and laptops, benefiting system integrators.

- Peripheral and accessory upsales — monitors, keyboards, headsets and cooling solutions — tied to higher-tier builds.

For gamers, the benefits are practical: more stable frame rates in demanding or unoptimized titles, better support for ray tracing and upscaling, and smoother experiences on high-refresh displays.

Outlook

The JPR forecast paints the PC gaming ecosystem as resilient and adaptive. Short-term growth is concentrated in hardware revenue and platform refreshes driven by software and OS changes; medium-term dynamics suggest a rebalancing of the install base with fewer budget rigs but a healthier share of mid-to-high-end systems. That shift favors producers who can capitalize on higher margins and deliver upgrade paths that align with modern game requirements.

Ultimately, the next few years look promising for the PC gaming hardware market: a blend of forced upgrades, genuine performance-driven demand and ongoing innovation that should keep the sector active and commercially attractive through the second half of the decade.

Source: wccftech

Leave a Comment