4 Minutes

NFT market posts second consecutive week of growth

The NFT market continued its recovery, with total sales volume increasing 4.09% to reach $109.8 million this week. Market participation showed a strong rebound even as transaction counts ticked down, signaling renewed buyer interest across multiple chains and collections.

Key market metrics and macro context

According to CryptoSlam data, buyer activity climbed sharply: unique NFT buyers rose 53.35% to 277,059, while unique sellers increased 67.19% to 206,669. NFT transactions, however, declined 6.65% to 1,630,579. During the same period, major cryptocurrencies strengthened — Bitcoin recovered toward the $115,000 level and Ethereum climbed near $4,400 — helping lift overall market sentiment. The global crypto market capitalization rose to approximately $4.04 trillion from $3.81 trillion the prior week.

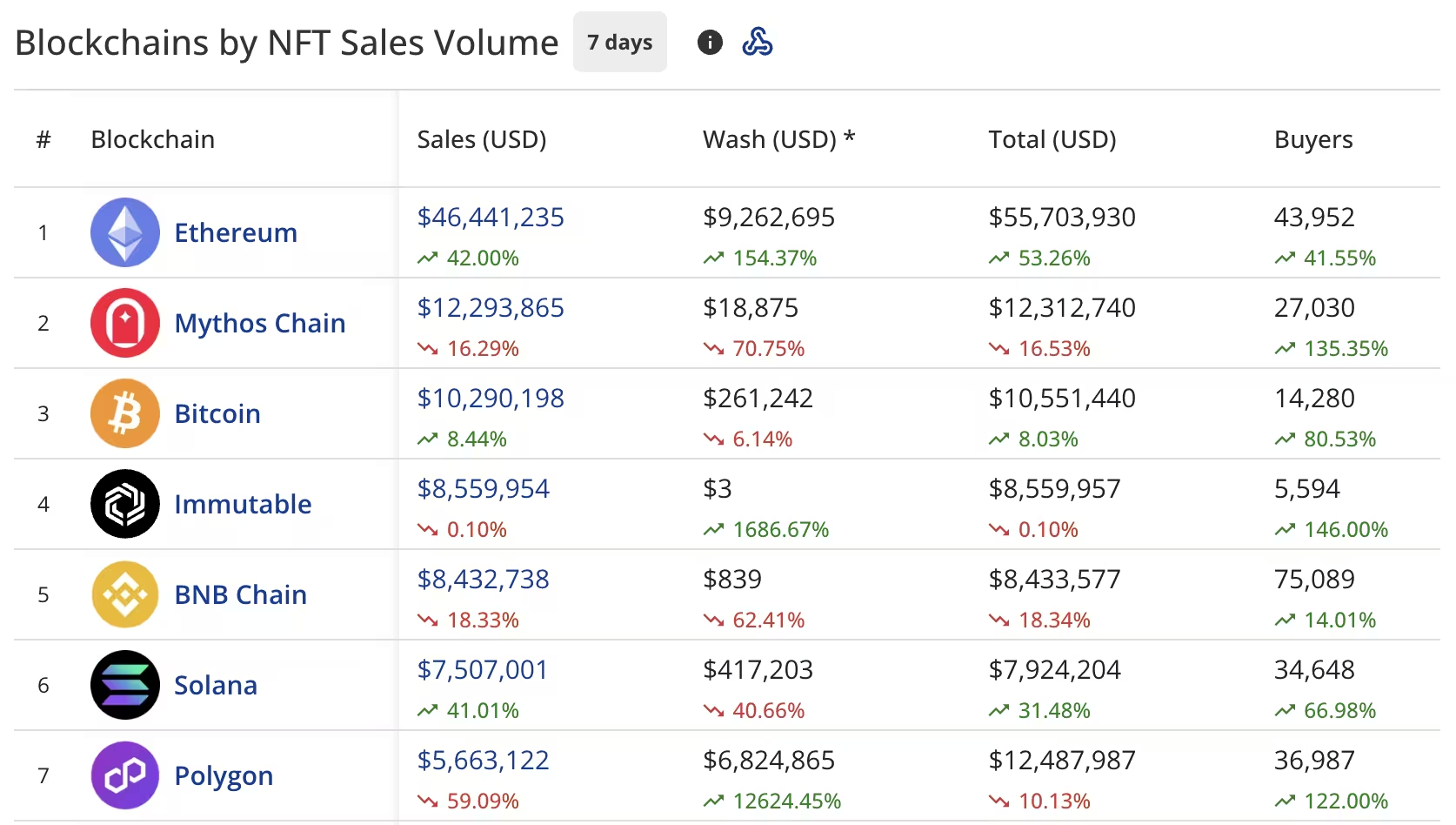

Top blockchains by NFT sales volume

Ethereum led weekly blockchain sales with $46.4 million, a 42% increase over the previous week. The Ethereum network also recorded a notable rise in reported wash trading, estimated at $9.2 million, up 154.37% week-over-week.

Mythos Chain retained the second spot with $12.2 million in sales despite a 16.29% decline. Bitcoin-based NFTs climbed to third with $10.2 million, up 8.44%.

Immutable held fourth with $8.5 million, nearly flat at down 0.10%. BNB Chain dropped to fifth with $8.4 million, off 18.33%. Solana rose to sixth with $7.5 million in sales, up 41.01%, while Polygon slipped to seventh with $5.6 million, down 59.09%.

Buyer counts rose on most networks, led by Immutable at 146% growth, followed by Mythos Chain at 135.35% and Polygon at 122%.

Marketplace and collection performance

DMarket remained the top-ranked collection by sales with $7.1 million, though it recorded declines across the board: sales were down 23.16%, transactions fell 21.24%, and buyers decreased 27.62%.

CryptoPunks rebounds with standout gains

CryptoPunks was the week’s standout performer, surging 136.83% to $7 million in sales and moving into second place among collections. The profile of recoveries included a 146.15% increase in transactions, a 100% rise in buyers, and a 136.36% jump in sellers.

Other notable collection movements included:

- Guild of Guardians Heroes: $4.8 million, modest growth of 1.20%.

- Courtyard (Polygon): $4.7 million, down sharply by 62.86%.

- Moonbirds: $4.6 million, up 141.12%, with transactions up 148.99% and buyers up 93.48%.

- Bored Ape Yacht Club: $4.4 million, rising 78.76%, with transactions up 108.33% and buyers up 93.33%.

High-value secondary market sales

The week also featured several high-ticket NFT sales across different chains and formats, illustrating continued demand for blue-chip and high-profile NFTs:

- BOOGLE sold for 1,380 SOL (approx. $324,846)

- CryptoPunks #8521 sold for 55.48 ETH (approx. $255,288)

- CryptoPunks #4420 sold for 56.388 ETH (approx. $254,250)

- CryptoPunks #2642 sold for 52.1 ETH (approx. $239,735)

- CryptoPunks #1180 sold for 49.89 ETH (approx. $232,394)

What this means for the NFT ecosystem

The mix of rising buyer participation and concentrated gains in marquee collections suggests renewed appetite among collectors and traders. Rising prices for major cryptocurrencies such as Bitcoin and Ethereum likely supported increased spending power and investor confidence, while the spike in reported wash trading on Ethereum highlights the ongoing need for transparent market surveillance.

Looking ahead, market watchers will monitor whether buyer growth translates into sustained increases in transactions and broader marketplace stability across chains including Ethereum, Solana, Polygon, Immutable, BNB Chain, and newer entrants like Mythos Chain.

Overall, the latest weekly data point to a cautious but visible recovery in NFT sales, driven by strong performances from legacy collections and increased participation across multiple blockchains.

Source: crypto

Leave a Comment