4 Minutes

XRP technical outlook: support under pressure

XRP is trading near $2.75 and remains positioned at the base of a descending triangle — a bearish continuation pattern that puts pressure on near-term price action. With sellers still active, the market risks an 8–10% pullback toward the $2.65–$2.45 range, potentially reaching a $2.50 pivot before buyers step in. A sustained break above $2.90 would invalidate the bearish setup, but current momentum favors one more dip into that liquidity-rich zone.

XRP one-day chart analysis

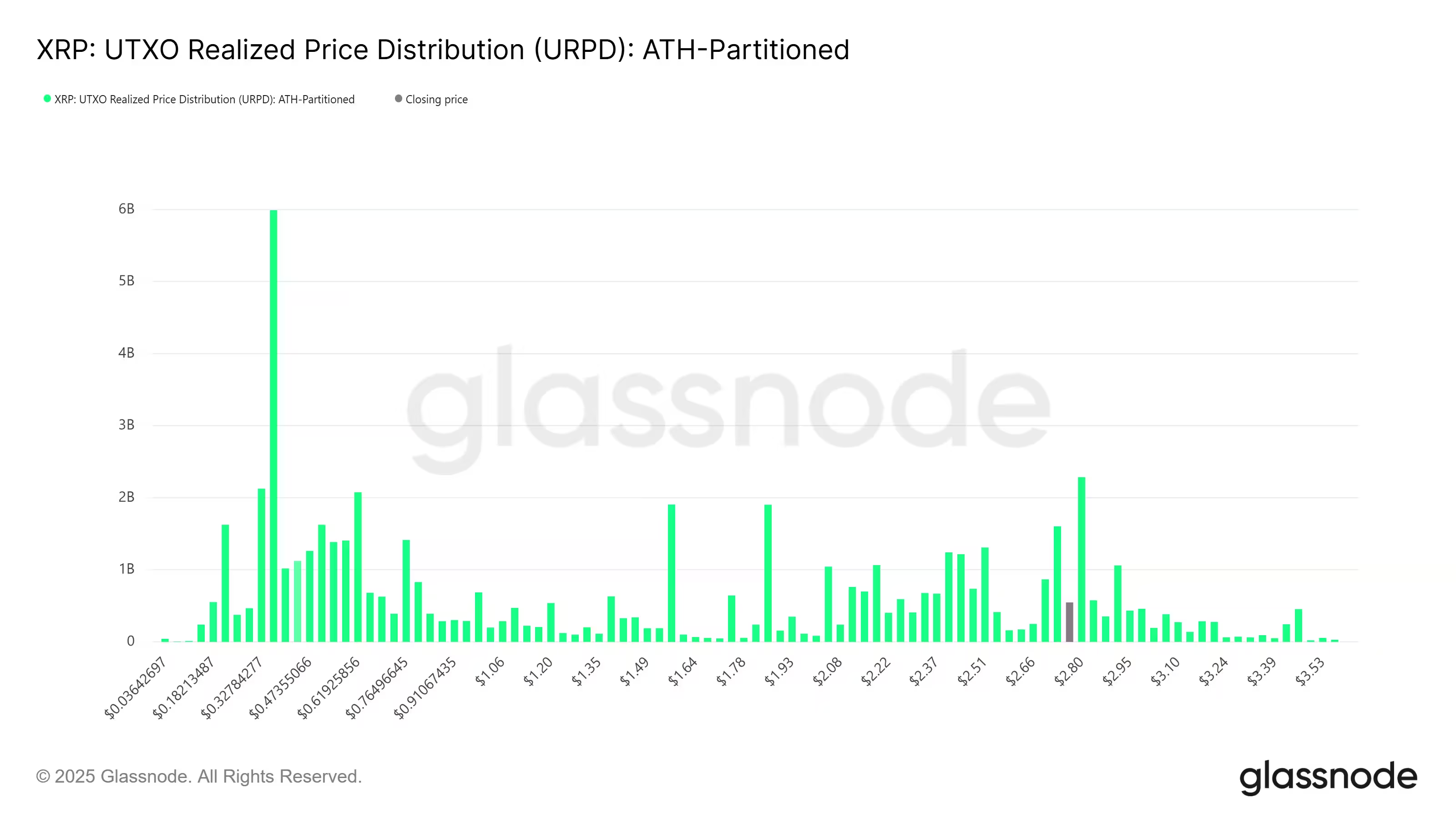

On-chain signals point to a buyer cluster near $2.45–$2.55

On-chain metrics reinforce the technical narrative. Glassnode’s Unrealized Price Distribution (URPD) for XRP highlights a dense concentration of holders with cost basis between $2.45 and $2.55. This area acts as a magnet for liquidity: if price revisits the pocket, defendable buying activity could absorb selling pressure and create a base for a rebound. The targeted zone also overlaps with a daily Fair Value Gap (FVG) and the 0.50–0.618 Fibonacci retracement levels, increasing its significance for traders using a blend of on-chain and classical technical analysis.

XRP UTXO Realized Price Distribution

Liquidity compression and fractal behavior

Market structure shows repeated fractal patterns from Q1 and Q3. XRP already tested the $2.65 area twice; historical structure suggests a possible sweep below that to capture stop liquidity in the FVG before a more sustainable rally. Compression in the order book over the past 10 weeks has narrowed intraday ranges and created pronounced gaps between price levels. These compression phases often precede volatility expansions when liquidity is released, so traders should be prepared for abrupt moves once order flow shifts.

XRP Q1, Q3 price fractal analysis

ETF catalysts, spot flows and market sentiment

ETF developments remain an important macro driver. Franklin Templeton’s decision on an XRP ETF was pushed to Nov. 14, while new products like REX/Osprey’s XRPR launched with roughly $38 million of first-day trading volume — signaling strong initial demand for spot XRP exposure. However, analysts warn that some optimism could already be priced in, increasing the risk of a "sell the news" reaction when approvals or denials are announced.

Spot market flows and the 90-day taker CVD indicate sellers have kept control despite intermittent buyer strength earlier in the year. A durable upside move requires a clear shift in trading volume toward aggressive buy-side execution. Until buyers assert dominance in volume terms, technical setups and on-chain liquidity pockets remain more likely to be tested than to immediately trigger a breakout.

XRP compression setup analysis by Sistine Research

What traders should watch

- Key support band: $2.45–$2.55 (Glassnode URPD buyer cluster and FVG overlap).

- Immediate risk: 8–10% dip to $2.50 if $2.75 and $2.65 fail.

- Upside invalidation: daily close and sustained volume above $2.90.

- Macro catalysts: ETF decisions, new spot product inflows, and CVD volume shifts.

In short, XRP is compressed and primed for volatility. On-chain buyer clusters and FVGs suggest a structured buy zone if price declines, but macro catalysts and order-book compression mean movement could be sharp and fast. Traders should manage risk, monitor volume-based indicators, and watch ETF-related headlines closely as potential triggers for the next directional move.

Source: cointelegraph

Leave a Comment