4 Minutes

Novogratz: Fed leadership may spark the next major Bitcoin rally

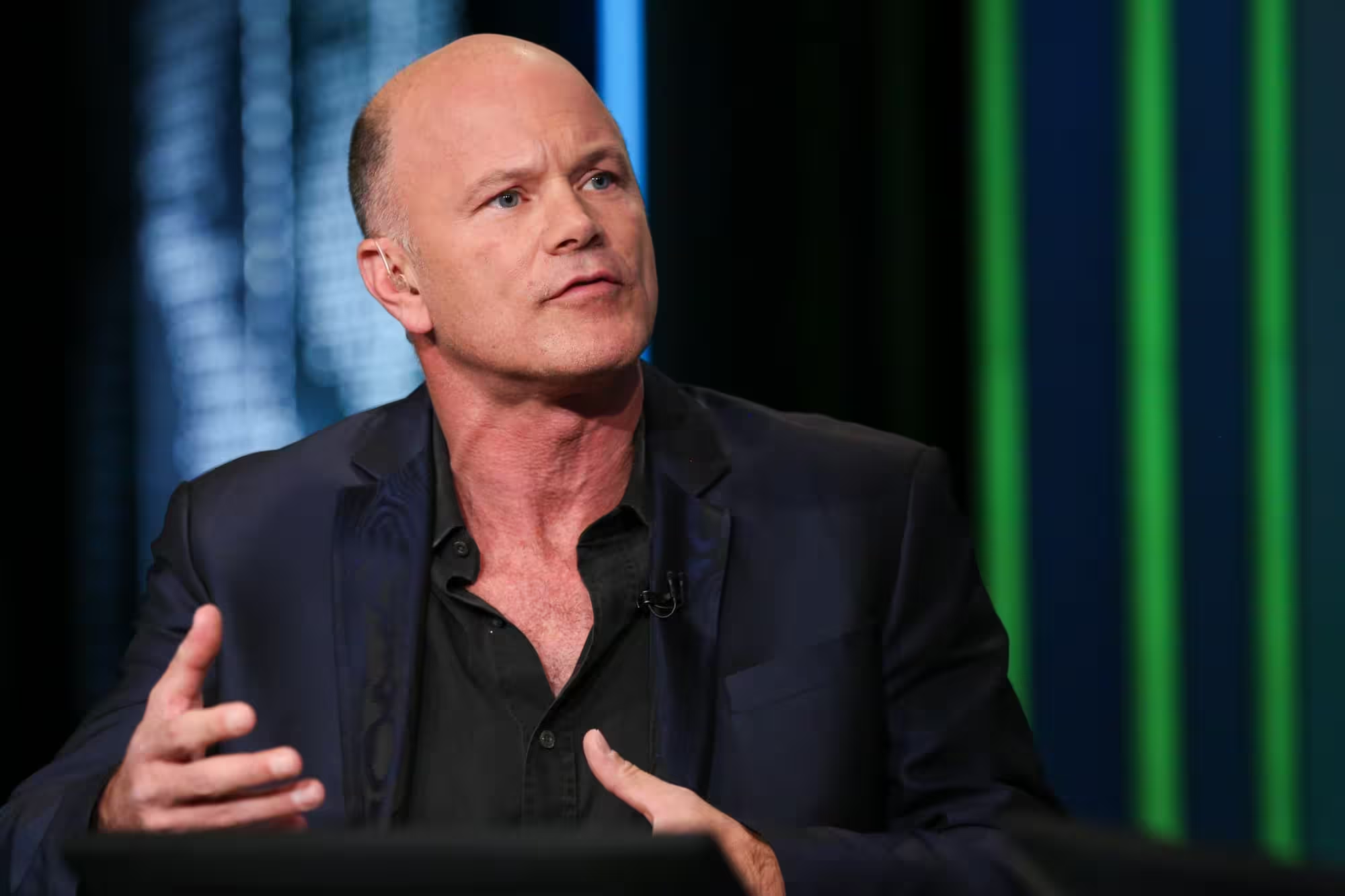

Galaxy Digital CEO Mike Novogratz warns that a highly dovish nominee for the next US Federal Reserve chair could become the single biggest bullish catalyst for Bitcoin and the wider crypto market. In a recent interview with Kyle Chasse published to YouTube, Novogratz said a Fed that pivots toward aggressive rate cuts could lift risk assets — and potentially send BTC toward new highs.

Why a dovish Fed matters for Bitcoin

Novogratz argues that if the Fed starts cutting rates when inflation remains a concern, and the central bank appoints a strong dove to lead that agenda, capital may flow out of cash and traditional fixed-income instruments and into assets like gold and Bitcoin. "That's the potential biggest bull catalyst for Bitcoin and the rest of crypto," he said, adding that such a policy mix could create a "blow-off top" scenario.

"Can Bitcoin get to $200K? Of course it could…Because it becomes a whole new conversation if that happens," Novogratz commented. He stressed, however, that an aggressive easing cycle would exact a price on the US economy and institutions: "Do I want it to happen? No. Why? Because I kind of love America," he said, warning about a potential loss of Fed independence.

Macro ripple effects: dollar, gold, and risk assets

A dovish shift at the Fed typically weakens the US dollar, makes fixed-rate bonds less attractive and pushes investors toward inflation hedges and growth assets. Novogratz suggested that such a change could trigger an "oh shit moment" in markets: "Gold skyrockets…Bitcoin skyrockets." The immediate effect would likely benefit BTC and major altcoins while pressuring the greenback and nominal yields.

Political angle: Trump’s shortlist and market timing

Novogratz linked the scenario to former President Trump’s stated intention to nominate a dovish Fed chair. He warned markets might not price in that risk until a formal nomination is made: "I don't think the market will buy that Trump's going to do the crazy, until he does the crazy," Novogratz said.

Reports suggest Trump has narrowed his shortlist to three figures: White House economic adviser Kevin Hassett, Federal Reserve Governor Christopher Waller, and former Fed Governor Kevin Warsh. Each candidate carries different implications for monetary policy and, by extension, for cryptocurrencies and the dollar.

What the markets and investors should watch

- Fed guidance and the official nomination process: Markets react quickly but often position themselves only after concrete signals.

- Dollar strength and bond yields: A weakening dollar and lower yields historically correlate with gains in gold and Bitcoin.

- Risk management: While a dovish Fed could turbocharge crypto prices, Novogratz cautions that the macro tradeoff could be damaging to the broader US economy, undermining confidence in central-bank independence.

Echoing Novogratz, Daleep Singh of PGIM Fixed Income recently said there is "a very decent chance that the FOMC looks and acts quite differently" after Jerome Powell’s term ends in May 2026, and that risks to the dollar are skewed to the downside on a cyclical basis.

Bottom line

A Federal Reserve tilt toward aggressive easing — especially under a newly appointed dovish chair — is a clearly visible upside catalyst for Bitcoin and crypto markets. But market participants should weigh those upside scenarios against the geopolitical and economic downsides Novogratz highlights: potential damage to the US economy, the erosion of central-bank independence, and a fast-moving macro environment that could produce both spectacular rallies and sharp corrections.

Source: cointelegraph

Leave a Comment