3 Minutes

GenAI-capable smartphone SoCs are set for a major surge in 2025, with Counterpoint Research forecasting these chips will make up 35% of total smartphone SoC shipments. Wider availability of on-device AI features across both premium and mid-range phones is driving rapid adoption and strong year-on-year growth.

Market forecast and what’s driving growth

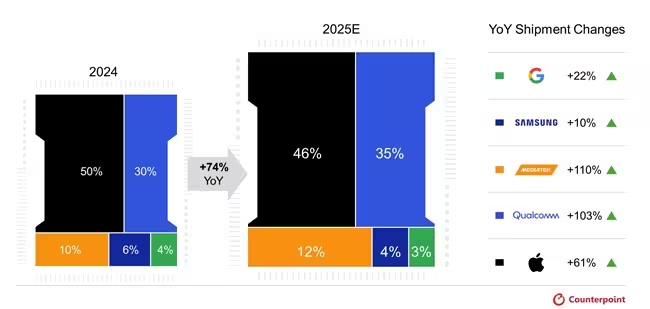

Counterpoint’s Q2 2025 Global Smartphone AP-SoC Shipment & Forecast Tracker projects a 74% year-on-year increase in GenAI-capable SoC shipments, reflecting growing demand for on-device language models, multimodal AI, and richer assistant features. As manufacturers integrate larger NPUs and more advanced CPU/GPU cores, phones are able to run increasingly capable AI models locally, reducing latency and preserving privacy compared with cloud-only implementations.

Who’s leading the GenAI SoC segment

Apple is expected to control roughly 46% of the GenAI SoC market in 2025, with Qualcomm at about 35% and MediaTek around 12%. Each vendor takes a different approach:

- Apple pairs on-device models with cloud options, including a 3-billion-parameter local language model and larger cloud-based models via Private Cloud Compute on Apple Silicon servers. Apple also integrated ChatGPT into iOS, iPadOS, and macOS through a partnership with OpenAI.

- Qualcomm provides an AI Orchestrator framework that helps device makers deliver GenAI services without having to manage LLM infrastructure or deep hardware/software integration themselves.

- MediaTek relies on its NeuroPilot software to allocate workloads across CPU, GPU, and NPU, and is collaborating closely with Chinese OEMs to optimize on-device GenAI deployments.

Premium chips push performance and pricing

Premium GenAI-capable SoC shipments are forecast to increase 53% year-on-year, with 88% of premium SoCs expected to support GenAI in 2025. Leading models that are accelerating this shift include Apple A19/A19 Pro, Qualcomm Snapdragon 8 Elite Gen 5, and MediaTek Dimensity 9500. Research analyst Shivani Parashar notes peak AI compute in premium SoCs could reach 100 TOPS in 2025 — nearly four times higher than 2021 levels — prompting higher average selling prices as brands move to advanced nodes and add more semiconductor content.

Mid-range adoption is picking up speed

The $300–$499 segment is set to see GenAI-capable SoC shipments triple year-on-year in 2025, representing 38% of that price band. Qualcomm leads mid-range GenAI with a 57% share, leveraging Snapdragon 700 and 6 series chips, while MediaTek’s Dimensity 8000 family jump-started on-device GenAI in the mid tier. Senior analyst Parv Sharma highlights that SoC vendors are optimizing LLMs for mid-tier hardware so vendors can deliver richer AI experiences without compromising battery life or thermal performance.

Conclusion

Overall, 2025 looks set to be a tipping point for mobile GenAI: stronger on-device compute, broader OEM support, and platform-level integrations are turning GenAI from a premium differentiator into a mainstream smartphone feature. As SoC vendors continue to optimize for performance and efficiency, expect GenAI capabilities to expand further down the price ladder in the coming years.

Source: fonearena

Leave a Comment