4 Minutes

OpenAI has tapped South Korea’s memory champions, Samsung Electronics and SK Hynix, in an initial supply pact tied to its sprawling Stargate data-center effort. The move sent both chipmakers’ shares surging and underscored just how big the next wave of AI infrastructure will be.

Why the deal matters to the AI chip market

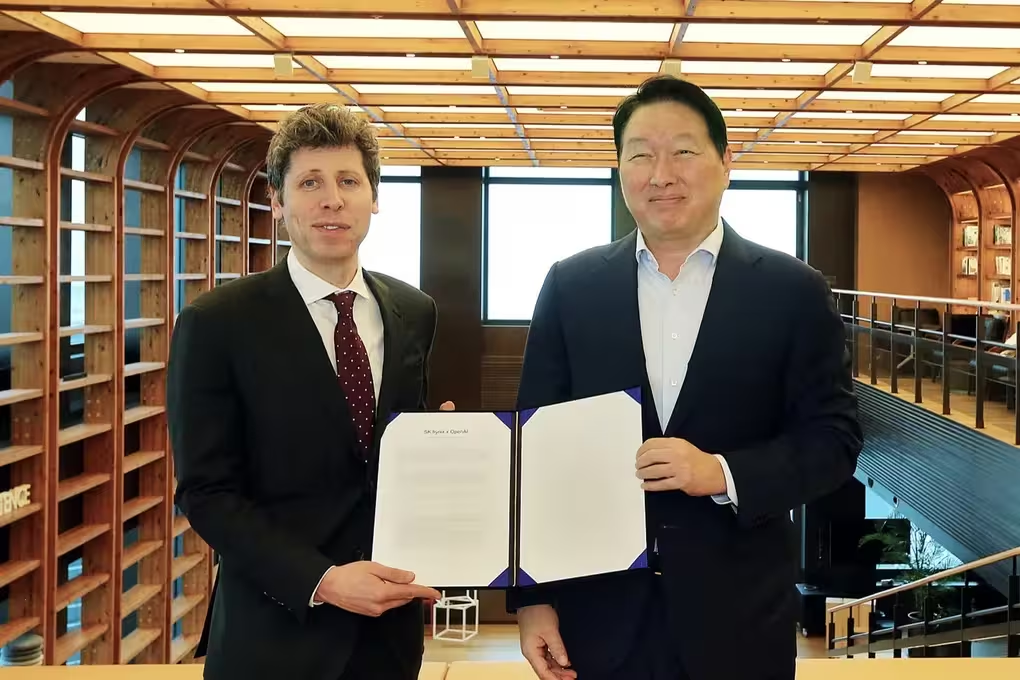

Sam Altman signed a letter of intent with Samsung and SK Hynix to supply memory chips for OpenAI’s Stargate project, a global build-out of AI data centers that involves industry heavyweights from Nvidia to Oracle. The scale OpenAI is hinting at is jaw-dropping: up to 900,000 wafer starts per month as Stargate grows. To put that in context, the companies say that volume could be more than double today’s worldwide capacity for HBM (high-bandwidth memory), the specialized modules that feed AI accelerators.

Markets reacted fast. SK Hynix — the market leader in HBM — jumped about 12%, hitting its highest valuation in more than two decades. Samsung climbed to a four-year high, gaining as much as 4.7%. Even smaller suppliers in the supply chain, like Hanmi Semiconductor, surged roughly 8% as investors priced in a potential bonanza for memory makers.

What Seoul gets out of the partnership

Beyond immediate commercial supply, the pact is designed to deepen long-term ties between OpenAI and Korea’s semiconductor ecosystem. The agreement includes cooperation to develop a domestic AI infrastructure in Seoul — part of a broader push by governments worldwide to anchor critical AI supply chains at home.

President Lee Jae Myung publicly welcomed the deal, saying he hopes Korean firms will play a central role in AI’s global spread. SK Telecom also signed on to build a dedicated OpenAI data center in South Korea’s southwest, signaling local partners will be involved from design to deployment.

How this fits into the global AI infrastructure race

OpenAI’s drive to build Stargate is dovetailing with other massive investments. Nvidia recently announced plans to invest up to $100 billion in OpenAI to back data-center capacity and related infrastructure — a reminder of the trillion-dollar scale that analysts now associate with next-generation AI systems. Nvidia’s accelerators rely heavily on HBM, so increased demand from OpenAI could amplify orders for SK Hynix and Samsung.

Altman’s tour of Asia continues: after Seoul, he was slated to meet Taiwan Semiconductor Manufacturing Co. and Hon Hai Precision Industry (Foxconn) in Taipei. That sequence of meetings highlights how building AI at scale requires coordination across chips, servers, cooling systems and data-center design partners.

Industry ripple effects and what to watch next

- Supply pressure: A potential 900,000 wafer starts per month would strain global HBM capacity and force rapid ramp-ups in production and logistics.

- Competitive stakes: Samsung is pushing to become a bigger HBM supplier alongside SK Hynix, and both are positioned to benefit if Stargate demands DRAM as well as HBM.

- Broader collaboration: Samsung affiliates — from SDS to Heavy Industries — may explore everything from floating data centers to design partnerships with OpenAI.

Imagine data centers expanding not just in scale but in diversity: land-based facilities next to experimental floating sites, all fueled by an ecosystem of memory suppliers, server makers and local infrastructure partners. That’s the picture OpenAI and its partners are sketching — and investors are already pricing in the potential payoff.

As Stargate moves from concept to construction, watch memory supply chains, HBM production capacity, and regional policy moves in Seoul and Taipei. Together they will shape who profits as AI moves from cloud experiments to a new industrial backbone.

Source: bloomberg

Leave a Comment