3 Minutes

Spot Bitcoin ETFs record heavy outflows after BTC drop

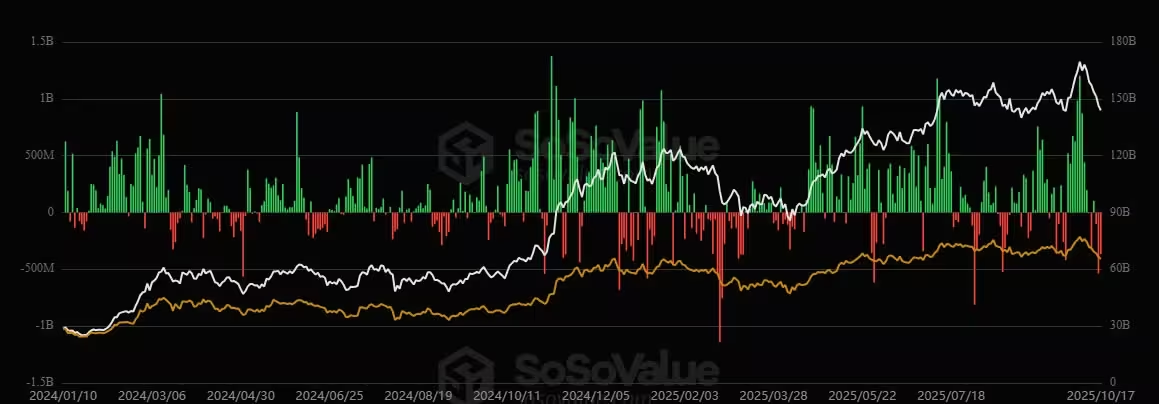

U.S. spot Bitcoin exchange-traded funds (ETFs) experienced significant outflows this week, with aggregate redemptions reaching roughly $1.22 billion as Bitcoin slipped. The eleven spot Bitcoin ETFs tracked in the market recorded a combined outflow of $366.6 million on Friday alone, capping a broadly negative week for BTC-linked institutional products.

Friday’s largest redemptions

BlackRock’s iShares Bitcoin Trust led the sell-off on Friday with an outflow of $268.6 million, according to SoSoValue. Fidelity’s spot Bitcoin ETF dropped $67.2 million, Grayscale’s GBTC saw $25 million leave, and Valkyrie posted a small outflow. The remaining funds reported zero net flows for the day.

Weekly totals and market impact

After one modest inflow day earlier in the week, total outflows for the seven-day stretch amounted to about $1.22 billion. The ETF exodus coincided with a sharp pullback in Bitcoin price: the market fell by more than $10,000 from just above $115,000 on Monday to a four-month low below $104,000 on Friday, a move that pressured many institutional products tied to BTC.

Spot Bitcoin ETFs see red this week

Charles Schwab sees growing demand despite red week

Despite the outflows industry-wide, Charles Schwab is reporting rising client engagement with crypto exchange-traded products (ETPs). CEO Rick Wurster told CNBC that Schwab clients now hold roughly 20% of all U.S. crypto ETPs. He highlighted that traffic to Schwab’s crypto pages has surged about 90% over the past year, calling the topic “one of high engagement.”

Product lineup and future plans

Charles Schwab already offers crypto ETFs and Bitcoin futures products to investors and has announced plans to provide spot crypto trading to its clients in 2026. ETF specialists have noted Schwab’s prominence in U.S. brokerage markets, signaling that wider adoption among retail and institutional customers could accelerate crypto product usage.

Outlook: can Uptober return?

October historically tends to be bullish for Bitcoin — BTC has recorded gains in ten of the last twelve Octobers — but this month has broken that pattern so far, losing roughly 6% according to CoinGlass. Analysts remain cautiously optimistic that the typical "Uptober" rally could resume later in the month, particularly if Federal Reserve rate cuts materialize and restore risk-on sentiment. For market participants, watching ETF flows, institutional demand, and macro drivers will be critical to assessing near-term Bitcoin price recovery prospects.

Key topics: Bitcoin ETFs, spot Bitcoin ETFs, crypto ETPs, ETF outflows, Charles Schwab, Bitcoin price, institutional investors, ETF flows, spot crypto trading.

Source: cointelegraph

Leave a Comment