5 Minutes

October retrace: Uptober’s rally meets a liquidity wall

October began with classic Uptober momentum for Bitcoin and broader crypto markets. Strong institutional demand, hefty U.S. spot ETF inflows and renewed accumulation pushed Bitcoin into fresh territory. But a record single-day liquidation and thin order books quickly erased much of that advance, leaving investors and traders asking what happens next for Bitcoin, ETFs, and the crypto market.

ETF flows and early-month strength

The month opened with notable spot-ETF demand. Large capital inflows helped Bitcoin break above prior supply bands and reach a near-term peak. On-chain and market data firms observed surging accumulation from mid-tier holders and a concentration of buying around new highs, creating the impression of a durable, institution-backed rally. Historical seasonality also supported bullish sentiment: October has often been one of Bitcoin's best months for percentage gains.

Bitcoin monthly price returns

What triggered the sharp pullback

On Oct. 11 a cascading deleveraging event wiped roughly 19 billion dollars from leveraged positions across exchanges. The sell-off was amplified by thin order books and crowded derivatives trades, which meant there was not enough resting liquidity to absorb rapid liquidation-driven selling. Prices plunged toward the low 100ks before a partial recovery, exposing how fragile rallies can be when leverage and depth are mismatched.

Liquidity, leverage and market structure

A repeated theme from market observers is that price moves were worsened by a stark liquidity gap. When volumes spiked during the panic, order books on major venues thinned dramatically, at times appearing nearly empty for several minutes. That absence of market-making depth allowed liquidations to push prices far more violently than they otherwise would have moved.

That dynamic shows why derivatives risk management, perps funding rates and option positioning matter for price stability. Excess leverage acts like a fault line: when it snaps, it can create outsized volatility and temporary dislocations between spot price and underlying demand.

Data points that matter

Market researchers highlighted several constructive signs that could help a rebound: the large deleveraging reduced structural risk, ETFs continued to see inflows totaling billions in a condensed period, and mid-tier accumulation returned a significant portion of circulating supply to profit. Those elements together make a case that the market setup is healthier than it looked during the liquidation spike.

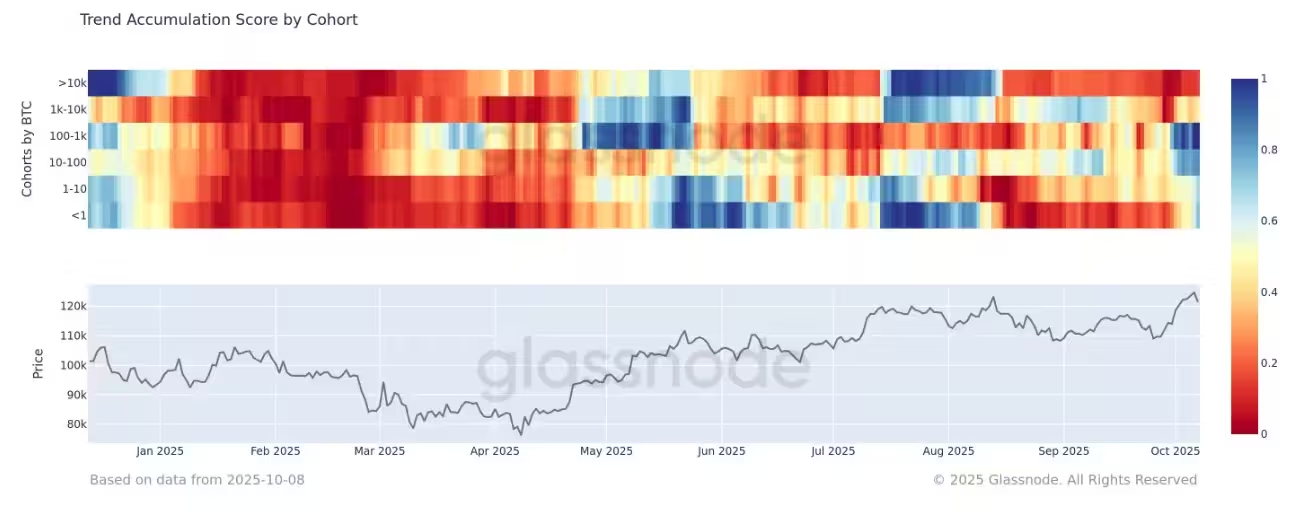

Bitcoin price vs accumulation cohort

Can Uptober still finish strong?

Analysts are split but cautiously optimistic. One scenario where Uptober recovers requires market makers, institutional buyers and liquidity providers to rebuild order-book depth. If funding rates normalize and perpetuals reset, that could provide a constructive base for renewed upside. With excessive leverage removed, inflows from ETFs and long-term accumulation may again drive price discovery.

Conversely, if liquidity providers stay cautious and derivatives remain crowded on one side, another shock could push prices lower or prolong consolidation. This makes near-term outcomes more dependent on structural market health than on seasonal narratives alone.

What investors should watch

- ETF flows and institutional demand: sustained spot-ETF buying remains a key bullish input.

- Order-book depth and liquidity across major exchanges: improved depth reduces the chance of another flash liquidation.

- Funding rates and derivatives open interest: falling leverage and normalized funding are constructive signs.

- On-chain accumulation metrics: continued accumulation by mid-tier holders indicates conviction beyond short-term traders.

Bottom line

Uptober did not unfold exactly as expected, but the core bullish thesis tied to ETF adoption and institutional interest is not necessarily invalidated. The Oct. 11 liquidation event highlighted vulnerabilities in market structure — specifically thin order books and high leverage — rather than a collapse in demand. If liquidity is rebuilt and leverage stays muted, Uptober can still finish on firmer footing. For traders and long-term holders alike, the coming weeks will be crucial in determining whether the seasonal rally resumes or whether October is remembered as a reset driven by liquidity constraints.

Source: crypto

Leave a Comment