5 Minutes

Bitcoin miners take on $12.7B in debt to stay competitive

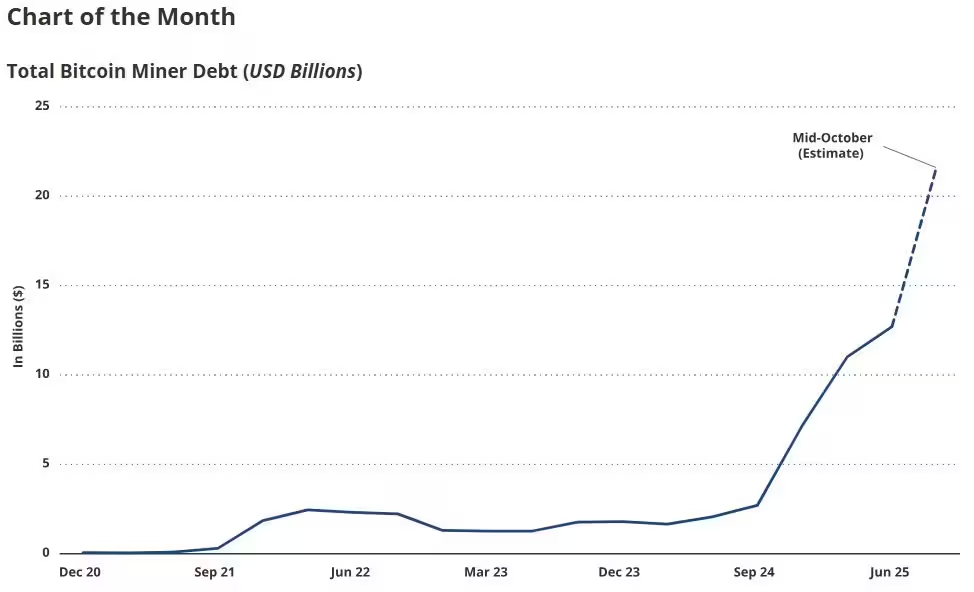

Bitcoin miners have dramatically increased leverage over the past year, borrowing roughly $12.7 billion to fund new rigs and build AI and high-performance computing (HPC) infrastructure. According to VanEck's October Bitcoin ChainCheck report, miner debt surged from about $2.1 billion to $12.7 billion in 12 months as firms scramble to preserve or grow their share of the global hashrate.

Why miners are borrowing: the hashrate and CapEx pressure

VanEck analysts Nathan Frankovitz and Matthew Sigel explain that without continual reinvestment in the latest ASIC machines and data-center upgrades, a miner's share of the network hashrate declines — which directly reduces daily Bitcoin rewards. They describe this dynamic as the "melting ice cube problem," where miners must keep replacing capacity to avoid losing revenue share.

Historically, many miners financed expensive capital expenditures (CapEx) via equity rather than debt because mining revenues are tied almost entirely to Bitcoin's volatile price, making future cash flows hard to underwrite. But with revenue profiles evolving, debt has become a more viable source of capital for many public miners.

Debt among Bitcoin miners has increased from $2.1 billion to $12.7 billion over the last 12 months.

Convertible notes and bond offerings on the rise

Industry tracker The Miner Mag estimates significant capital markets activity from public miners: combined debt and convertible-note offerings among 15 public companies totaled about $4.6 billion in Q4 2024, $200 million at the start of 2025, and $1.5 billion in Q2 2025. Several notable financings illustrate the trend:

- Bitfarms closed a $588 million convertible note offering earmarked for HPC and AI infrastructure across North America.

- TeraWulf announced a $3.2 billion senior secured notes offering to help expand data-center capacity at its Lake Mariner campus in Barker, New York.

- IREN completed a $1 billion convertible notes offering, allocating proceeds for general corporate needs and working capital.

AI and HPC hosting: miners diversify revenues

After the April 2024 Bitcoin halving — which lowered block rewards to 3.125 BTC — many miners saw margins compressed. To stabilize cash flows, a growing number of operators are enabling AI and HPC workloads alongside traditional Bitcoin mining. Selling hosting services and long-term AI contracts creates more predictable revenue streams backed by multi-year agreements, which in turn allows miners to access debt markets and reduce overall cost of capital compared with equity financing.

Frankovitz and Sigel note that these predictable AI/HPC contracts have helped miners secure financing that would have been difficult when revenue depended solely on Bitcoin's speculative price.

Is the AI pivot a threat to Bitcoin security?

Miners remain core to Bitcoin's security model: they validate transactions and add blocks, and a higher collective hashrate strengthens network defenses. VanEck argues the industry shift toward AI and HPC is not a danger to Bitcoin's hashrate. Rather, the coexistence of mining and AI workloads can be complementary. AI data centers tend to prioritize reliable electricity, and Bitcoin mining provides a quick way to monetize excess or intermittent power — effectively subsidizing the buildout of flexible compute facilities.

"AI's priority for electrons is a net benefit to Bitcoin," the analysts write, emphasizing that AI's diurnal demand patterns mean spare capacity can be redirected back to mining when AI loads fall.

Operational synergies and cost-saving measures

Sources quoted in the VanEck report say miners are experimenting with ways to monetize surplus electrical capacity during low AI demand, which could reduce or remove the need for expensive backup solutions like diesel generators. If successful, these optimizations would yield better utilization of both electrical and financial capital, tightening margins for operators and improving sustainability metrics.

Miners are also using multi-use facility designs that can switch between mining and AI/HPC tasks, improving asset utilization and creating diversified revenue lines. This capability makes it easier to service debt and supports larger balance-sheet financings such as convertible notes and securitized offerings.

What this means for investors and the Bitcoin network

For investors, the surge in debt highlights both opportunity and risk. Access to lower-cost debt can accelerate growth and infrastructure improvements, but higher leverage also increases financial exposure if Bitcoin prices languish or CapEx projects underperform. For the Bitcoin ecosystem, a stronger, better-capitalized miner cohort may mean continued hashrate resilience and improved infrastructure that bolsters long-term network security.

As the market evolves, expect more capital markets activity from miners pursuing AI and HPC strategies. The interplay between mining economics, debt markets, and AI demand will be a key theme to watch in the coming quarters as participants contend with hardware cycles, power markets, and Bitcoin price volatility.

Source: cointelegraph

Comments

datapulse

AI pivot makes sense but feels optimistic. Lots of moving parts, and if power prices spike or AI contracts get delayed, that debt could choke these firms. Hope they hedged but idk

cryptovox

Wait miners piled on $12.7B debt? Sounds wild. Is this sustainable if BTC dips hard or are we just building a bigger risk bubble... kinda nervous tbh

Leave a Comment