3 Minutes

CoinShares rolls out Toncoin ETP amid market weakness

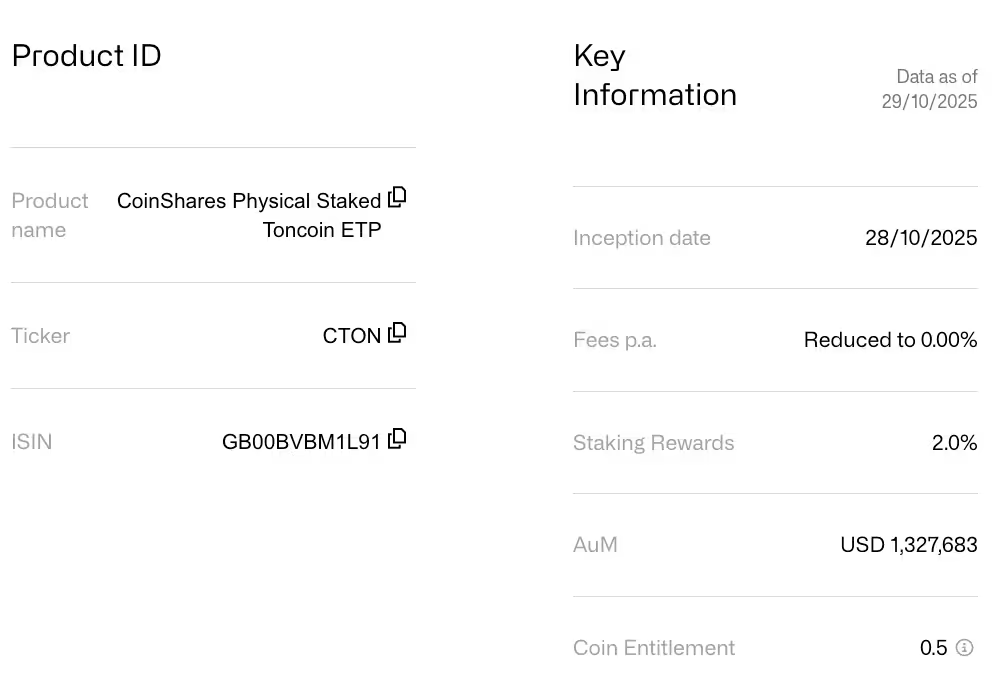

CoinShares, a leading European crypto asset manager, has launched a new exchange-traded product (ETP) that provides direct exposure to Toncoin, the native token of The Open Network (TON) closely linked to Telegram. The product, named CoinShares Physical Staked Toncoin and listed under the ticker CTON, began trading on Switzerland’s primary stock exchange, SIX.

Product highlights

The new ETP combines price exposure with automatic staking rewards. CoinShares says the vehicle will generate yield from network validation rewards and targets a roughly 2% staking yield, with trades settled in U.S. dollars. The product aims to appeal to institutional and retail investors seeking regulated access to TON without direct custody of the native asset.

Data and sources

Data on the CoinShares Physical Staked Toncoin as of Wednesday.

Market context: TON’s recent performance

Toncoin has experienced a steep decline over the past year. According to market data providers, TON’s market capitalization fell about 59% year-to-date to roughly $5.7 billion at the time of publication. Despite this drop, CoinShares points to Telegram’s large user base and TON’s technical throughput as reasons for continued institutional interest.

Technical and network fundamentals

CoinShares highlighted Telegram’s 900+ million active users and TON’s high throughput, citing the blockchain’s technical ability to process many transactions per second as an advantage when combined with Telegram’s distribution reach.

Where Toncoin fits in CoinShares’ offerings

This Toncoin ETP is not CoinShares’ first product featuring TON. The asset manager also included TON in its CoinShares Altcoins ETF (DIME), a U.S.-traded ETP that offers diversified exposure to several major altcoins such as Solana, Polkadot, Cardano and Cosmos.

Related ecosystem moves

Separately, Wallet in Telegram — a third-party wallet built inside the Telegram ecosystem — began offering tokenized shares and ETFs through xStocks, listing tokenized versions of about 50 stocks and ETFs, some with dividend features. Toncoin reacted modestly to these developments, rising roughly 5% to around $2.30 after the announcements. At publication, TON ranked among the top 40 cryptocurrencies by market capitalization.

Investor considerations

Investors should weigh the regulated access and automated staking yield provided by CTON against TON’s recent volatility and market-cap contraction. As always, due diligence on custody, fee structure, and tax implications is recommended before allocating capital to crypto ETPs or staking products.

Source: cointelegraph

Leave a Comment