5 Minutes

Mass Liquidations Push Crypto Market Lower

The cryptocurrency market recorded roughly $825.4 million in liquidations on Oct. 30, with long positions accounting for the lion's share of forced closures. A sharp pullback among major tokens erased momentum from recent gains and pushed the overall crypto market capitalization down about 1.6% to $3.8 trillion, while 24-hour trading volume hovered near $192 billion.

The sell-off intensified after a period of speculative positioning around the Federal Reserve's 25-basis-point rate cut. Traders who had piled into leveraged long positions were especially exposed when momentum faded, triggering a cascade of liquidations that amplified downward price pressure.

The crypto market recorded $825 million in liquidations, mostly coming from Bitcoin positions

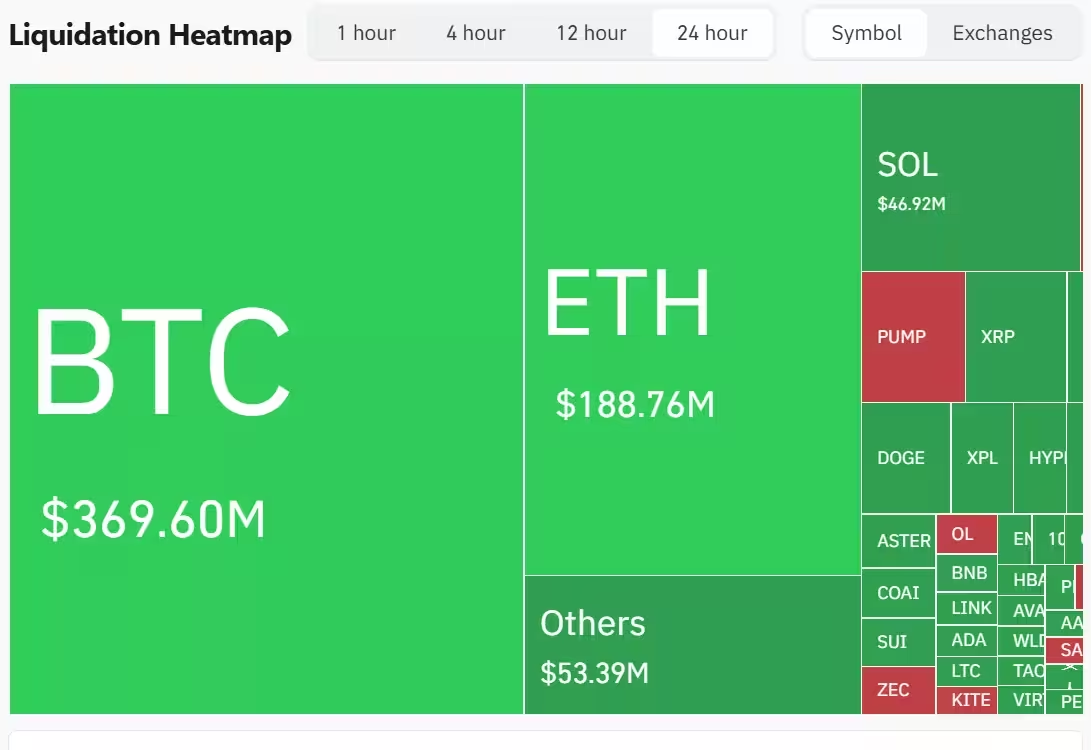

Liquidation breakdown and short-term heatmap

Of the total $825.4 million wiped out across derivatives markets, long positions made up about $656.7 million while shorts comprised roughly $168.9 million. Bitcoin long positions suffered the largest single-asset blow at approximately $310.3 million in liquidations, versus about $59.2 million in Bitcoin shorts.

In the most recent hour of trading, nearly $10 million in additional liquidations were recorded. On the liquidation heatmap, Bitcoin dominated with about $2.88 million, Ethereum followed with $2.41 million, and a basket of other altcoins added roughly $815,650. Solana appeared among the harder-hit altcoins with about $481,430 in derivatives liquidations.

Price impact on major coins

Bitcoin slipped toward the $110,000 region, down around 2.4% over 24 hours. Ethereum fell approximately 2.5% to trade below the $4,000 mark at roughly $3,899. Solana, despite recent ETF-backed enthusiasm, eased back from a brief $201 high and traded nearer to $190. XRP also dropped sharply, trading near $2.56 after a 3.5% decline.

Smaller-cap tokens were not spared: a range of altcoins including meme and niche projects fell in the low single-digit to mid-single-digit percentage range, contributing to the broader sentiment shift across spot and derivatives markets.

Why the crash occurred — macro and market drivers

This pullback was driven by a blend of macroeconomic uncertainty, structural vulnerabilities in crypto markets, and the prevalence of leveraged derivatives. First, the Fed’s 0.25% rate cut reduced the initial bullish narrative that had been pricing in easier monetary policy; once the event passed, the "buy the rumor, sell the news" dynamic reversed short-term momentum.

Second, crypto markets remain reliant on derivatives and high leverage. Thin liquidity during rapid moves makes the market susceptible to liquidation cascades: falling prices trigger forced closures of leveraged longs, which in turn push prices lower and create additional liquidations.

New ETFs failed to sustain the rally

Recent ETF listings — including staking-focused products tied to Solana and other launches such as Litecoin and HBAR ETFs — initially lifted sentiment, but the buying interest proved insufficient to overcome the liquidation-driven sell pressure. Momentum around these new funds waned as the broader market corrected.

What traders and investors should watch next

Risk management is essential in the current environment. Traders using leverage should reduce exposure and set conservative stop-loss levels to avoid rapid liquidations. Longer-term investors ought to watch macro signals — especially Fed commentary and liquidity indicators — and monitor on-chain metrics such as exchange flows, futures open interest, and funding rates for signs of stress or stabilization.

Key technical levels to watch include Bitcoin support around the low $110k area and psychological resistance above recent highs. For Ethereum and large-cap altcoins, breaks below multi-week support could accelerate outflows from risk assets, while stabilization in funding rates and declining liquidation volumes would be bullish signals that the worst of the derisking is over.

Takeaway

The $825 million wipeout underscores how quickly sentiment can reverse in crypto when macro catalysts collide with structurally leveraged markets. While ETF innovation and institutional adoption remain medium-term tailwinds, near-term price action will likely be governed by liquidity dynamics, trader positioning, and evolving macro guidance from central banks.

Source: crypto

Comments

Armin

Is this even true? Bitcoin near 110k.. really confusing, feels like a typo or i'm missing something. Watch funding rates and exchange flows, tho...

blockfuse

wow didnt expect $825M gone so fast. Leverage really nukes moves, lol. who was long on that scale?? ETFs didn't hold, markets fragile…

Leave a Comment